Question: How to solve Note: Unless otherwise advised, you oget credit for those solutions if you show your calculations clearly using the appropriate formulas ( be

How to solve

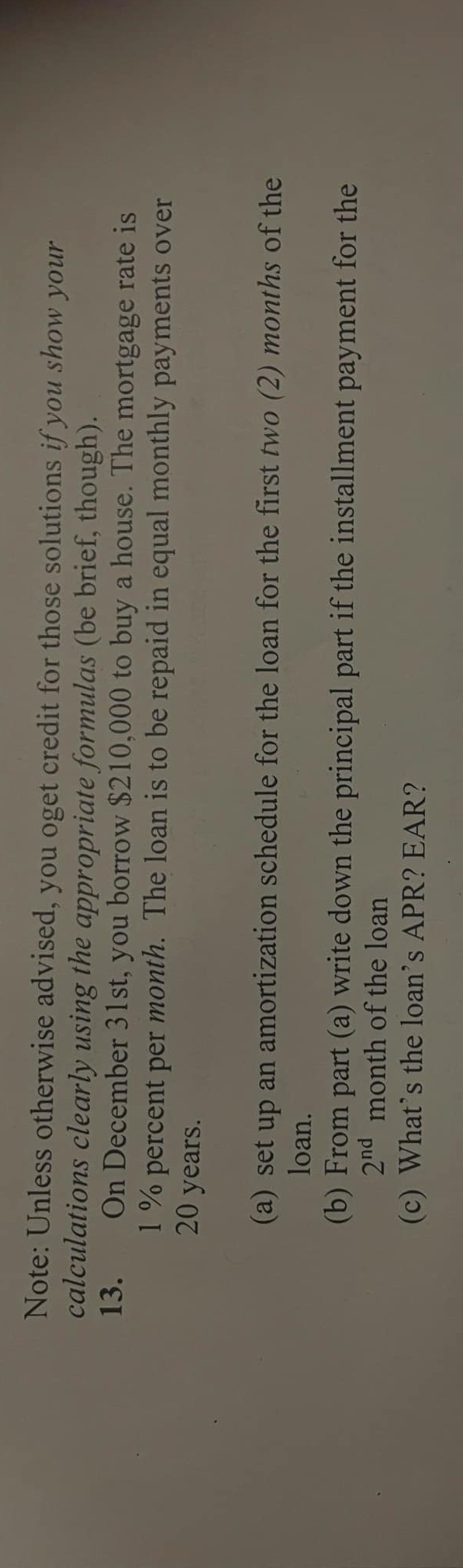

Note: Unless otherwise advised, you oget credit for those solutions if you show your calculations clearly using the appropriate formulas be brief, though

On December st you borrow $ to buy a house. The mortgage rate is percent per month. The loan is to be repaid in equal monthly payments over years.

a set up an amortization schedule for the loan for the first two months of the loan.

b From part a write down the principal part if the installment payment for the month of the loan

c What's the loan's APR? EAR?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock