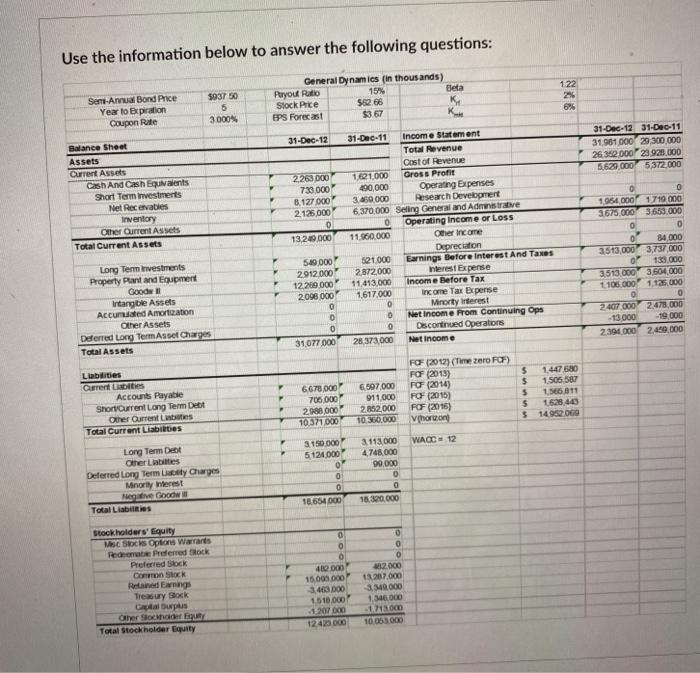

Question: how to solve each one step by step Use the information below to answer the following questions: Beta $037 50 5 3 000 Seni Annual

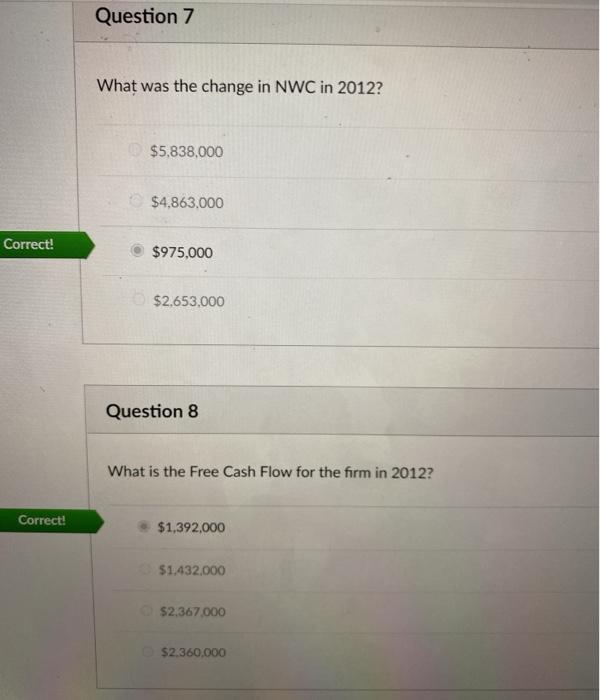

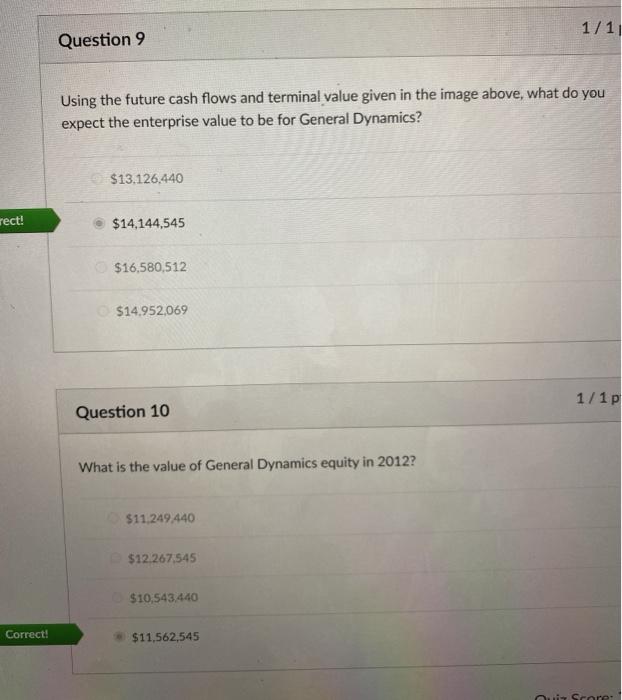

Use the information below to answer the following questions: Beta $037 50 5 3 000 Seni Annual Bond Price Year to Bipiration Coupon Rate 122 2% 6% General Dynamics (in thousands) Puryout Ratio 15% Stock Price 582 66 K EPS Forecast $3 67 . 31-Dec-12 31-Dec-12 31-Dec-11 31.981 000 29300.000 26.362 000 23 925,000 5,629.000 5,372.000 Balance Sheet Assets Current Assets Cash And Cash Equatents Short Term investments Net Recevables Inventory Other Current Assets Total Current Assets 2263 000 730 000 8.127 000 2.125.000 0 13.200.000 31-Dec-11 Income Statement Total Revenue Cost of Revenue 161.000 Gross Profit 490,000 Operating Expenses 3.950.000 Research Development 6.370,000 Seling General and Administrative 0 Operating Income or Loss 11.500.000 Other Income Depreciation 521.000 Earnings Before Interest And Taxes 2872,000 Interest Expense 11 413.000 Income Before Tax 1.617.000 Income Tax Expense Mortyrerest 0 Net Income from Continuing Ops 0 Discornued Operations 28.373.000 Net Income 0 1954 000 1.710.000 37675.000 3663.000 0 0 84000 3513,000 3,737.000 O 133.000 3513 000 3.604,000 1106 000 1.125.000 0 0 24070002478,000 -13 000 -19 000 234000 2400 000 549.000 2912000 12209.000 2098 000 0 O 0 31077.000 Long Term Investments Property Plant and Equpment Good Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Assets Liabilities Current sites Accounts Payable Short Current Long Term Debt Other Current Lubits Total Current Liabilities 6678.000 706 000 2.988 000 10371.000 6,507.000 911 000 2852.000 100.000 FO (2012) (Time zero FOF) FCF (2013) FO (2014) FCF (2015) FCF (2016) $ $ $ $ $ 1.447580 1506 587 1566511 1628.400 149520G WAOC 12 3.150.000 5124 000 0 Long Term Debt Other Liabilities Deferred Long Term Ly Charges Minority interest Rege Good Total Liabilis 3118000 4.748.000 90,000 0 0 18.300.000 0 18.654 stockholders' Equity West Stocks Options Warrants Redeemab Preemed Rock Preferred Stock Common SEK Retained Earning Treasury Stock Gauplus Other Socher Total Stockholder Equity 0 0 410000 15 000 000 3463 000 1 510.000 1207 000 124000 0 0 0 12 000 1207.000 3.340.000 1.346.000 -1 13 000 10 0637000 Question 7 What was the change in NWC in 2012? $5.838,000 $4,863.000 Correct! $975.000 $2,653,000 Question 8 What is the Free Cash Flow for the firm in 2012? Correct! $1,392,000 $1.432.000 $2,367,000 $2.360,000 1/11 Question 9 Using the future cash flows and terminal value given in the image above, what do you expect the enterprise value to be for General Dynamics? $13.126.440 rect! $14,144,545 $16,580,512 $14.952,069 1/1p Question 10 What is the value of General Dynamics equity in 2012? $11. 249440 $12.267,545 $10,543,440 Correct! $11,562,545 Score Use the information below to answer the following questions: Beta $037 50 5 3 000 Seni Annual Bond Price Year to Bipiration Coupon Rate 122 2% 6% General Dynamics (in thousands) Puryout Ratio 15% Stock Price 582 66 K EPS Forecast $3 67 . 31-Dec-12 31-Dec-12 31-Dec-11 31.981 000 29300.000 26.362 000 23 925,000 5,629.000 5,372.000 Balance Sheet Assets Current Assets Cash And Cash Equatents Short Term investments Net Recevables Inventory Other Current Assets Total Current Assets 2263 000 730 000 8.127 000 2.125.000 0 13.200.000 31-Dec-11 Income Statement Total Revenue Cost of Revenue 161.000 Gross Profit 490,000 Operating Expenses 3.950.000 Research Development 6.370,000 Seling General and Administrative 0 Operating Income or Loss 11.500.000 Other Income Depreciation 521.000 Earnings Before Interest And Taxes 2872,000 Interest Expense 11 413.000 Income Before Tax 1.617.000 Income Tax Expense Mortyrerest 0 Net Income from Continuing Ops 0 Discornued Operations 28.373.000 Net Income 0 1954 000 1.710.000 37675.000 3663.000 0 0 84000 3513,000 3,737.000 O 133.000 3513 000 3.604,000 1106 000 1.125.000 0 0 24070002478,000 -13 000 -19 000 234000 2400 000 549.000 2912000 12209.000 2098 000 0 O 0 31077.000 Long Term Investments Property Plant and Equpment Good Intangible Assets Accumulated Amortization Other Assets Deferred Long Term Asset Charges Total Assets Liabilities Current sites Accounts Payable Short Current Long Term Debt Other Current Lubits Total Current Liabilities 6678.000 706 000 2.988 000 10371.000 6,507.000 911 000 2852.000 100.000 FO (2012) (Time zero FOF) FCF (2013) FO (2014) FCF (2015) FCF (2016) $ $ $ $ $ 1.447580 1506 587 1566511 1628.400 149520G WAOC 12 3.150.000 5124 000 0 Long Term Debt Other Liabilities Deferred Long Term Ly Charges Minority interest Rege Good Total Liabilis 3118000 4.748.000 90,000 0 0 18.300.000 0 18.654 stockholders' Equity West Stocks Options Warrants Redeemab Preemed Rock Preferred Stock Common SEK Retained Earning Treasury Stock Gauplus Other Socher Total Stockholder Equity 0 0 410000 15 000 000 3463 000 1 510.000 1207 000 124000 0 0 0 12 000 1207.000 3.340.000 1.346.000 -1 13 000 10 0637000 Question 7 What was the change in NWC in 2012? $5.838,000 $4,863.000 Correct! $975.000 $2,653,000 Question 8 What is the Free Cash Flow for the firm in 2012? Correct! $1,392,000 $1.432.000 $2,367,000 $2.360,000 1/11 Question 9 Using the future cash flows and terminal value given in the image above, what do you expect the enterprise value to be for General Dynamics? $13.126.440 rect! $14,144,545 $16,580,512 $14.952,069 1/1p Question 10 What is the value of General Dynamics equity in 2012? $11. 249440 $12.267,545 $10,543,440 Correct! $11,562,545 Score

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts