Question: How to finish Exercise 13.1? Practical exercises Exercise 13.1: Peter Mayer is the proprietor of Pete's Paint Shop. He commenced business on 2004 and has

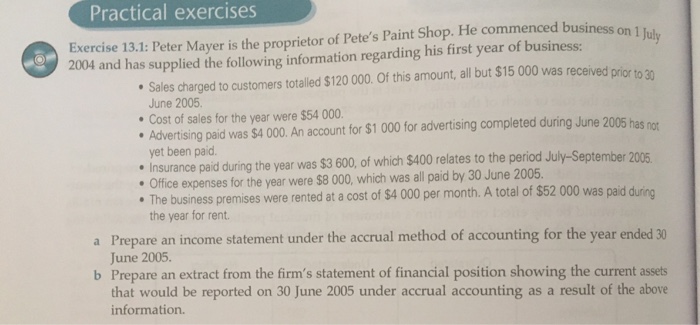

Practical exercises Exercise 13.1: Peter Mayer is the proprietor of Pete's Paint Shop. He commenced business on 2004 and has supplied the following information regarding his first year of business: July Sales charged to customers totaled $120 000. Of this amount, all but $15 000 was received prior to June 2005 Cost of sales for the year were $54 000. Advertising paid was $4 000. An account for $1 000 for advertising completed during June 2005 has not yet been paid. Insurance paid during the year was $3 600, of which $400 relates to the period July-September 2005 Office expenses for the year were $8 000, which was all paid by 30 June 2005. The business premises were rented at a cost of $4 000 per month. A total of $52 000 was paid the year for rent. a Prepare an income statement under the accrual method of accounting for the year ended 30 b Prepare an extract from the firm's statement of financial position showing the current assets June 2005. that would be reported on 30 June 2005 under accrual accounting as a result of the above information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts