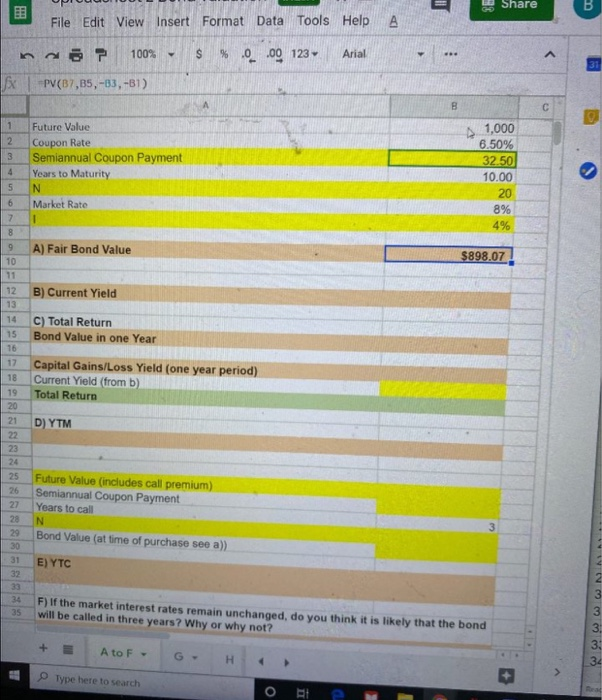

Question: how to fill the blank using excel formulas to solve please show work so i can understand Share File Edit View Insert Format Data Tools

Share File Edit View Insert Format Data Tools Help A n $ % . .00 123 Arial a 100%, PV(B7,B5,-33, -B1) 2 Future Value Coupon Rate Semiannual Coupon Payment Years to Maturity 3 1,000 6.50% 32.50 10.00 20 8% 6 Market Rate 496 8 9 10 A) Fair Bond Value $898.07 11 B) Current Yield 1 14 15 c) Total Return Bond Value in one Year 17 Capital Gains/Loss Yield (one year period) Current Yield (from b) Total Return 19 20 21 D) YTM 25 26 Future Value (includes call premium) Semiannual Coupon Payment Years to call 27 Bond Value (at time of purchase see a)) 30 31 E) YTO -- 4 mm F) If the market interest rates remain unchanged. do you think it is likely that the bond will be called in three years? Why or why not? A to F- G H Type here to search Share File Edit View Insert Format Data Tools Help A n $ % . .00 123 Arial a 100%, PV(B7,B5,-33, -B1) 2 Future Value Coupon Rate Semiannual Coupon Payment Years to Maturity 3 1,000 6.50% 32.50 10.00 20 8% 6 Market Rate 496 8 9 10 A) Fair Bond Value $898.07 11 B) Current Yield 1 14 15 c) Total Return Bond Value in one Year 17 Capital Gains/Loss Yield (one year period) Current Yield (from b) Total Return 19 20 21 D) YTM 25 26 Future Value (includes call premium) Semiannual Coupon Payment Years to call 27 Bond Value (at time of purchase see a)) 30 31 E) YTO -- 4 mm F) If the market interest rates remain unchanged. do you think it is likely that the bond will be called in three years? Why or why not? A to F- G H Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts