Question: I JUST NEED HELP WITH QUESTION 2 QUESTIONS 1. Should the resort's depreciation expense of $30,000 per month be consid ered in your cash budget?

I JUST NEED HELP WITH QUESTION 2

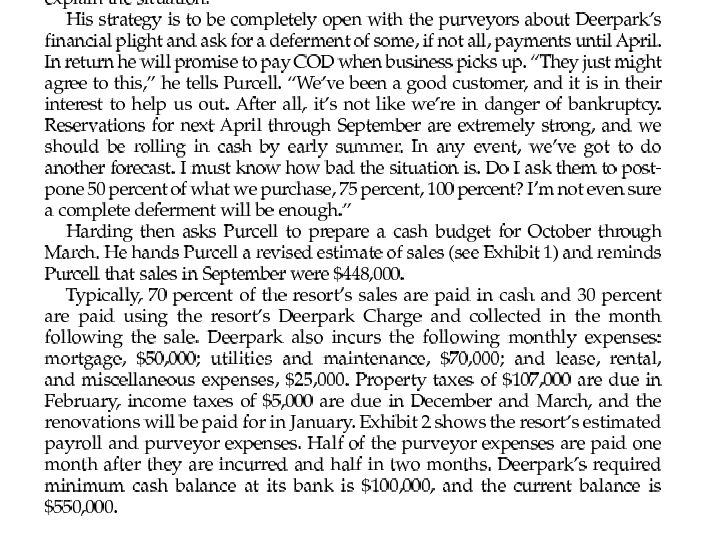

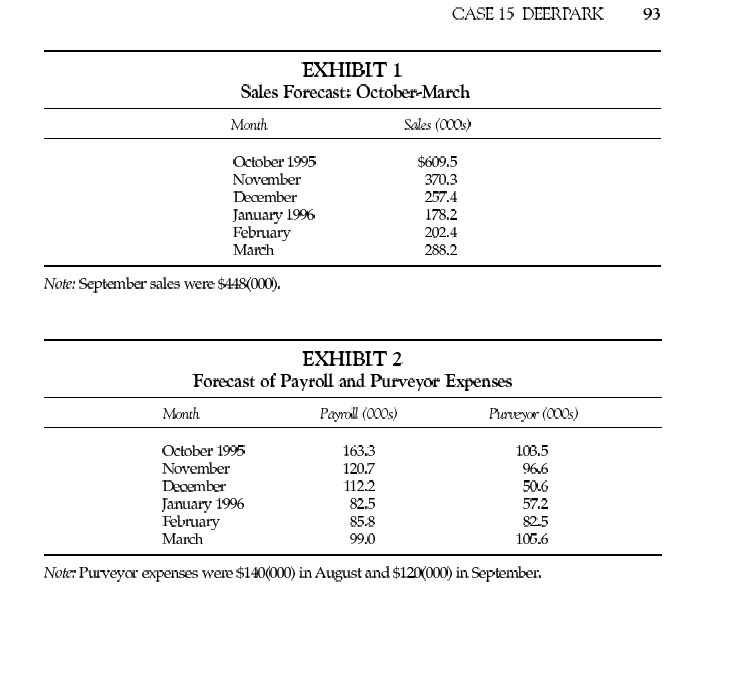

QUESTIONS 1. Should the resort's depreciation expense of $30,000 per month be consid ered in your cash budget? Explain 2. Prepare a cash budget for the period October through March CASH FLOW CONCERNS Three months ago Harding had prepared a cash flow forecast for the period October 1995 to May 19%. November through March is generally a slow period for the resort, and it is not unusual for the lodge to run cash deficits during most, if not all, of these months. However, the cash surplus generated during the peak period, from August through October, is typically sufficient to meet the shortfal. This is precisely what Harding had predicted would occur when he had made the cash budget projection in July. But now, in early October, he is having second thoughts about the forecast Three factors concern Harding. First, the renovations planned for January need to be more extensive than originally thought. Harding had estimated the cost to be $420,000, but it appears $500,000 of work is necessary. Second, the resort's long-time sales manager left unexpectedly in August and her replace ment does not seem to be as effective in obtaining convention business. Third, a recession has hit much of the area and Deerpark's sales are definitely sensi tive to the state of the regional economy. All this suggests Harding's sales forecasts, which he had labeled "conservative" in July, are too high. "I can see indications of this now," he tells Purcell. "Revenue is off 10 percent for September and October, and our advance bookings for the rest of the year are also down. I'm sure we won't hit the levels we predicted." Harding has always been an advocate of cash budget forecasts and constantly revises an estimate in light of new information. There is no doubt a new projection is necessary. THE ALTERNATIVES "What will you do in the event of a cash shortfall?" Purcell asks. Harding explains the options available. The resort could postpone or reduce the renovations, delay accounts payable, ask the owners for additional money, arrange a loan with the resort's bank, or use some combination of these options There are problems with most of these alternatives, however. If the renova tions are not made in January, sales will likely suffer in future months; the resort is showing signs of wear, and it is important to alter the hotel's decor periodi cally. And, of course, the renovations are best made during an off-peak month like January. Further, the ownes at a recent mecting had made it clear that it would be "extremely difficult, if not impossible" for them to raise capital at this time. Nor is the prospect of a loan an appealing option. Relations with the bank have been strained since the resort nearly went bankrupt a few years ago, before Harding's arrival as manager. The bank, assuming it would grant a loan is likely to impose severe restrictions on the operation of the resort. That would be interference that neither Harding nor the owners would welcome. Harding's most attractive option is to delay accounts payable with the other alternatives used if needed. He intends to call a meeting of all Deerpark's purveyors and explain the situation His strategy is to be completely open with the purveyors about Deerpark's financial plight and ask for a deferment of some, if not all, payments until April In return he will promise to pay COD when business picks up. "They just might agree to this," he tells Purcell. "We've been a good customer, and it is in their interest to help us out. After all, it's not like we're in danger of bankruptcy Reservations for next April through September are extremely strong, and we should be rolling in cash by early summer. In any event, we've got to do another forecast. I must know how bad the situation is. Do I ask them to post- pone 50 percent of what we purchase, 75 percent, 100 percent? I'm not even sure a complete deferment will be enough." Harding then asks Purcell to prepare a cash budget for October through March. He hands Purcell a revised estimate of sales (see Exhibit 1) and reminds Purcell that sales in September were $448,000. Typically, 70 percent of the resort's sales are paid in cash and 30 percent are paid using the resort's Deerpark Charge and collected in the month following the sale. Deerpark also incurs the following monthly expenses: mortgage, $50,000; utilities and maintenance, $70,000; and lease, rental, and miscellaneous expenses, $25,000. Property taxes of $107,000 are due in February, income taxes of $5,000 are due in December and March, and the renovations will be paid for in January. Exhibit 2 shows the resort's estimated payroll and purveyor expenses. Half of the purveyor expenses are paid one month after they are incurred and half in two months. Deerpark's required minimum cash balance at its bank is $100,000, and the current balance is $550,000 CASE 15 DEERPARK 93 EXHIBIT 1 Sales Forecast October-March Month Sales (000s) October 1995 November $609.5 370.3 December 257.4 January 1996 February 178.2 202.4 March 288.2 Note: September sales were $448(000) EXHIBIT 2 Forecast of Payroll and Purveyor Expenses Purveyor (000s) Month Payrol (000s) 103.5 October 1995 163,3 November December 120.7 966 112.2 50.6 57.2 January 1996 February 82.5 85.8 82.5 100.6 March 99.0 Note: Purveyor expenses were $140(000) in August and $120(000) in September QUESTIONS 1. Should the resort's depreciation expense of $30,000 per month be consid ered in your cash budget? Explain 2. Prepare a cash budget for the period October through March CASH FLOW CONCERNS Three months ago Harding had prepared a cash flow forecast for the period October 1995 to May 19%. November through March is generally a slow period for the resort, and it is not unusual for the lodge to run cash deficits during most, if not all, of these months. However, the cash surplus generated during the peak period, from August through October, is typically sufficient to meet the shortfal. This is precisely what Harding had predicted would occur when he had made the cash budget projection in July. But now, in early October, he is having second thoughts about the forecast Three factors concern Harding. First, the renovations planned for January need to be more extensive than originally thought. Harding had estimated the cost to be $420,000, but it appears $500,000 of work is necessary. Second, the resort's long-time sales manager left unexpectedly in August and her replace ment does not seem to be as effective in obtaining convention business. Third, a recession has hit much of the area and Deerpark's sales are definitely sensi tive to the state of the regional economy. All this suggests Harding's sales forecasts, which he had labeled "conservative" in July, are too high. "I can see indications of this now," he tells Purcell. "Revenue is off 10 percent for September and October, and our advance bookings for the rest of the year are also down. I'm sure we won't hit the levels we predicted." Harding has always been an advocate of cash budget forecasts and constantly revises an estimate in light of new information. There is no doubt a new projection is necessary. THE ALTERNATIVES "What will you do in the event of a cash shortfall?" Purcell asks. Harding explains the options available. The resort could postpone or reduce the renovations, delay accounts payable, ask the owners for additional money, arrange a loan with the resort's bank, or use some combination of these options There are problems with most of these alternatives, however. If the renova tions are not made in January, sales will likely suffer in future months; the resort is showing signs of wear, and it is important to alter the hotel's decor periodi cally. And, of course, the renovations are best made during an off-peak month like January. Further, the ownes at a recent mecting had made it clear that it would be "extremely difficult, if not impossible" for them to raise capital at this time. Nor is the prospect of a loan an appealing option. Relations with the bank have been strained since the resort nearly went bankrupt a few years ago, before Harding's arrival as manager. The bank, assuming it would grant a loan is likely to impose severe restrictions on the operation of the resort. That would be interference that neither Harding nor the owners would welcome. Harding's most attractive option is to delay accounts payable with the other alternatives used if needed. He intends to call a meeting of all Deerpark's purveyors and explain the situation His strategy is to be completely open with the purveyors about Deerpark's financial plight and ask for a deferment of some, if not all, payments until April In return he will promise to pay COD when business picks up. "They just might agree to this," he tells Purcell. "We've been a good customer, and it is in their interest to help us out. After all, it's not like we're in danger of bankruptcy Reservations for next April through September are extremely strong, and we should be rolling in cash by early summer. In any event, we've got to do another forecast. I must know how bad the situation is. Do I ask them to post- pone 50 percent of what we purchase, 75 percent, 100 percent? I'm not even sure a complete deferment will be enough." Harding then asks Purcell to prepare a cash budget for October through March. He hands Purcell a revised estimate of sales (see Exhibit 1) and reminds Purcell that sales in September were $448,000. Typically, 70 percent of the resort's sales are paid in cash and 30 percent are paid using the resort's Deerpark Charge and collected in the month following the sale. Deerpark also incurs the following monthly expenses: mortgage, $50,000; utilities and maintenance, $70,000; and lease, rental, and miscellaneous expenses, $25,000. Property taxes of $107,000 are due in February, income taxes of $5,000 are due in December and March, and the renovations will be paid for in January. Exhibit 2 shows the resort's estimated payroll and purveyor expenses. Half of the purveyor expenses are paid one month after they are incurred and half in two months. Deerpark's required minimum cash balance at its bank is $100,000, and the current balance is $550,000 CASE 15 DEERPARK 93 EXHIBIT 1 Sales Forecast October-March Month Sales (000s) October 1995 November $609.5 370.3 December 257.4 January 1996 February 178.2 202.4 March 288.2 Note: September sales were $448(000) EXHIBIT 2 Forecast of Payroll and Purveyor Expenses Purveyor (000s) Month Payrol (000s) 103.5 October 1995 163,3 November December 120.7 966 112.2 50.6 57.2 January 1996 February 82.5 85.8 82.5 100.6 March 99.0 Note: Purveyor expenses were $140(000) in August and $120(000) in September

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts