Question: QUESTION 55 How to construct a typical zero investment arbitrage portfolio as a hedge fund manager if you have the following assets: Asset p which

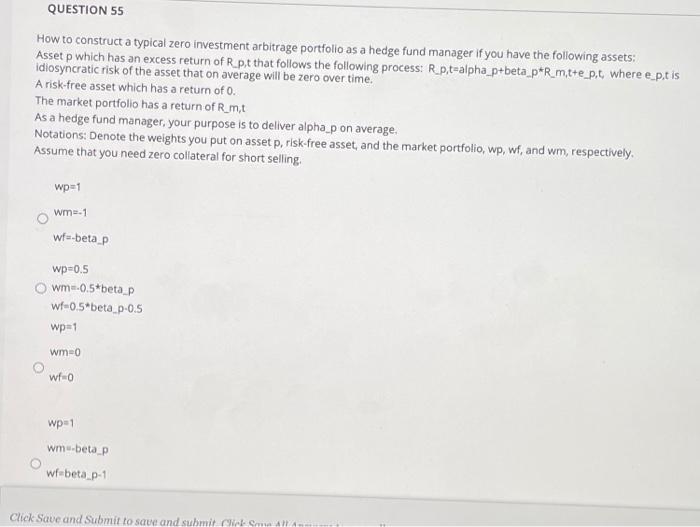

QUESTION 55 How to construct a typical zero investment arbitrage portfolio as a hedge fund manager if you have the following assets: Asset p which has an excess return of R.pt that follows the following process: R_p.t-alpha_p+beta p*R_m.tte_p,t, where e ptis idiosyncratic risk of the asset that on average will be zero over time. A risk-free asset which has a return of O. The market portfolio has a return of R.mt As a hedge fund manager, your purpose is to deliver alpha_p on average. Notations: Denote the weights you put on asset p, risk-free asset, and the market portfolio, wp, wf, and wm, respectively, Assume that you need zero collateral for short selling wpe1 wm. 1 wf--betap wp=0.5 wm-0.5*betap wf-0.5.beta_p-0.5 wp=1 wm-0 wf 0 wp1 wm-betap wfabeta p-1 Click Save and Submit to save and submit Charm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts