Question: How to remeber this on the test Required information Exercise 7-17A Record the sale of equipment (LO7-6) [The following information applies to the questions displayed

How to remeber this on the test

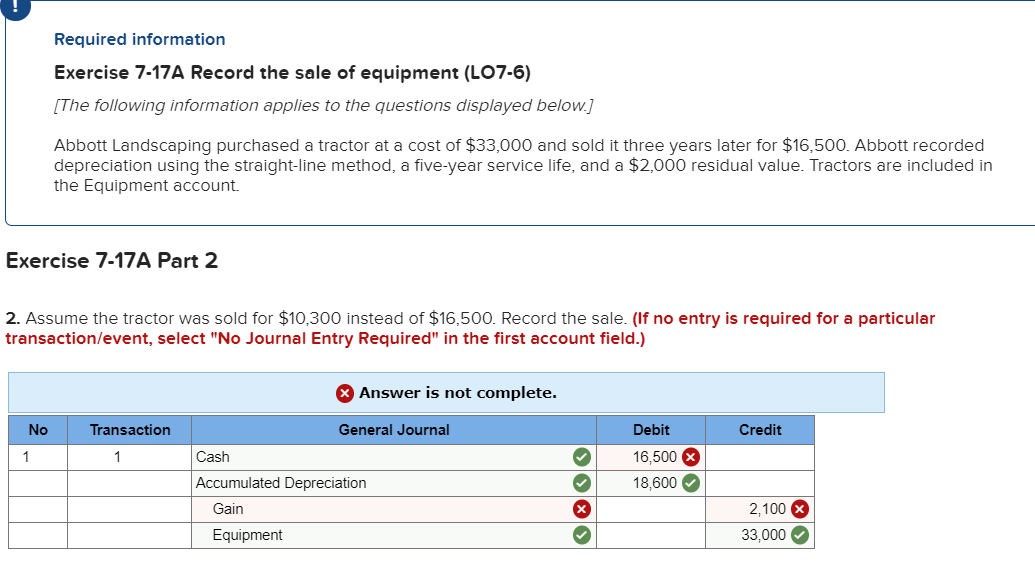

Required information Exercise 7-17A Record the sale of equipment (LO7-6) [The following information applies to the questions displayed below.) Abbott Landscaping purchased a tractor at a cost of $33,000 and sold it three years later for $16,500. Abbott recorded depreciation using the straight-line method, a five-year service life, and a $2,000 residual value. Tractors are included in the Equipment account. Exercise 7-17A Part 2 2. Assume the tractor was sold for $10,300 instead of $16,500. Record the sale. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. No Transaction General Journal Credit Cash Debit 16,500 18,600 Accumulated Depreciation Gain Equipment 2,100 33,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts