Question: hOW TO CREATE GENERAL JOURNAL USING GIVEN DATA After completing this chapter, you should be able to ' NOTES Air Care Services l0!) Balair Avenue,

hOW TO CREATE GENERAL JOURNAL USING GIVEN DATA

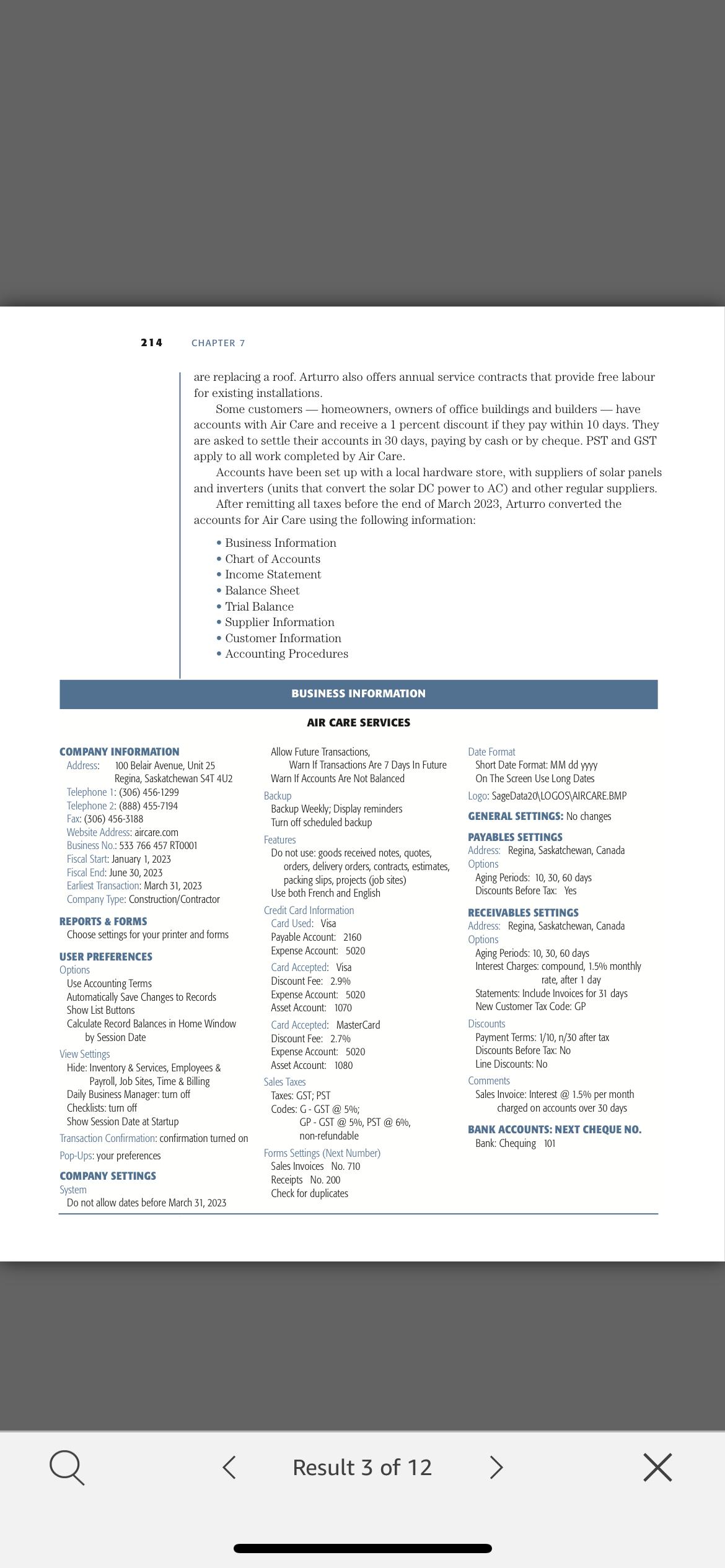

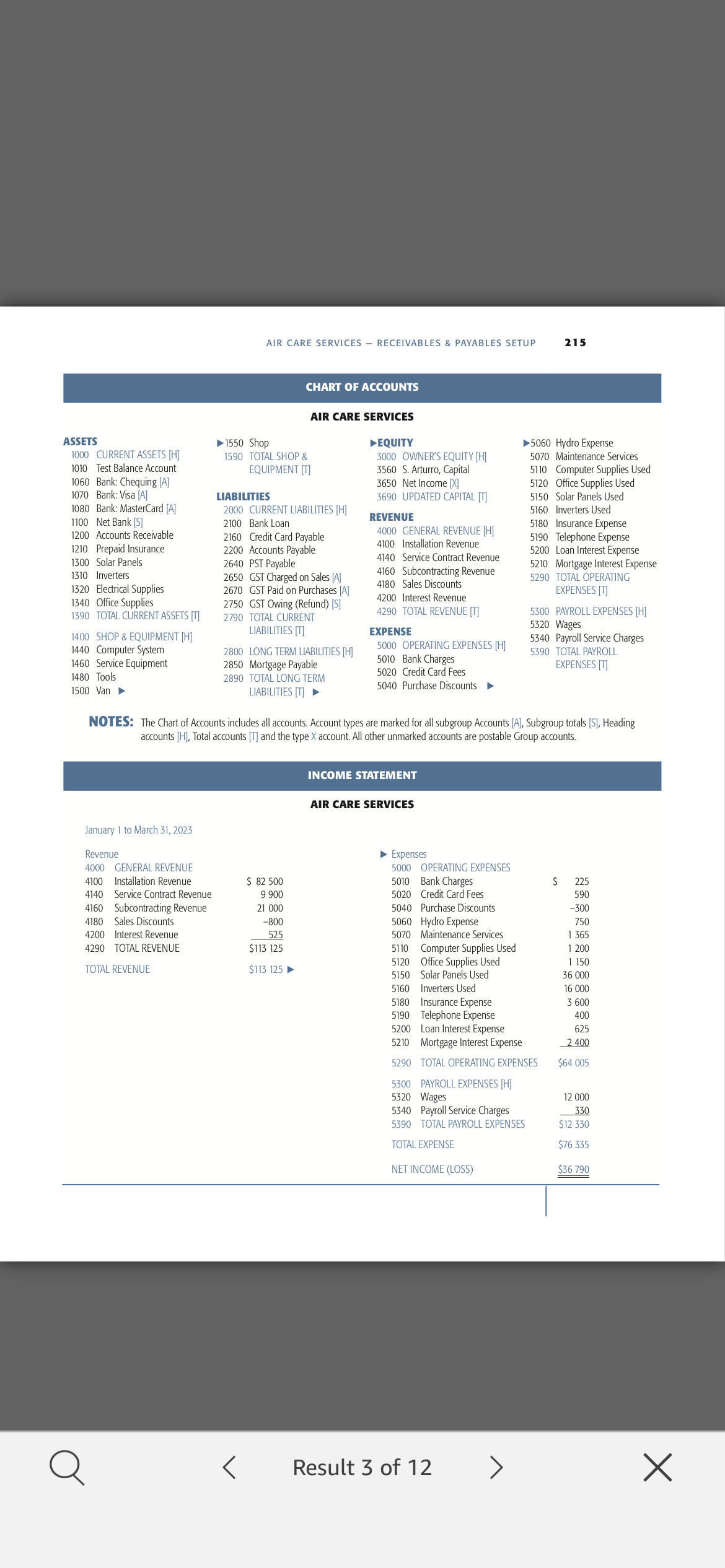

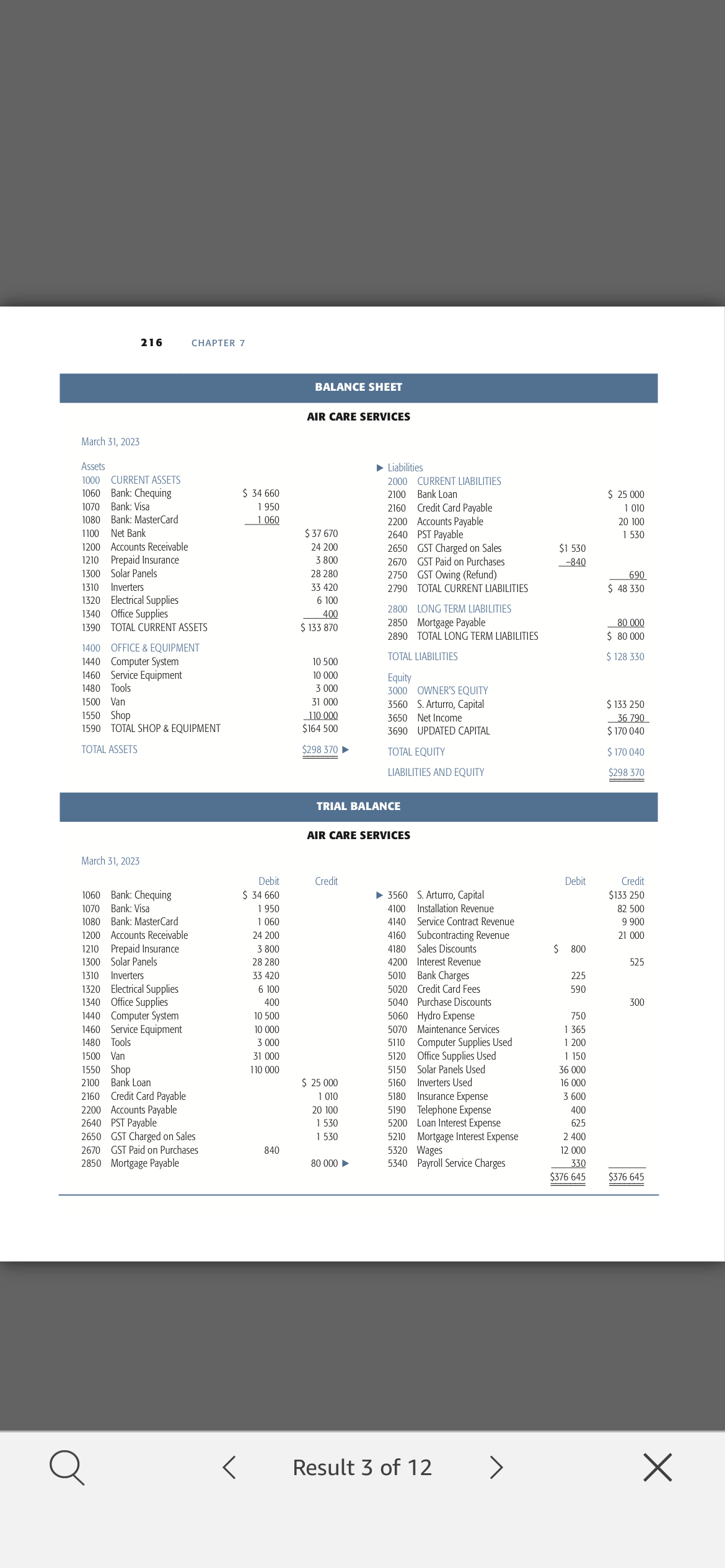

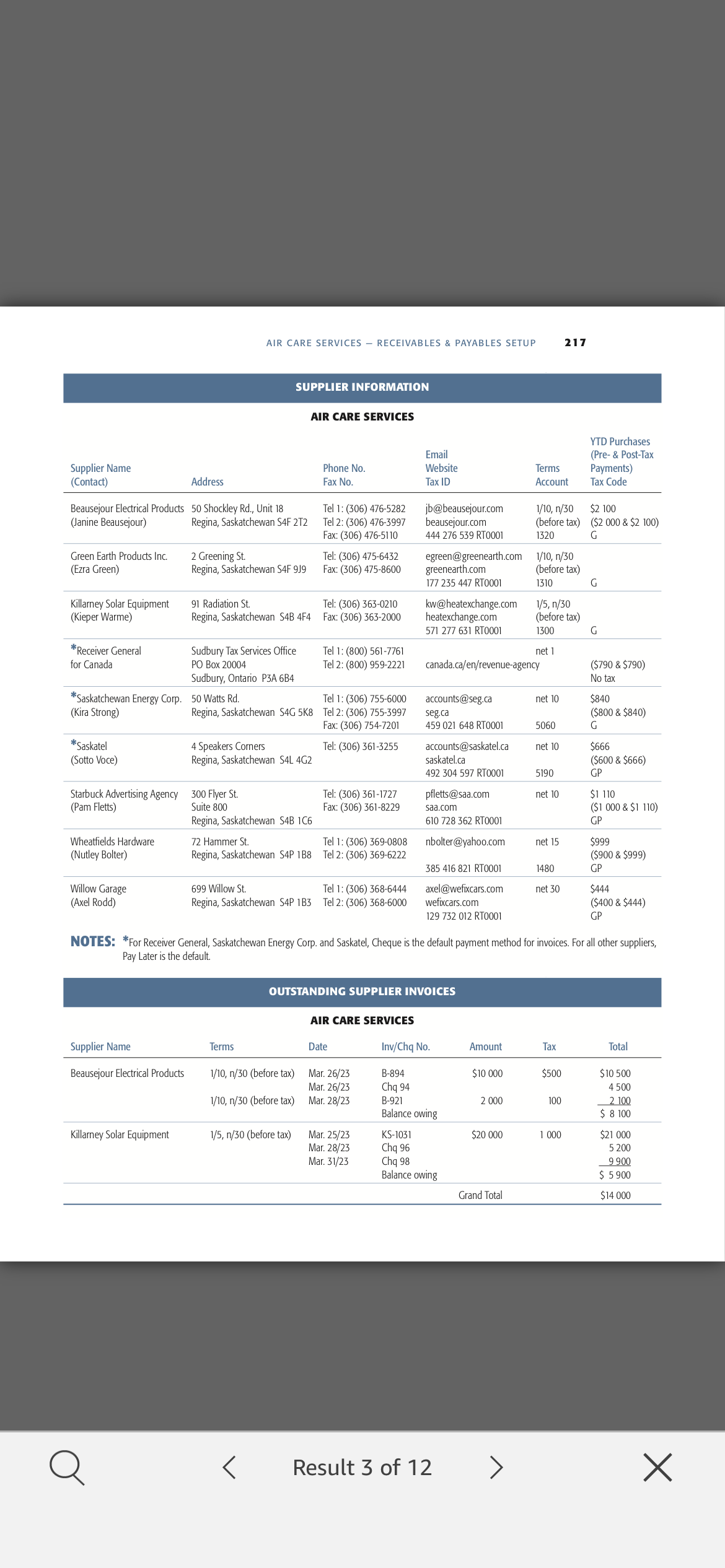

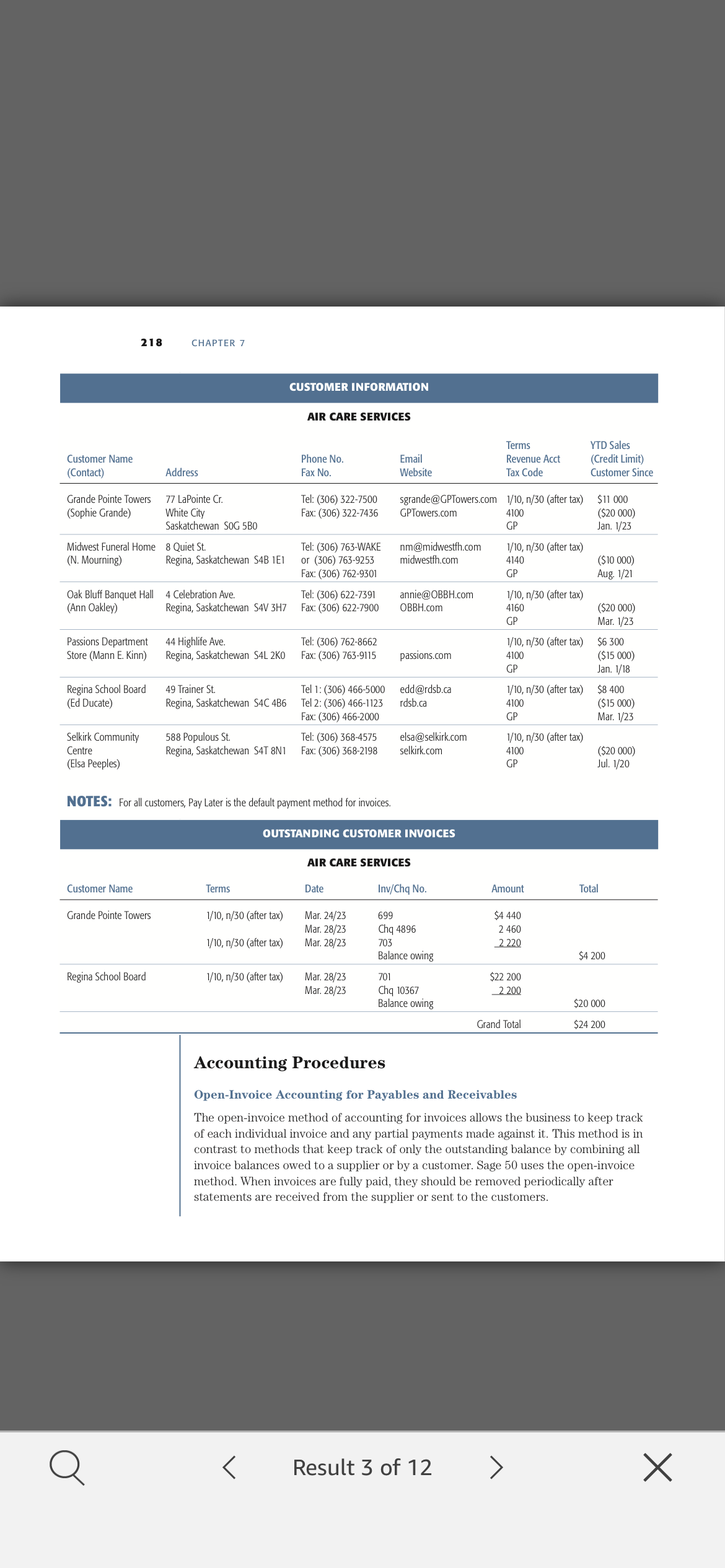

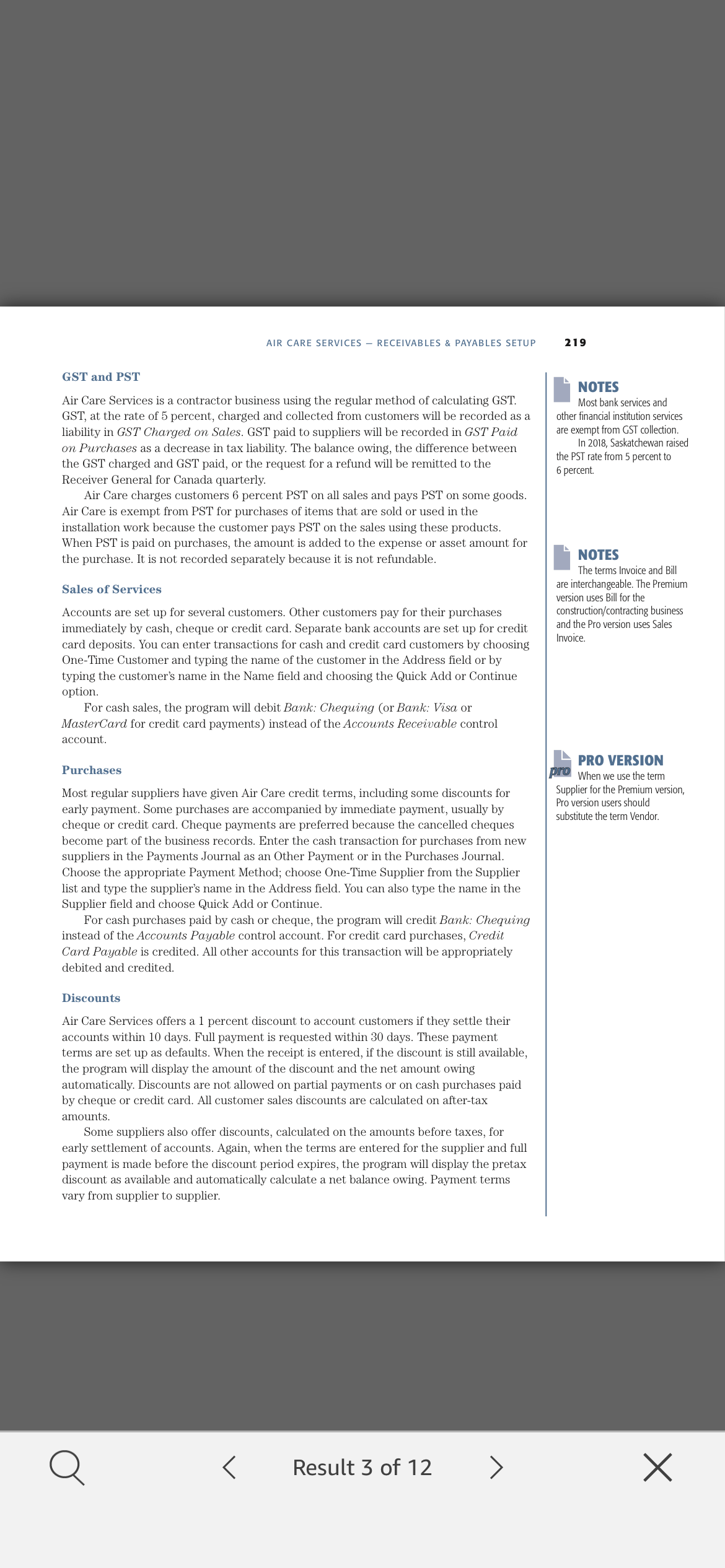

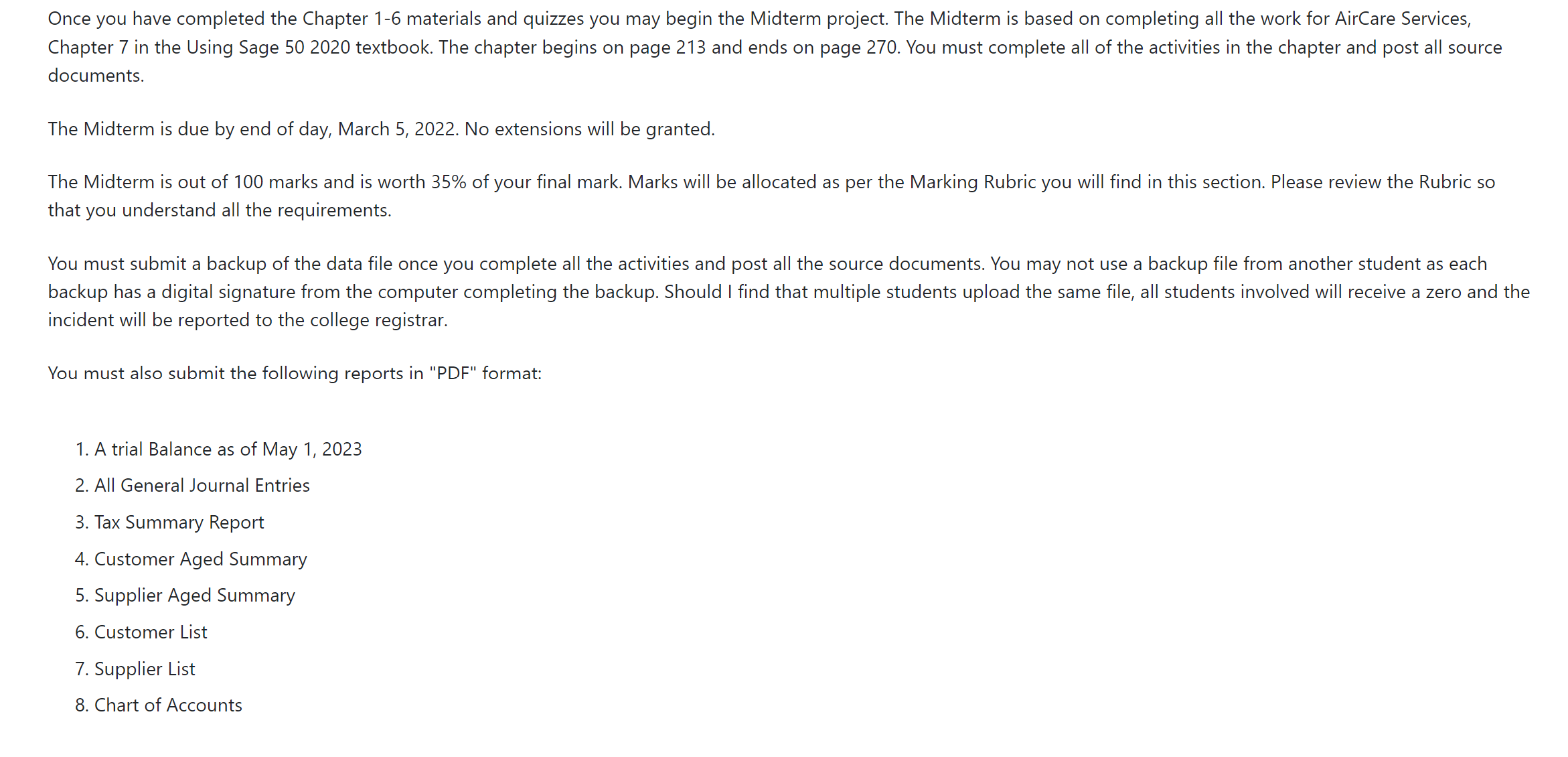

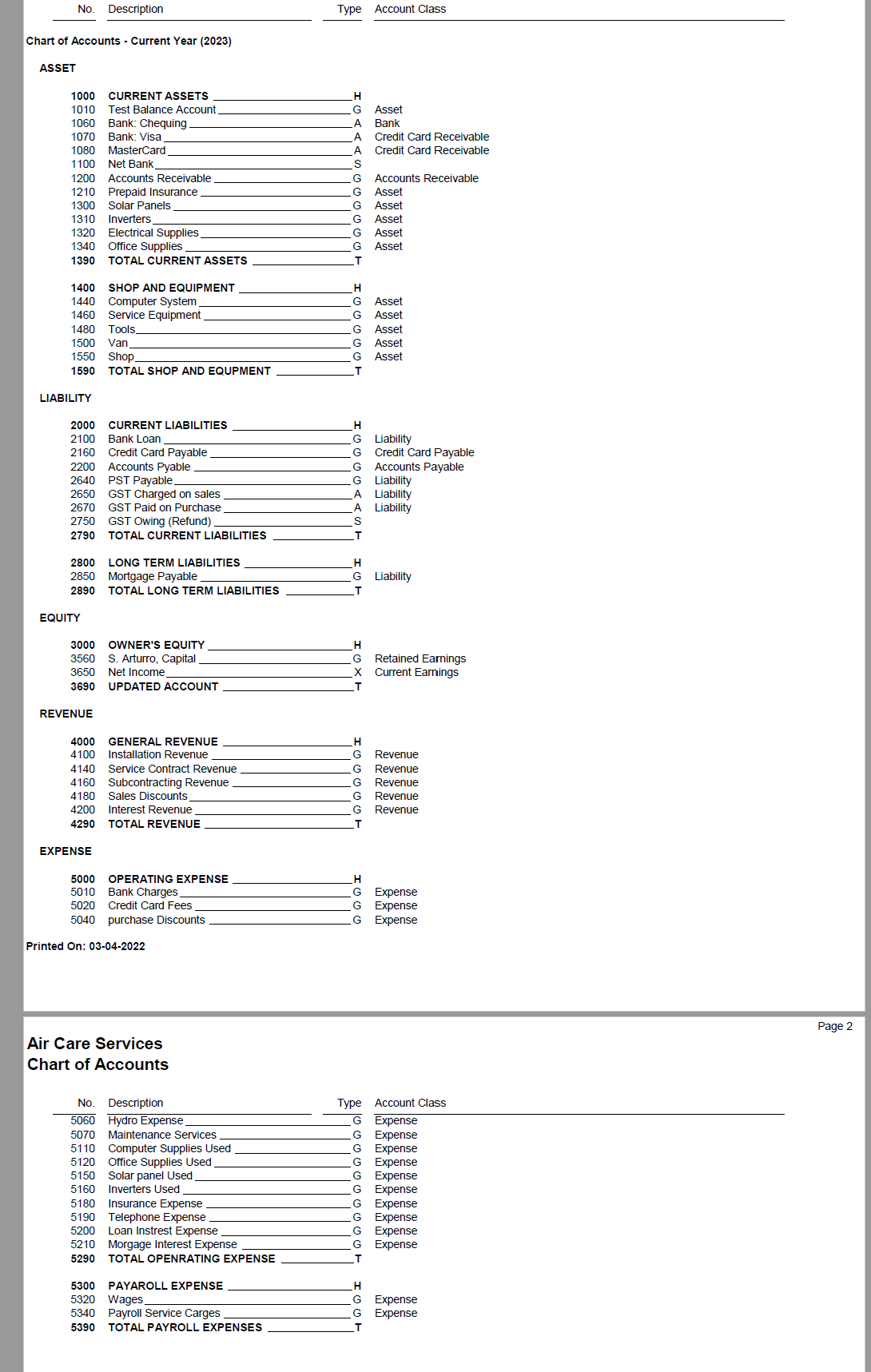

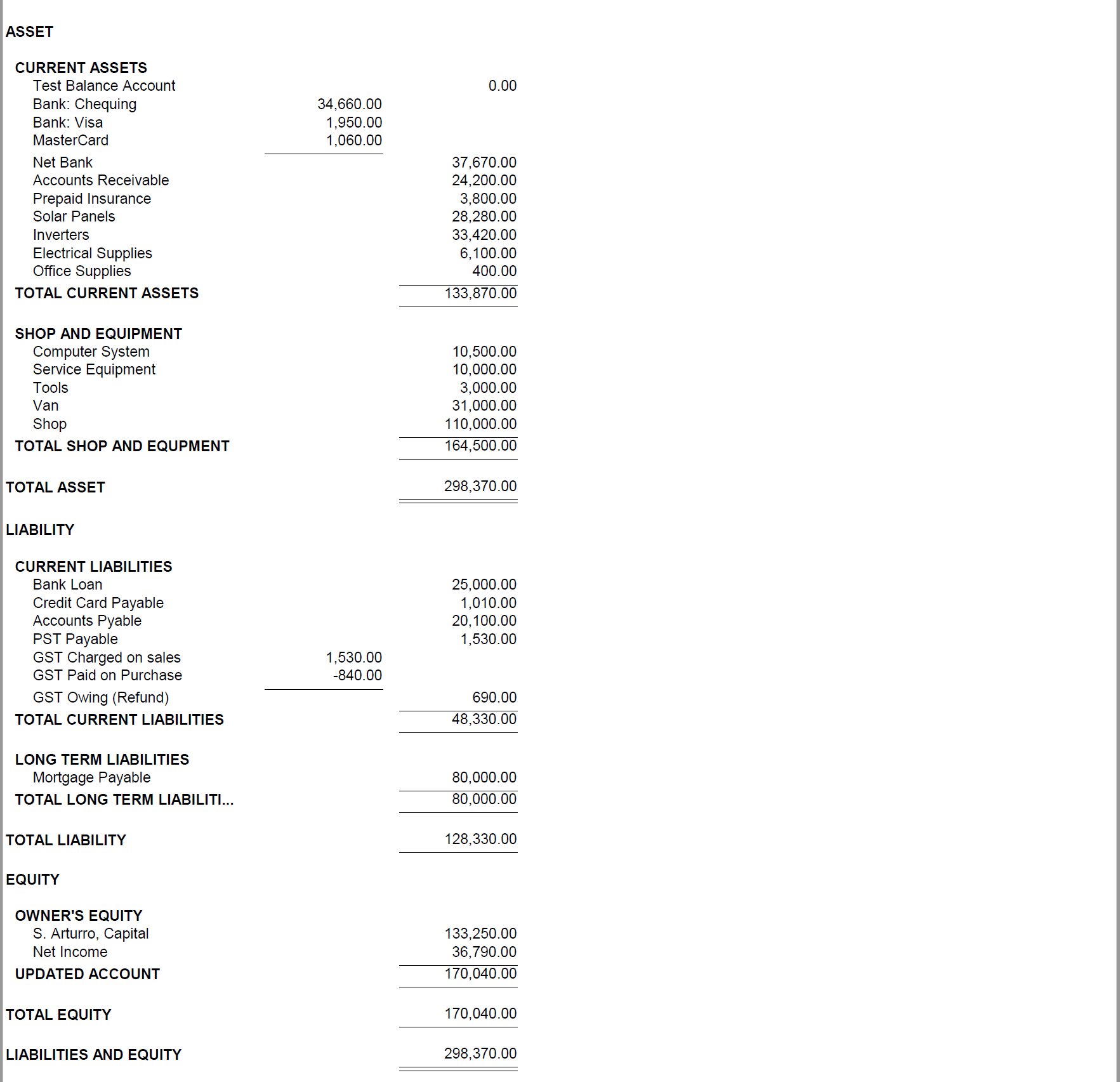

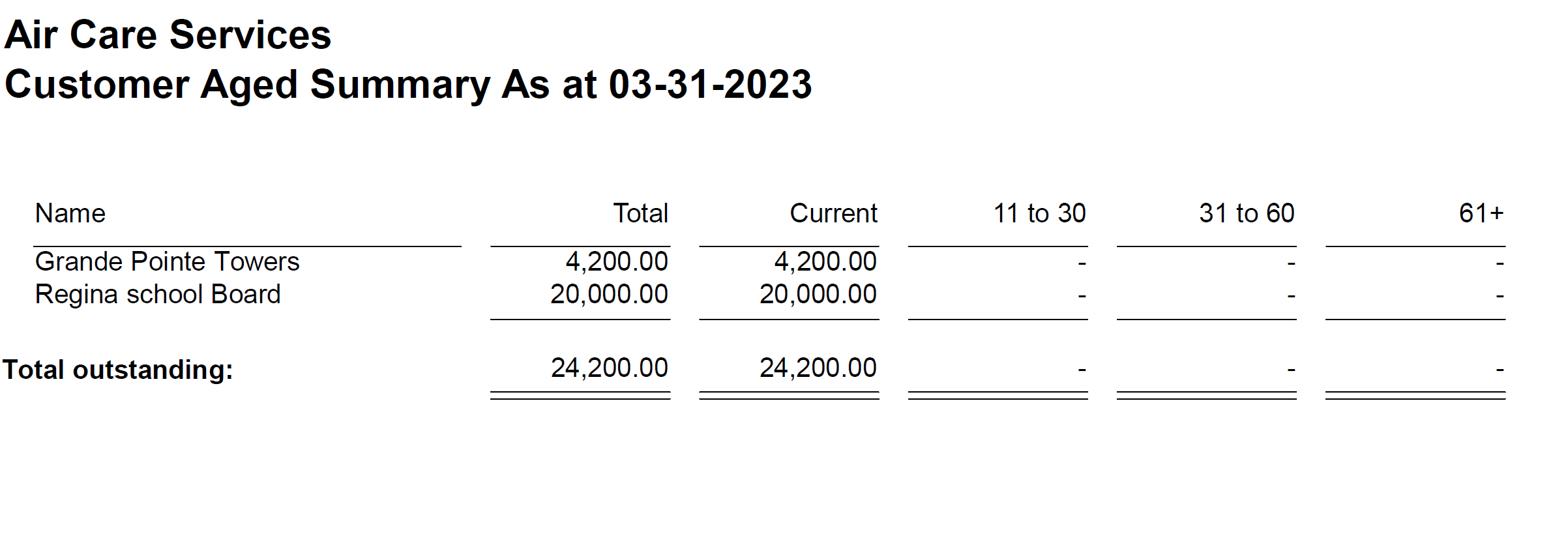

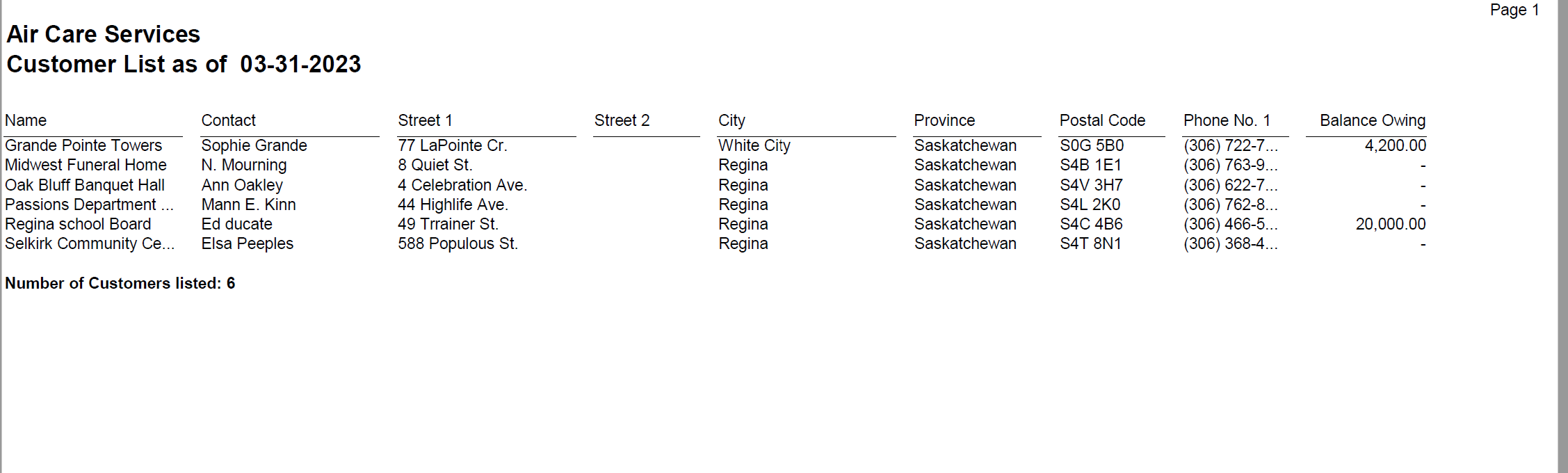

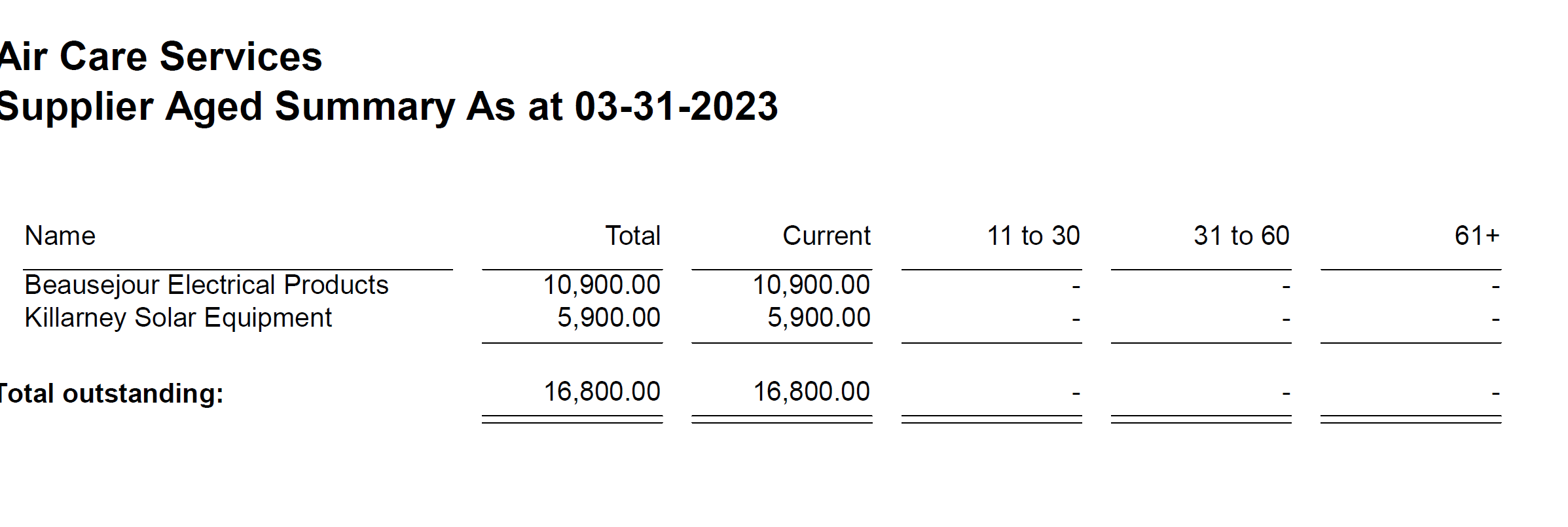

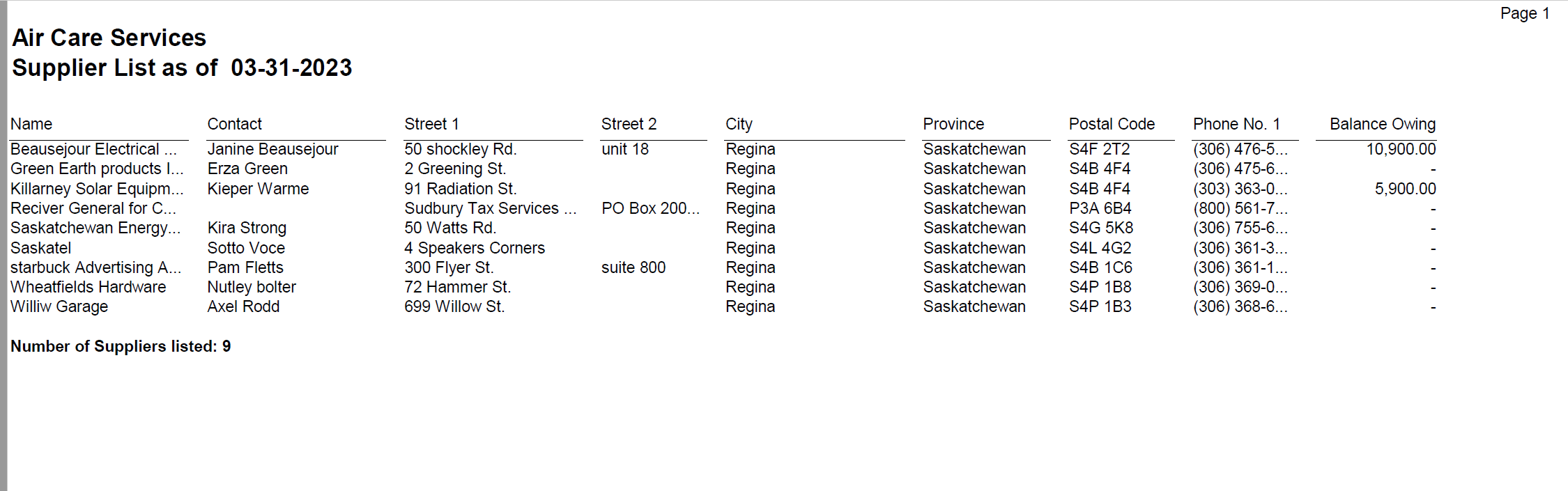

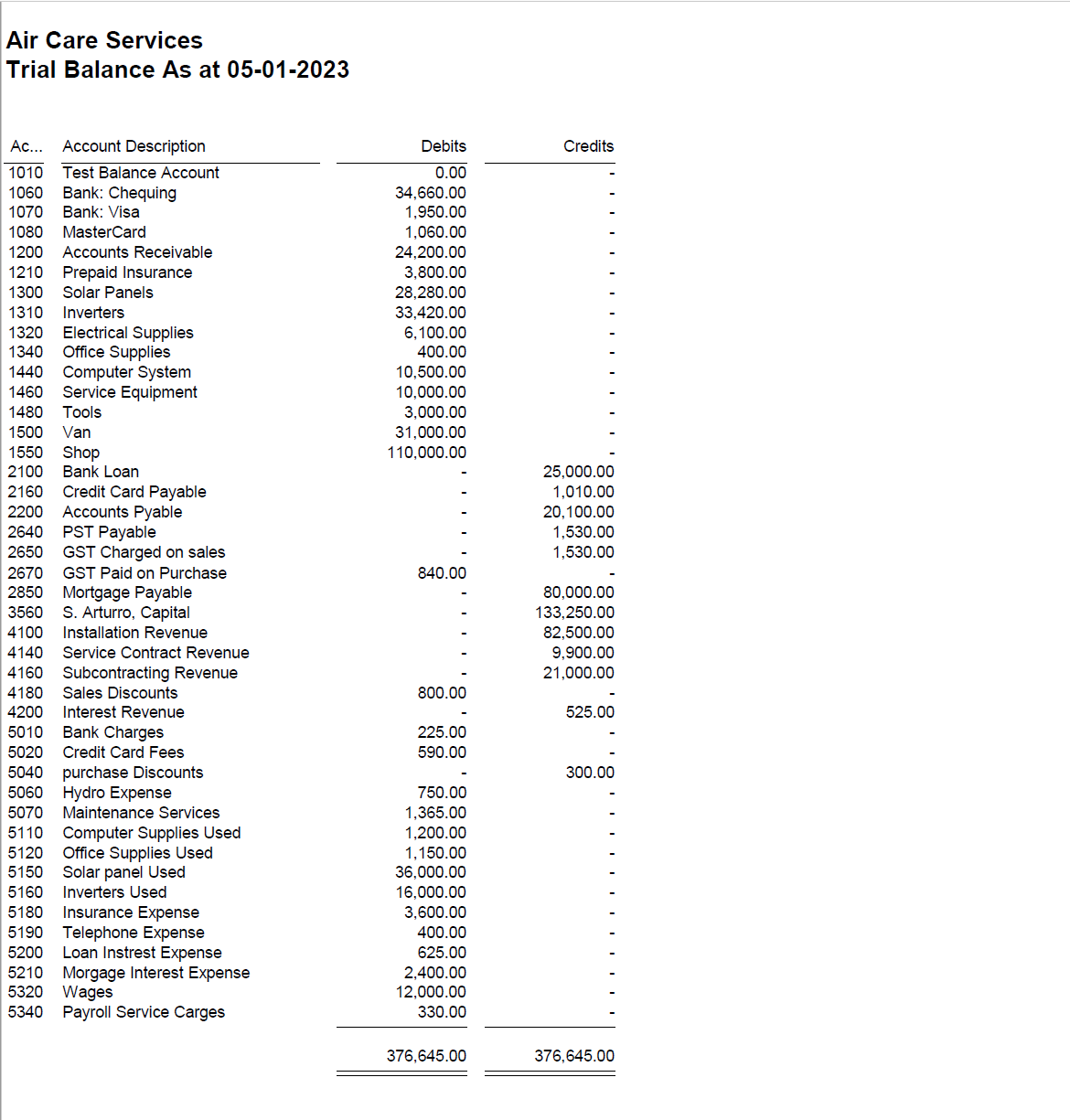

After completing this chapter, you should be able to ' NOTES Air Care Services l0!) Balair Avenue, Unit 25 Regina, SK S4T 4lJZ Tel 1: (306) 4564299 Tel 2: (333) 455-7194 Fax: (306) 456-3l88 Business No: 533 766 157 AirCare . SerVICes OBJECTIVES plan and design an accounting system for a small business prepare procedures for convening from a manual system understand the objectives of a computerized system create company files create and understand linked accounts set up accounts in the General, Payables and Receivables ledgers enter historical information for suppliers and customers correct historical transactions after recording them set up credit cards for receipts and payments set up sales taxes and tax codes leave history in an unbalanced state nish entering history after entering journal transactions enter postdated transactions COM PANY INFORMATION Company Profile it Care Services, located in sunny Regina, Saskatchewan, has been operating successfully for the past 15 years under the ownership and management of Simon Arturro. After his mechanical engineering education and several years' experience with heating installations, he became a certied installer of solar electrical panels, As more consumers are eager to rely less on fossil fuels as their source of power, the demand for solar energy is steadily increasing, Arturro has two assistants: a certied electrician and an assistant installer. Revenue comes from four sources: installation of new units, repairs, service contracts and subcontracting. Most jobs are new installations, either for individual customers or subcontracts for building projects Small and mediumesized home roof installation jobs are usually nished in two to four days, Repair work, outside of the service contracts, may include removing and replacing the panels when customers 2|! X 214 CHAPTER 7 are replacing a roof. Arturro also offers annual service contracts that provide free labour for existing installations. Some customers - homeowners, owners of office buildings and builders - have accounts with Air Care and receive a 1 percent discount if they pay within 10 days. They are asked to settle their accounts in 30 days, paying by cash or by cheque. PST and GST apply to all work completed by Air Care. Accounts have been set up with a local hardware store, with suppliers of solar panels and inverters (units that convert the solar DC power to AC) and other regular suppliers. After remitting all taxes before the end of March 2023, Arturro converted the accounts for Air Care using the following information: . Business Information . Chart of Accounts . Income Statement Balance Sheet Trial Balance Supplier Information . Customer Information . Accounting Procedures BUSINESS INFORMATION AIR CARE SERVICES COMPANY INFORMATION Allow Future Transactions, Date Format Address: 100 Belair Avenue, Unit 25 Warn If Transactions Are 7 Days In Future Short Date Format: MM dd yyyy Regina, Saskatchewan S4T 4U2 Warn If Accounts Are Not Balanced On The Screen Use Long Dates Telephone 1: (306) 456-1299 Backup Logo: SageData20\\ LOGOS\\ AIRCARE.BMP Telephone 2: (888) 455-7194 Backup Weekly; Display reminders Fax: (306) 456-3188 Turn off scheduled backup GENERAL SETTINGS: No changes Website Address: aircare.com PAYABLES SETTINGS Business No.: 533 766 457 RTOO01 Features Fiscal Start: January 1, 2023 Do not use: goods received notes, quotes, Address: Regina, Saskatchewan, Canada Options Fiscal End: June 30, 2023 orders, delivery orders, contracts, estimates, packing slips, projects (job sites) Aging Periods: 10, 30, 60 days Earliest Transaction: March 31, 2023 Discounts Before Tax: Yes Company Type: Construction/Contractor Use both French and English Credit Card Information RECEIVABLES SETTINGS REPORTS & FORMS Card Used: Visa Address: Regina, Saskatchewan, Canada Choose settings for your printer and forms Payable Account: 2160 Options USER PREFERENCES Expense Account: 5020 Aging Periods: 10, 30, 60 days Options Card Accepted: Visa Interest Charges: compound, 1.5% monthly Use Accounting Terms Discount Fee: 2.9% rate, after 1 day Automatically Save Changes to Records Expense Account: 5020 Statements: Include Invoices for 31 days Show List Buttons Asset Account: 1070 New Customer Tax Code: GP Calculate Record Balances in Home Window Card Accepted: MasterCard Discounts by Session Date Discount Fee: 2.7% Payment Terms: 1/10, n/30 after tax View Settings Expense Account: 5020 Discounts Before Tax: No Hide: Inventory & Services, Employees & Asset Account: 1080 Line Discounts: No Payroll, Job Sites, Time & Billing Sales Taxes Comments Daily Business Manager: turn off Taxes: GST; PST Sales Invoice: Interest @ 1.5% per month Checklists: turn off Codes: G - GST @ 5%; charged on accounts over 30 days Show Session Date at Startup GP - GST @ 5%, PST @ 6%, BANK ACCOUNTS: NEXT CHEQUE NO. Transaction Confirmation: confirmation turned on non-refundable Bank: Chequing 101 Pop-Ups: your preferences Forms Settings (Next Number) Sales Invoices No. 710 COMPANY SETTINGS Receipts No. 200 System Check for duplicates Do not allow dates before March 31, 2023 Q Result 3 of 12 X\f216 CHAPTER 7 BALANCE SHEET AIR CARE SERVICES March 31, 2023 Assets Liabilities 1000 CURRENT ASSETS 2000 CURRENT LIABILITIES 1060 Bank: Chequing $ 34 660 2100 Bank Loan $ 25 000 1070 Bank: Visa 1 950 2160 Credit Card Payable 1 010 1080 Bank: MasterCard 1 060 2200 Accounts Payable 20 100 1100 Net Bank $ 37 670 2640 PST Payable 1 530 1200 Accounts Receivable 24 200 2650 GST Charged on Sales $1 530 1210 Prepaid Insurance 3 800 2670 GST Paid on Purchases -840 1300 Solar Panels 28 280 2750 GST Owing (Refund) 690 1310 Inverters 33 420 2790 TOTAL CURRENT LIABILITIES 48 330 1320 Electrical Supplies 6 100 1340 Office Supplies 400 2800 LONG TERM LIABILITIES 1390 TOTAL CURRENT ASSETS $ 133 870 2850 Mortgage Payable 80 000 2890 TOTAL LONG TERM LIABILITIES $ 80 000 1400 OFFICE & EQUIPMENT 1440 Computer System 10 500 TOTAL LIABILITIES $ 128 330 1460 Service Equipment 10 000 Equity 1480 Tools 3 000 3000 OWNER'S EQUITY 1500 Van 31 000 3560 S. Arturro, Capital $ 133 250 1550 Shop 110 000 3650 Net Income 36 790 1590 TOTAL SHOP & EQUIPMENT $164 500 3690 UPDATED CAPITAL $ 170 040 TOTAL ASSETS $298 370 TOTAL EQUITY $ 170 040 LIABILITIES AND EQUITY $298 370 TRIAL BALANCE AIR CARE SERVICES March 31, 2023 Debit Credit Debit Credit 1060 Bank: Chequing $ 34 660 3560 S. Arturro, Capital $133 250 1070 Bank: Visa 1 950 4100 Installation Revenue 82 500 1080 Bank: MasterCard 1 060 4140 Service Contract Revenue 9 900 1200 Accounts Receivable 24 200 4160 Subcontracting Revenue 21 000 1210 Prepaid Insurance 3 800 4180 Sales Discounts $ 800 1300 Solar Panels 28 280 4200 Interest Revenue 525 1310 Inverters 33 420 Bank Charges 225 1320 Electrical Supplies 6 100 5020 Credit Card Fees 590 1340 Office Supplies 400 5040 Purchase Discounts 300 1440 Computer System 10 500 5060 Hydro Expense 750 1460 Service Equipment 10 000 5070 Maintenance Services 1 365 1480 Tools 3 000 5110 Computer Supplies Used 1 200 1500 Van 31 000 5120 Office Supplies Used 1 150 1550 Shop 110 000 Solar Panels Used 36 00 2100 Bank Loan $ 25 000 5160 Inverters Used 16 000 2160 Credit Card Payable 1 010 5180 Insurance Expense 3 600 2200 Accounts Payable 20 100 5190 Telephone Expense 400 PST Payable 1 530 5200 Loan Interest Expense 625 2650 GST Charged on Sales 1530 5210 Mortgage Interest Expense 2 400 2670 GST Paid on Purchases 840 5320 Wages 12 000 2850 Mortgage Payable 80 000 5340 Payroll Service Charges 330 $376 645 $376 645 Q Result 3 of 12 XAIR CARE SERVICES - RECEIVABLES & PAYABLES SETUP 217 SUPPLIER INFORMATION AIR CARE SERVICES YTD Purchases Email (Pre- & Post-Tax Supplier Name Phone No. Website Terms Payments) (Contact) Address Fax No. Tax ID Account Tax Code Beausejour Electrical Products 50 Shockley Rd., Unit 18 Tel 1: (306) 476-5282 jb@beausejour.com 1/10, n/30 $2 100 (Janine Beausejour Regina, Saskatchewan S4F 2T2 Tel 2: (306) 476-3997 beausejour.com before tax) ($2 000 & $2 100) Fax: (306) 476-5110 444 276 539 RTO001 1320 Green Earth Products Inc. 2 Greening St. Tel: (306) 475-6432 egreen@greenearth.com 1/10, n/30 (Ezra Green) Regina, Saskatchewan S4F 919 Fax: (306) 475-8600 greenearth.com (before tax) 177 235 447 RTO001 1310 G Killarney Solar Equipment 91 Radiation St. Tel: (306) 363-0210 kw@heatexchange.com 1/5, n/30 (Kieper Warme) Regina, Saskatchewan S4B 4F4 Fax: (306) 363-2000 heatexchange.com before tax) $71 277 631 RTOOO 1300 G *Receiver General Sudbury Tax Services Office Tel 1: (800) 561-7761 net 1 for Canada PO Box 20004 Tel 2: (800) 959-2221 canada.ca/en/revenue-agency ($790 & $790) Sudbury, Ontario P3A 6B4 No tax *Saskatchewan Energy Corp. 50 Watts Rd Tel 1: (306) 755-6000 accounts@seg.ca net 10 $840 (Kira Strong) Regina, Saskatchewan S4G 5K8 Tel 2: (306) 755-3997 seg.ca ($800 & $840) Fax: (306) 754-7201 459 021 648 RT0001 5060 *Saskatel 4 Speakers Corners Tel: (306) 361-3255 accounts@saskatel.ca net 10 $666 (Sotto Voce) Regina, Saskatchewan S4L 4G2 saskatel.ca ($600 & $666) 492 304 597 RTO001 5190 GF Starbuck Advertising Agency 300 Flyer St. Tel: (306) 361-1727 pfletts@saa.com net 10 $1 110 (Pam Fletts) Suite 800 Fax: (306) 361-8229 sad.com ($1 000 & $1 110) Regina, Saskatchewan S4B 1C 610 728 362 RTOO01 GP Wheatfields Hardware 72 Hammer St. Tel 1: (306) 369-0808 nbolter@yahoo.com net 15 $999 (Nutley Bolter) Regina, Saskatchewan S4P 1B8 Tel 2: (306) 369-6222 ($900 & $999) 385 416 821 RTOO01 1480 Willow Garage 699 Willow St. Tel 1: (306) 368-6444 axel@wefixcars.com net 30 $444 (Axel Rodd) Regina, Saskatchewan S4P 1B3 Tel 2: (306) 368-6000 wefixcars.com ($400 & $444) 129 732 012 RTOO01 NOTES: *For Receiver General, Saskatchewan Energy Corp. and Saskatel, Cheque is the default payment method for invoices. For all other suppliers, Pay Later is the default. OUTSTANDING SUPPLIER INVOICES AIR CARE SERVICES Supplier Name Terms Date Inv/Chq No. Amount Tax Total Beausejour Electrical Products 1/10, n/30 (before tax) Mar. 26/23 B-894 $10 000 $500 $10 500 Mar. 26/23 Cha 94 4 500 1/10, n/30 (before tax) Mar. 28/23 B-921 2 000 100 2 100 Balance owing $ 8 100 Killarney Solar Equipment 1/5, n/30 (before tax) Mar. 25/23 KS-103 $20 000 1 000 $21 000 Mar. 28/23 Cha 96 5 200 Mar. 31/23 Cha 98 9 900 Balance owing $ 5 900 Grand Total $14 000 Q Result 3 of 12 X\fAIR CARE SERVICES RECEIVABLES it PAYABLES SETUP GST and PST Air Care Services is a contractor business using the regular method of calculating GST. GST, at the rate of 5 percent, charged and collected from customers will be recorded as a liability in GST Charged on Sales. GST paid to suppliers will be recorded in GST Paid on Purchases as a decrease in tax liability. The balance owing, the difference between the GST charged and GST paid, or the request for a refund will be remitted to the Receiver General for Canada quarterly. Air Care charges customers 6 percent PST on all sales and pays PST on some goods. Air Care is exempt from PST for purchases of items that are sold or used in the installation work because the customer pays PST on the sales using these products. When PST is paid on purchases, the amount is added to the expense or asset amount for the purchase. It is not recorded separately because it is not refundable. Sales of Services Accounts are set up for several customers Other customers pay for their purchases immediately by cash, cheque or credit card. Separate bank accounts are set up for credit card deposits. You can enter transactions for cash and credit card customers by choosing Onee'Iime Customer and typing the name of the customer in the Address eld or by typing the customer's name in the Name eld and choosing the Quick Add or Continue option. For cash sales, the program will debit Bank: Chequmg (or Bonk: Visa or MasterCard for credit card payments) instead of the Accounts Receivable control account. Purchase s Most regular suppliers have given Air Care credit terms, including some discounts for early payment. Some purchases are accompanied by immediate payment, usually by cheque or credit card. Cheque payments are preferred because the cancelled cheques become part of the business records. Enter the cash transaction for purchases from new suppliers in the Payments Journal as an Other Payment or in the Purchases Journall Choose the appropriate Payment Method; choose OneeTime Supplier from the Supplier list and type the supplier's name in the Address eld. You can also type the name in the Supplier field and choose Quick Add or Continue. For cash purchases paid by cash or cheque, the program will credit Bank: Chequing instead of the Accoums Payable control account. For credit card purchases, Credit Card Payable is credited. All other accounts for this transaction will be appropriately debited and credited. Discounts Air Care Services offers a 1 percent discount to account customers if they settle their accounts within 10 days. Ful payment is requested within 30 days. These payment terms are set up as defaults. When the receipt is entered, if the discount is still available, the program will display the amount of the discount and the net amount owing automatically. Discounts are not allowed on partial payments or on cash purchases paid by cheque or credit card. Al customer sales discounts are calculated on after-tax amounts Some suppliers also offer discounts, calculated on the amounts before taxes, for early settlement of accounts. Again, when the terms are entered for the supplier and full payment is made before the discount period expires, the program will display the pretax discount as available and automatically calculate a net balance owing. Payment terms vary from supplier to supplierl Result 3 of 1 2 > 219 ' norrs Most bank services and other nancial institution services are exempt from CST collection. In 2018, Saskatchewan raised the PST rate from 5 percent to 6 percent K NOTES The terms Invoice and Bill are interchangeable, The Premium version uses Bill for the construction/cumming business and the Pro version usa Sales Invoice. ' no vensrou When we use the term Supplier for the Premium version, Pro version users should substitute the term Vendor. Once you have completed the Chapter 1-6 materials and quizzes you may begin the Midterm project. The Midterm is based on completing all the work for AirCare Services, Chapter 7 in the Using Sage 50 2020 textbook. The chapter begins on page 213 and ends on page 270. You must complete all of the activities in the chapter and post all source documents The Midterm is due by end of day, March 5,2022. No extensions will be granted. The Midterm is out of 100 marks and is worth 35% of your final mark. Marks will be allocated as per the Marking Rubric you will find in this section. Please review the Rubric so that you understand all the requirements. You must submit a backup of the data file once you complete all the activities and post all the source documents. You may not use a backup file from another student as each backup has a digital signature from the computer completing the backup. Should I find that multiple students upload the same file, all students involved will receive a zero and the incident will be reported to the college registrar. You must also submit the following reports in "PDF" format: 1. A trial Balance as of May 1, 2023 2. All General Journal Entries 3. Tax Summary Report 4. Customer Aged Summary 5. Supplier Aged Summary 6. Customer List 7. Supplier List 8. Chart of Accounts No. Description Type Account Class Chart of Accounts - Current Year (2023) ASSET 1000 CURRENT ASSETS 1010 Test Balance Account Asset 1060 Bank: Chequing. A Bank 1070 Bank: Visa A Credit Card Receivable 1080 MasterCard A Credit Card Receivable 1100 Net Bank_ .S 1200 Accounts Receivable Accounts Receivable 1210 Prepaid Insurance Asset 1300 Solar Panels G Asset 1310 Inverters_ G Asset 1320 Electrical Supplies G Asset 1340 Office Supplies G Asset 1390 TOTAL CURRENT ASSETS 1400 SHOP AND EQUIPMENT H 1440 Computer System G Asset 1460 Service Equipment G Asset 1480 Tools Asset 1500 Van_ Asset 1550 Shop G Asset 1590 TOTAL SHOP AND EQUPMENT LIABILITY 2000 CURRENT LIABILITIES 2100 Bank Loan Liability 2160 Credit Card Payable Credit Card Payable 2200 Accounts Pyable Accounts Payable 2640 PST Payable. Liability 2650 GST Charged on sales A Liability 2670 GST Paid on Purchase Liability 2750 GST Owing (Refund). HOP. 2790 TOTAL CURRENT LIABILITIES 2800 LONG TERM LIABILITIES DI 2850 Mortgage Payable Liability 2890 TOTAL LONG TERM LIABILITIES EQUITY 3000 OWNER'S EQUITY 560 S. Arturro, Capital Retained Earnings 3650 Net Income Current Earnings 3690 UPDATED ACCOUNT REVENUE 4000 GENERAL REVENUE 4100 Installation Revenue . Revenue 4140 Service Contract Revenue Revenue 4160 Subcontracting Revenue Revenue 4180 Sales Discounts Revenue 4200 Interest Revenue Revenue 4290 TOTAL REVENUE EXPENSE 5000 OPERATING EXPENSE 5010 Bank Charges. Expense 5020 Credit Card Fees Expense 5040 purchase Discounts Expense Printed On: 03-04-2022 Page 2 Air Care Services Chart of Accounts No. Description Type Account Class 5060 Hydro Expense_ G Expense 5070 Maintenance Services _ Expense 5110 Computer Supplies Used Expense 5120 Office Supplies Used G Expense 5150 Solar panel Used G Expense 5160 Inverters Used G Expense 5180 Insurance Expense Expense 5190 Telephone Expense G Expense 5200 Loan Instrest Expense _ Expense 5210 Morgage Interest Expense Expense 5290 TOTAL OPENRATING EXPENSE 5300 PAYAROLL EXPENSE 5320 Wages_ Expense 5340 Payroll Service Carges Expense 5390 TOTAL PAYROLL EXPENSESASS ET CURRENT ASSETS Test Balance Account 0.00 Bank: Chequing 34,660.00 Bank: Visa 1,950.00 MasterCard 1,060.00 Net Bank 37,670.00 Accounts Receivable 24,200.00 Prepaid Insurance 3,800.00 Solar Panels 28,280.00 Inverters 33,420.00 Electrical Supplies 6,100.00 Office Supplies 400.00 TOTAL CURRENT ASSETS 133,870.00 SHOP AND EQUIPMENT Computer System 10,500.00 Service Equipment 10,000.00 Tools 3,000.00 Van 31,000.00 Shop 110,000.00 TOTAL SHOP AND EQUPMENT 164,500.00 TOTAL ASSET 298,370.00 LIABILITY CURRENT LIABILITIES Bank Loan 25,000.00 Credit Card Payable 1,010.00 Accounts Pyable 20,100.00 PST Payable 1,530.00 GST Charged on sales 1,530.00 GST Paid on Purchase -840.00 GST Owing (Refund) 690.00 TOTAL CURRENT LIABILITIES 48,330.00 LONG TERM LIABILITIES Mortgage Payable 80,000.00 TOTAL LONG TERM LIABILITI... 80,000.00 TOTAL LIABILITY 128,330.00 EQUITY OWNER'S EQUITY S. Arturro, Capital 133,250.00 Net Income 36,790.00 UPDATED ACCOUNT 170,040.00 TOTAL EQUITY 170,040.00 LIABILITIES AND EQUITY 298,370.00 Air Care Services Customer Aged Summary As at 03-31-2023 Name Total Current 11 to 30 31 to 60 61+ Grande Pointe Towers 4,200.00 4,200.00 Regina school Board 20,000.00 20,000.00 Total outstanding: 24,200.00 24,200.00Page 1 Air Care Services Customer List as of 03-31-2023 Name Contact Street 1 Street 2 City Province Postal Code Phone No. 1 Balance Owing Grande Pointe Towers Sophie Grande 77 LaPointe Cr. White City Saskatchewan SOG 5B0 (306) 722-7... 4,200.00 Midwest Funeral Home N. Mourning 8 Quiet St. Regina Saskatchewan S4B 1E1 (306) 763-9... Oak Bluff Banquet Hall Ann Oakley 4 Celebration Ave. Regina Saskatchewan S4V 3H7 (306) 622-7... Passions Department ... Mann E. Kinn 44 Highlife Ave. Regina Saskatchewan S4L 2KO (306) 762-8... Regina school Board Ed ducate 49 Trainer St. Regina Saskatchewan S4C 4B6 (306) 466-5.. 20,000.00 Selkirk Community Ce... Elsa Peeples 588 Populous St. Regina Saskatchewan S4T 8N1 (306) 368-4... Number of Customers listed: 6Air Care Services Supplier Aged Summary As at 03-31-2023 Name Total Current 11 to 30 31 to 60 61+ Beausejour Electrical Products 10,900.00 10,900.00 Killarney Solar Equipment 5,900.00 5,900.00 otal outstanding: 16,800.00 16,800.00Page 1 Air Care Services Supplier List as of 03-31-2023 Name Contact Street 1 Street 2 City Province Postal Code Phone No. 1 Balance Owing Beausejour Electrical ... Janine Beausejour 50 shockley Rd. unit 18 Regina Saskatchewan S4F 2T2 (306) 476-5... 10,900.00 Green Earth products I... Erza Green 2 Greening St. Regina Saskatchewan S4B 4F4 (306) 475-6... Killarney Solar Equipm... Kieper Warme 91 Radiation St. Regina Saskatchewan S4B 4F4 (303) 363-0... 5,900.00 Reciver General for C... Sudbury Tax Services ... PO Box 200... Regina Saskatchewan P3A 6B4 (800) 561-7... Saskatchewan Energy... Kira Strong 50 Watts Rd. Regina Saskatchewan S4G 5K8 (306) 755-6... Saskatel Sotto Voce 4 Speakers Corners Regina Saskatchewan S4L 4G2 (306) 361-3... starbuck Advertising A... Pam Fletts 300 Flyer St. suite 800 Regina Saskatchewan S4B 106 (306) 361-1... Wheatfields Hardware Nutley bolter 72 Hammer St. Regina Saskatchewan S4P 1B8 (306) 369-0... Williw Garage Axel Rodd 699 Willow St. Regina Saskatchewan S4P 1B3 (306) 368-6... Number of Suppliers listed: 9Air Care Services Trial Balance As at 05-01-2023 Ac... Account Description Debits Credits 1010 Test Balance Account 0.00 1060 Bank: Chequing 34,660.00 1070 Bank: Visa 1,950.00 1080 MasterCard 1,060.00 1200 Accounts Receivable 24,200.00 1210 Prepaid Insurance 3,800.00 1300 Solar Panels 28,280.00 1310 Inverters 33,420.00 1320 Electrical Supplies 6, 100.00 1340 Office Supplies 400.00 1440 Computer System 10,500.00 1460 Service Equipment 10,000.00 1480 Tools 3,000.00 1500 Van 31,000.00 1550 Shop 110,000.00 2100 Bank Loan 25,000.00 2160 Credit Card Payable 1,010.00 2200 Accounts Pyable 20, 100.00 2640 PST Payable 1,530.00 2650 GST Charged on sales 1,530.00 2670 GST Paid on Purchase 840.00 2850 Mortgage Payable 80,000.00 3560 S. Arturro, Capital 133,250.00 4100 Installation Revenue 82,500.00 4140 Service Contract Revenue 9,900.00 4160 Subcontracting Revenue 21,000.00 4180 Sales Discounts 800.00 4200 Interest Revenue 525.00 5010 Bank Charges 225.00 5020 Credit Card Fees 590.00 5040 purchase Discounts 300.00 5060 Hydro Expense 750.00 5070 Maintenance Services 1,365.00 5110 Computer Supplies Used 1,200.00 5120 Office Supplies Used 1, 150.00 5150 Solar panel Used 36,000.00 5160 Inverters Used 16,000.00 5180 Insurance Expense 3,600.00 5190 Telephone Expense 400.00 5200 Loan Instrest Expense 625.00 5210 Morgage Interest Expense 2,400.00 5320 Wages 12,000.00 5340 Payroll Service Carges 330.00 376,645.00 376,645.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts