Question: How to solve these problems below 1. How much is total cost of goods manufactured? * A company uses job order costing. At the beginning

How to solve these problems below

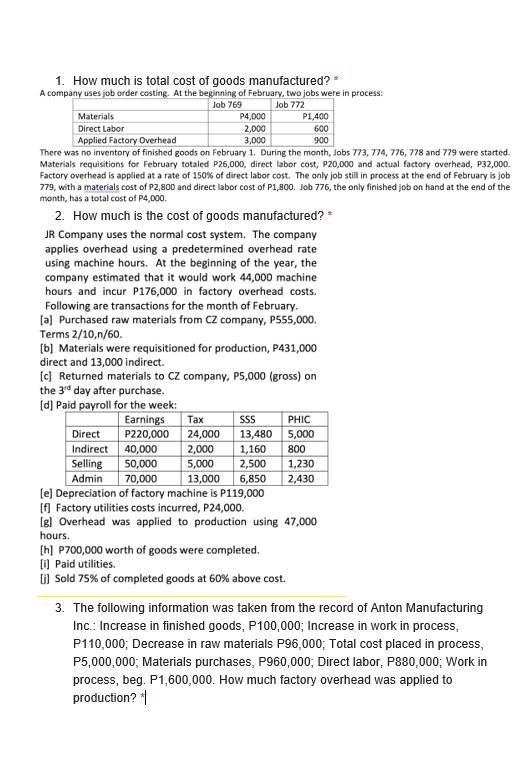

1. How much is total cost of goods manufactured? * A company uses job order costing. At the beginning of February, two jobs were in process: Job 769 Job 772 Materials P4,000 P1,400 Direct Labor 2,000 600 Applied Factory Overhead 3,000 900 There was no inventory of finished goods on February 1. During the month, Jobs 773, 774, 776, 778 and 779 were started. Materials requisitions for February totaled P26,000, direct labor cost, P20,000 and actual factory overhead, P32,000. Factory overhead is applied at a rate of 150%% of direct labor cost. The only job still in process at the end of February is job 779, with a materials cost of P2,800 and direct labor cost of P1,800. Job 776, the only finished job on hand at the end of the month, has a total cost of P4,000. 2. How much is the cost of goods manufactured? * JR Company uses the normal cost system. The company applies overhead using a predetermined overhead rate using machine hours. At the beginning of the year, the company estimated that it would work 44,000 machine hours and incur P176,000 in factory overhead costs. Following are transactions for the month of February. [a] Purchased raw materials from CZ company, P555,000. Terms 2/10,n/60. [b] Materials were requisitioned for production, P431,000 direct and 13,000 indirect. [c] Returned materials to CZ company, P5,000 (gross) on the 3"d day after purchase. [d] Paid payroll for the week: Earnings Tax $55 PHIC Direct P220,000 24,000 13,480 5,000 Indirect 40,000 2,000 1,160 800 Selling 50,000 5,000 2,500 1,230 Admin 70,000 13,000 6,850 2,430 [e] Depreciation of factory machine is P119,000 [f] Factory utilities costs incurred, P24,000. [g] Overhead was applied to production using 47,000 hours. [h] P700,000 worth of goods were completed. [i] Paid utilities. [i] Sold 75% of completed goods at 60% above cost. 3. The following information was taken from the record of Anton Manufacturing Inc.: Increase in finished goods, P100,000; Increase in work in process, P110,000; Decrease in raw materials P96,000; Total cost placed in process, P5,000,000; Materials purchases, P960,000; Direct labor, P880,000; Work in process, beg. P1,600,000. How much factory overhead was applied to production? *

1. How much is total cost of goods manufactured? * A company uses job order costing. At the beginning of February, two jobs were in process: Job 769 Job 772 Materials P4,000 P1,400 Direct Labor 2,000 600 Applied Factory Overhead 3,000 900 There was no inventory of finished goods on February 1. During the month, Jobs 773, 774, 776, 778 and 779 were started. Materials requisitions for February totaled P26,000, direct labor cost, P20,000 and actual factory overhead, P32,000. Factory overhead is applied at a rate of 150%% of direct labor cost. The only job still in process at the end of February is job 779, with a materials cost of P2,800 and direct labor cost of P1,800. Job 776, the only finished job on hand at the end of the month, has a total cost of P4,000. 2. How much is the cost of goods manufactured? * JR Company uses the normal cost system. The company applies overhead using a predetermined overhead rate using machine hours. At the beginning of the year, the company estimated that it would work 44,000 machine hours and incur P176,000 in factory overhead costs. Following are transactions for the month of February. [a] Purchased raw materials from CZ company, P555,000. Terms 2/10,n/60. [b] Materials were requisitioned for production, P431,000 direct and 13,000 indirect. [c] Returned materials to CZ company, P5,000 (gross) on the 3"d day after purchase. [d] Paid payroll for the week: Earnings Tax $55 PHIC Direct P220,000 24,000 13,480 5,000 Indirect 40,000 2,000 1,160 800 Selling 50,000 5,000 2,500 1,230 Admin 70,000 13,000 6,850 2,430 [e] Depreciation of factory machine is P119,000 [f] Factory utilities costs incurred, P24,000. [g] Overhead was applied to production using 47,000 hours. [h] P700,000 worth of goods were completed. [i] Paid utilities. [i] Sold 75% of completed goods at 60% above cost. 3. The following information was taken from the record of Anton Manufacturing Inc.: Increase in finished goods, P100,000; Increase in work in process, P110,000; Decrease in raw materials P96,000; Total cost placed in process, P5,000,000; Materials purchases, P960,000; Direct labor, P880,000; Work in process, beg. P1,600,000. How much factory overhead was applied to production? * Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock