Question: how to solve these questions in steps ? Example 1 Millon National Bank has 10 million British pounds () in one-year assets and 8 million

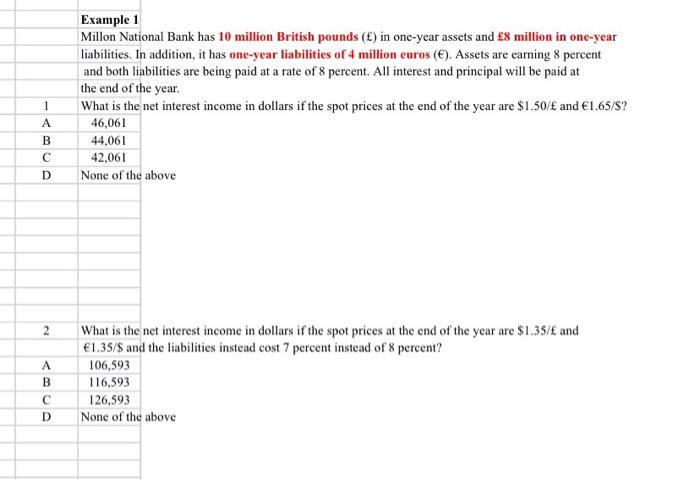

Example 1 Millon National Bank has 10 million British pounds () in one-year assets and 8 million in one-year liabilities. In addition, it has one-year liabilities of 4 million euros ( ). Assets are earning 8 percent and both liabilities are being paid at a rate of 8 percent. All interest and principal will be paid at the end of the year. A What is the net interest income in dollars if the spot prices at the end of the year are $1.50/ and 1.65/$ ? 2 What is the net interest income in dollars if the spot prices at the end of the year are $1.35/ and 1.35/$ and the liabilities instead cost 7 percent instead of 8 percent? \begin{tabular}{|l|l|} \hline A & 106,593 \\ \hline B & 116,593 \\ \hline C & 126,593 \\ \hline \end{tabular} D None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts