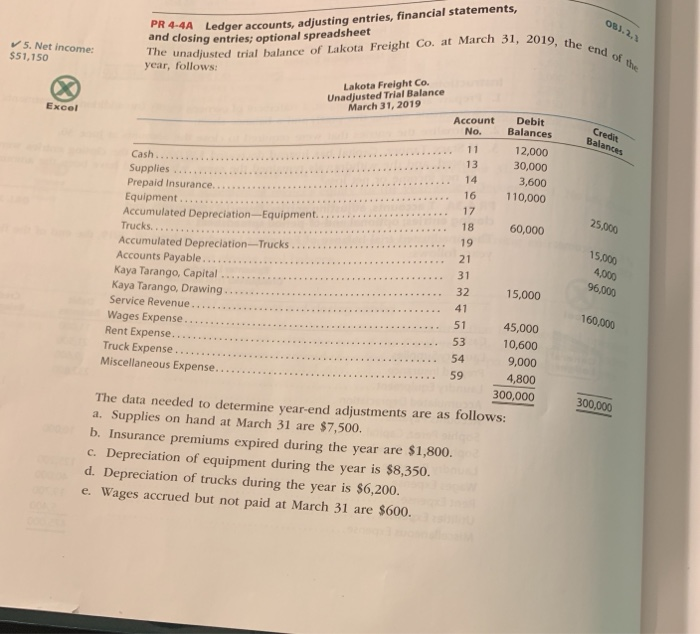

Question: how to do adjustment , adjusted trail blance ,income statement , The unadjusted trial balance of Lakota Freight Co. at March 31, 2019,th year, follows:

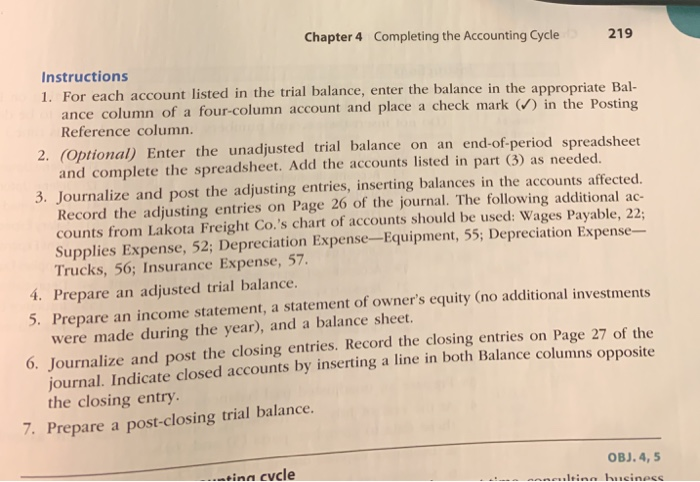

The unadjusted trial balance of Lakota Freight Co. at March 31, 2019,th year, follows: OB).2,1 the end of the ger accounts, adjusting entries, financial statements, spreadsheet and closing entries; optional 5. Net income: $51,150 Lakota Freight Co. Unadjusted Trial Balance March 31, 2019 Account Debit Excel No. Balances 12,000 13 30,000 3,600 16 110,000 Cash Supplies Prepaid Insurance.. Equipment Accumulated Depreciation-Equipment 18 60,000 25000 Accumulated Depreciation-Trucks Accounts Payable Kaya Tarango, Capital. Kaya Tarango, Drawing .. 32 15,000 Service Revenue.. 51 45,000 53 10,600 9,000 4,800 300,000 Wages Expense Rent Expense Truck Expense . . . 59 300,000 The data needed to determine year-end adjustments are as follows: a. Supplies on hand at March 31 are $7,500. Insurance premiums expired during the year are $1,800. c. Depreciation of equipment during the year is $8,350. d. Depreciation of trucks during the year is $6,200. e. Wages accrued but not paid at March 31 are s600. Chapter 4 Completing the Accounting Cycle 219 Instructions 1. For each account listed in the trial balance, enter the balance in the appropriate Bal- ance column of a four-column account and place a check mark in the Reference column. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed. 3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional ac- counts from Lakota Freight Co.'s chart of accounts should be used: Wages Payable, 22; Supplies Expense, 52; Depreciation Expense-Equipment, 55; Depreciation Expense- Trucks, 56; Insurance Expense, 57. 4. Prepare an adjusted trial balance 5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a balance sheet. 6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry 7. Prepare a post-closing trial balance. OBJ. 4, 5 eina cvcle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts