Question: How to remember this on test? Required information Exercise 7-17A Record the sale of equipment (LO7-6) [The following information applies to the questions displayed below.]

How to remember this on test?

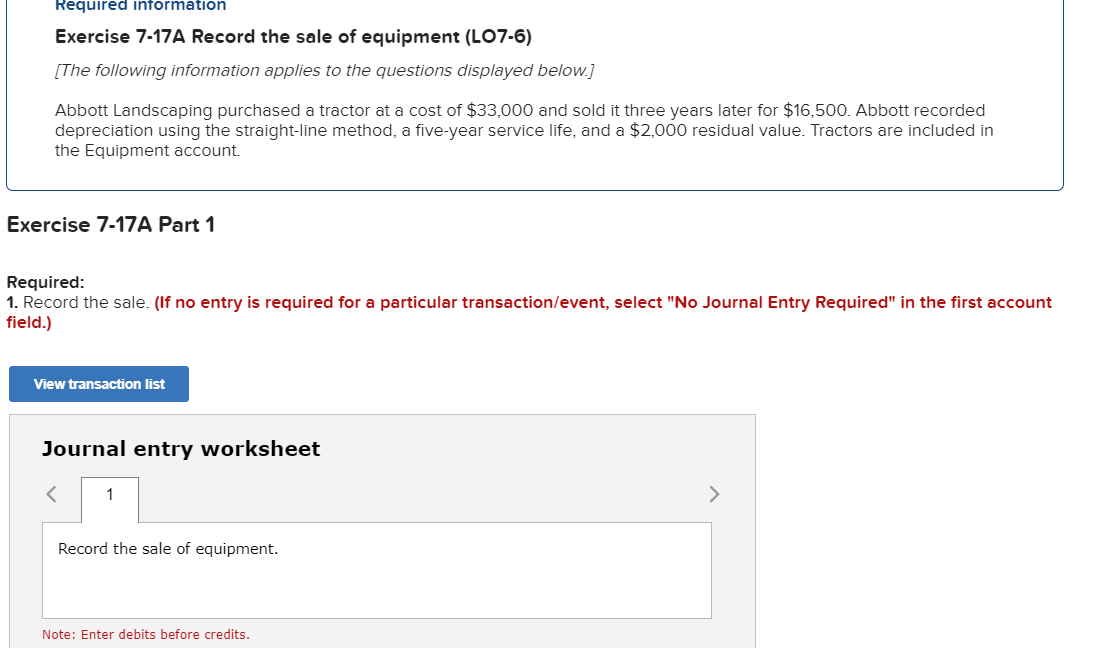

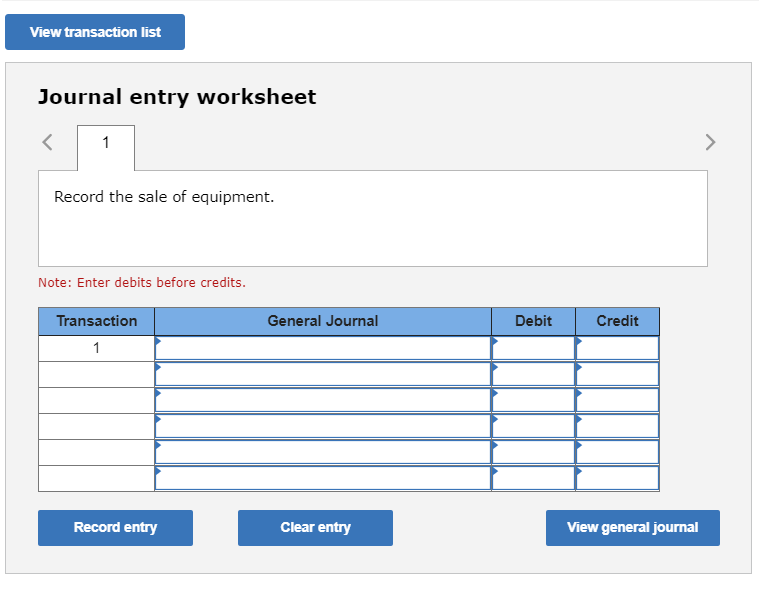

Required information Exercise 7-17A Record the sale of equipment (LO7-6) [The following information applies to the questions displayed below.] Abbott Landscaping purchased a tractor at a cost of $33,000 and sold it three years later for $16,500. Abbott recorded depreciation using the straight-line method, a five-year service life, and a $2,000 residual value. Tractors are included in the Equipment account. Exercise 7-17A Part 1 Required: 1. Record the sale. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the sale of equipment. Note: Enter debits before credits. View transaction list Journal entry worksheet 1 Record the sale of equipment. Note: Enter debits before credits. General Journal Debit Transaction Credit 1 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts