Question: how to solve it and the answer please !! thank you!!! In this part of the assignment, you are required to prepare a loan repayment

how to solve it and the answer please !! thank you!!!

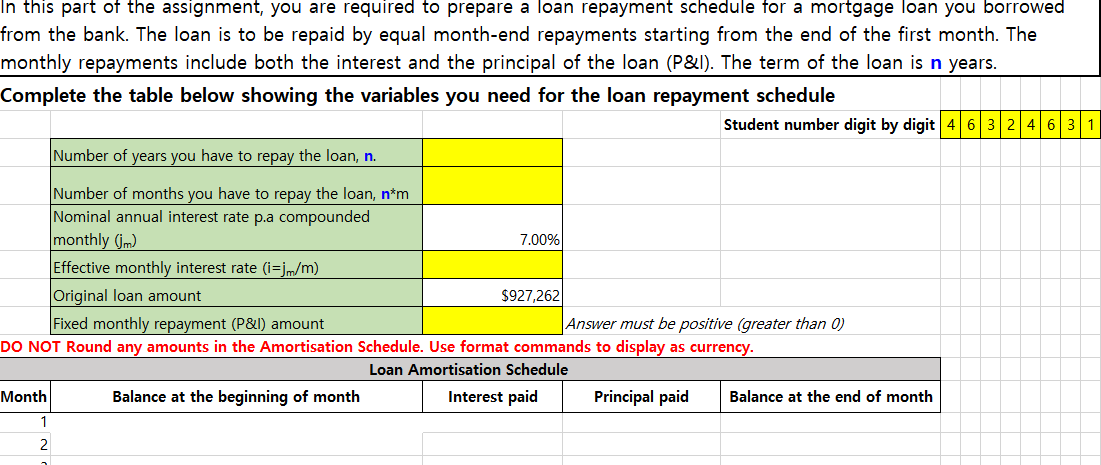

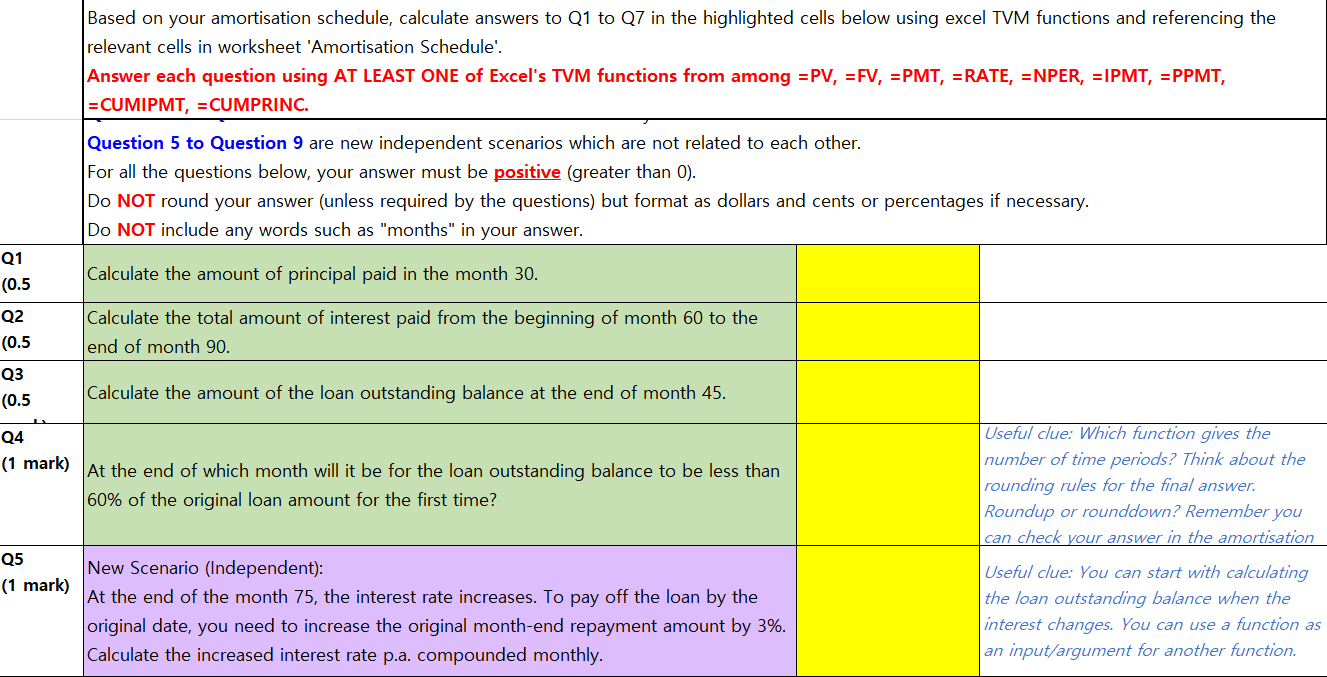

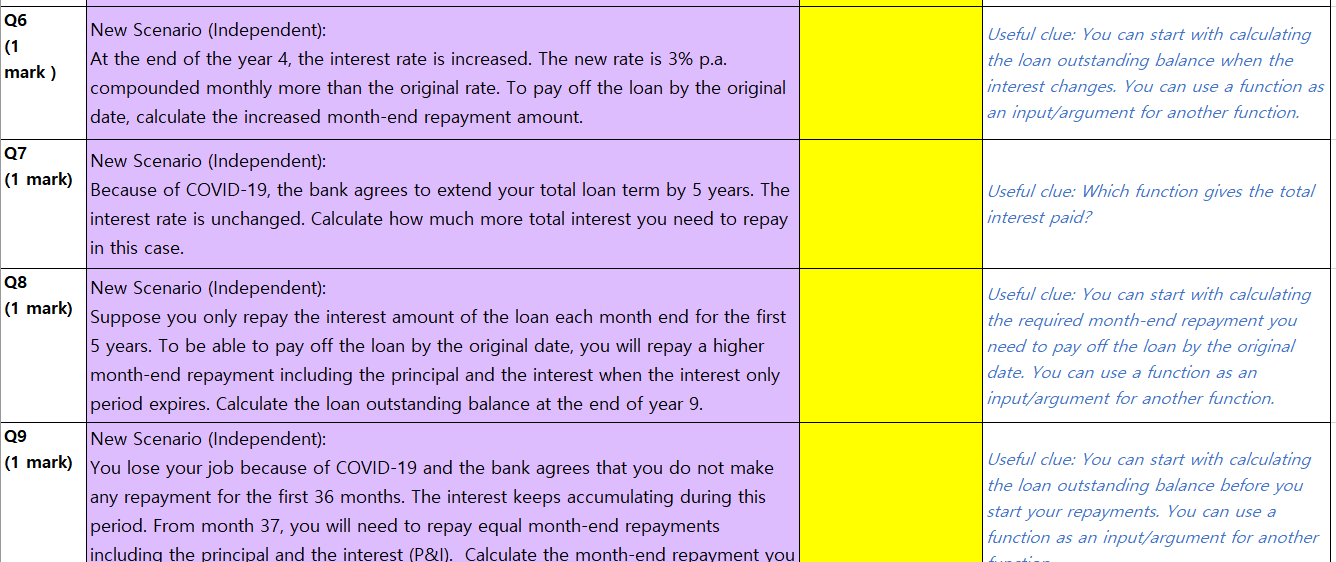

In this part of the assignment, you are required to prepare a loan repayment schedule for a mortgage loan you borrowed from the bank. The loan is to be repaid by equal month-end repayments starting from the end of the first month. The monthly repayments include both the interest and the principal of the loan (P&I). The term of the loan is n years. Complete the table below showing the variables you need for the loan repayment schedule Student number digit by digit 4632 4631 Number of years you have to repay the loan, n. Number of months you have to repay the loan, n*m Nominal annual interest rate p.a compounded monthly (m) 7.00% Effective monthly interest rate (i=jm/m) Original loan amount $927,262 Fixed monthly repayment (P&I) amount Answer must be positive (greater than 0) DO NOT Round any amounts in the Amortisation Schedule. Use format commands to display as currency. Loan Amortisation Schedule Month Balance at the beginning of month Interest paid Principal paid Balance at the end 1 2 month Based on your amortisation schedule, calculate answers to Q1 to Q7 in the highlighted cells below using excel TVM functions and referencing the relevant cells in worksheet 'Amortisation Schedule'. Answer each question using AT LEAST ONE of Excel's TVM functions from among =PV, EFV, EPMT, ERATE, ENPER, =IPMT, EPPMT, =CUMIPMT, = CUMPRINC. Question 5 to Question 9 are new independent scenarios which are not related to each other. For all the questions below, your answer must be positive (greater than 0). Do NOT round your answer (unless required by the questions) but format as dollars and cents or percentages if necessary. Do NOT include any words such as "months" in your answer. Q1 Calculate the amount of principal paid in the month 30. (0.5 Q2 (0.5 Calculate the total amount of interest paid from the beginning of month 60 to the end of month 90. Q3 (0.5 Calculate the amount of the loan outstanding balance at the end of month 45. Q4 (1 mark) At the end of which month will it be for the loan outstanding balance to be less than 60% of the original loan amount for the first time? Useful clue: Which function gives the number of time periods? Think about the rounding rules for the final answer. Roundup or rounddown? Remember you can check your answer in the amortisation Useful clue: You can start with calculating the loan outstanding balance when the interest changes. You can use a function as an input/argument for another function. Q5 (1 mark) New Scenario (Independent): At the end of the month 75, the interest rate increases. To pay off the loan by the original date, you need to increase the original month-end repayment amount by 3%. Calculate the increased interest rate p.a. compounded monthly. Q6 (1 mark) New Scenario (Independent): At the end of the year 4, the interest rate is increased. The new rate is 3% p.a. compounded monthly more than the original rate. To pay off the loan by the original date, calculate the increased month-end repayment amount. Useful clue: You can start with calculating the loan outstanding balance when the interest changes. You can use a function as an input/argument for another function. Q7 (1 mark) New Scenario (Independent): Because of COVID-19, the bank agrees to extend your total loan term by 5 years. The interest rate is unchanged. Calculate how much more total interest you need to repay in this case. Useful clue: Which function gives the total interest paid? Useful clue: You can start with calculating the required month-end repayment you need to pay off the loan by the original date. You can use a function as an input/argument for another function. Q8 New Scenario (Independent): (1 mark) Suppose you only repay the interest amount of the loan each month end for the first 5 years. To be able to pay off the loan by the original date, you will repay a higher month-end repayment including the principal and the interest when the interest only period expires. Calculate the loan outstanding balance at the end of year 9. Q9 New Scenario (Independent): (1 ark) You lose your job because of COVID-19 and the bank agrees that you do not make any repayment for the first 36 months. The interest keeps accumulating during this period. From month 37, you will need to repay equal month-end repayments including the principal and the interest (P&I). Calculate the month-end repayment you Useful clue: You can start with calculating the loan outstanding balance before you start your repayments. You can use a function as an input/argument for another

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts