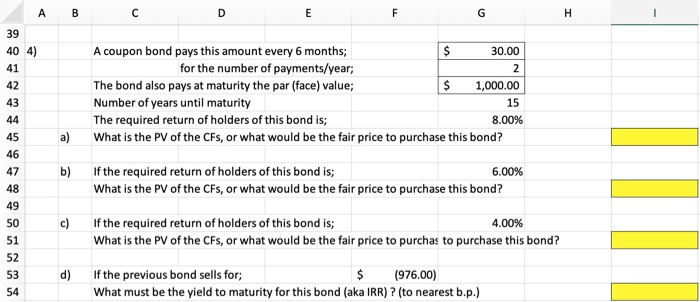

Question: How to solve in excel? A B D E LL G H 1 39 40 4) 41 42 43 A coupon bond pays this amount

A B D E LL G H 1 39 40 4) 41 42 43 A coupon bond pays this amount every 6 months; $ 30.00 for the number of payments/year; 2 The bond also pays at maturity the par (face) value; $ 1,000.00 Number of years until maturity 15 The required return of holders of this bond is; 8.00% What is the PV of the CFs, or what would be the fair price to purchase this bond? a) b) 6.00% If the required return of holders of this bond is; What is the PV of the CFs, or what would be the fair price to purchase this bond? 44 45 46 47 48 49 50 51 52 53 54 c) If the required return of holders of this bond is; 4.00% What is the PV of the CFs, or what would be the fair price to purchas to purchase this bond? If the previous bond sells for; $ (976.00) What must be the yield to maturity for this bond (aka IRR) ? (to nearest b.p.) d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts