Question: how to solve these questions in steps ? Example 1 Millon National Bank has 10 million British pounds () in one-year assets and 8 million

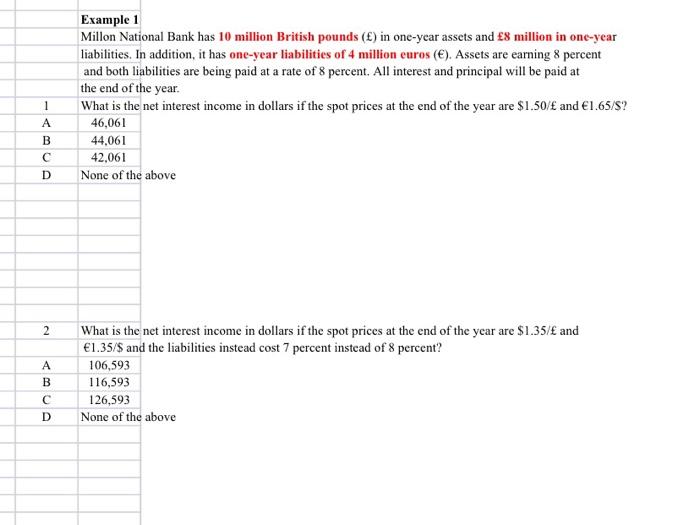

Example 1 Millon National Bank has 10 million British pounds () in one-year assets and 8 million in one-year liabilities. In addition, it has one-year liabilities of 4 million euros ( ). Assets are earning 8 percent and both liabilities are being paid at a rate of 8 percent. All interest and principal will be paid at the end of the year. What is the net interest income in dollars if the spot prices at the end of the year are $1.50/ and 1.65/$ ? \begin{tabular}{|c|c|} \hline 1 & What is the net intere \\ \hline A & 46,061 \\ \hline B & 44,061 \\ \hline C & 42,061 \\ \hline D & None of the above \\ \hline \end{tabular} 2 What is the net interest income in dollars if the spot prices at the end of the year are $1.35/ and 1.35/$ and the liabilities instead cost 7 percent instead of 8 percent? \begin{tabular}{|c|c|} \hline A & 106,593 \\ \hline B & 116,593 \\ \hline C & 126,593 \\ \hline \end{tabular} D None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts