Question: how to solve this problem? please let me know my friends~~!! Thank you and i'll ready to thumbs up Sabrina Duncan had gross earnings for

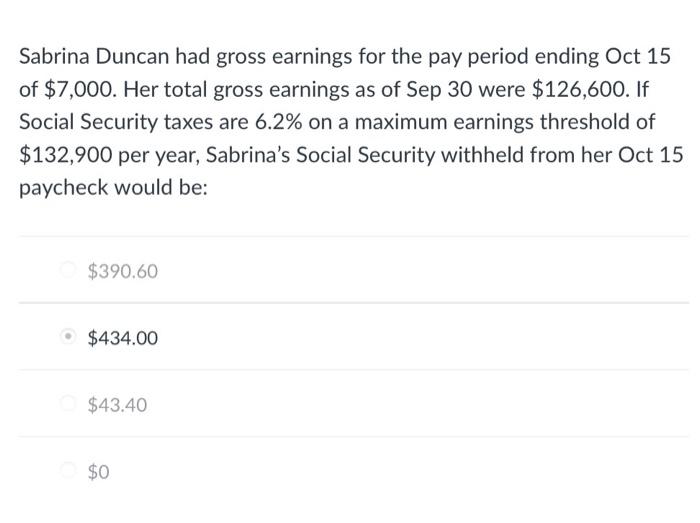

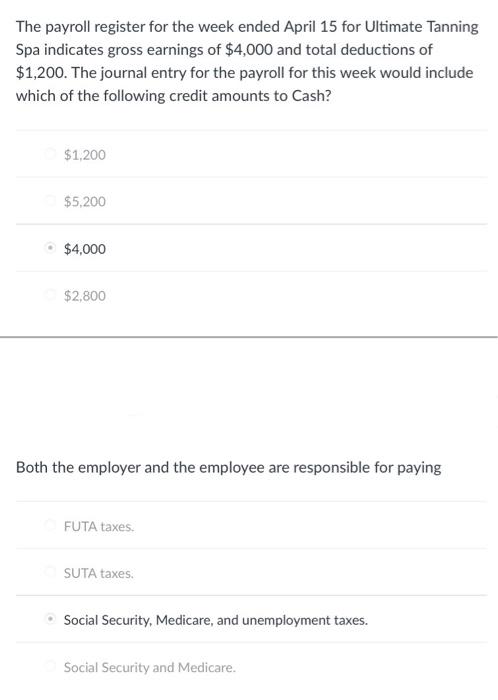

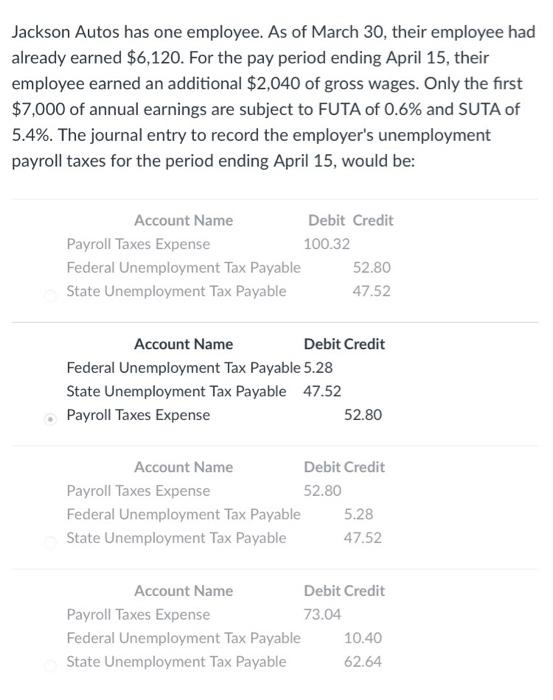

Sabrina Duncan had gross earnings for the pay period ending Oct 15 of $7,000. Her total gross earnings as of Sep 30 were $126,600. If Social Security taxes are 6.2% on a maximum earnings threshold of $132,900 per year, Sabrina's Social Security withheld from her Oct 15 paycheck would be: $390.60 $434.00 $43.40 $0 The payroll register for the week ended April 15 for Ultimate Tanning Spa indicates gross earnings of $4,000 and total deductions of $1,200. The journal entry for the payroll for this week would include which of the following credit amounts to Cash? $1,200 $5,200 $4,000 $2,800 Both the employer and the employee are responsible for paying FUTA taxes. SUTA taxes Social Security, Medicare, and unemployment taxes. Social Security and Medicare. Jackson Autos has one employee. As of March 30, their employee had already earned $6,120. For the pay period ending April 15, their employee earned an additional $2,040 of gross wages. Only the first $7,000 of annual earnings are subject to FUTA of 0.6% and SUTA of 5.4%. The journal entry to record the employer's unemployment payroll taxes for the period ending April 15, would be: Account Name Debit Credit Payroll Taxes Expense 100.32 Federal Unemployment Tax Payable 52.80 State Unemployment Tax Payable 47.52 Account Name Debit Credit Federal Unemployment Tax Payable 5.28 State Unemployment Tax Payable 47.52 Payroll Taxes Expense 52.80 Account Name Debit Credit Payroll Taxes Expense 52.80 Federal Unemployment Tax Payable 5.28 State Unemployment Tax Payable 47.52 Account Name Debit Credit Payroll Taxes Expense 73.04 Federal Unemployment Tax Payable 10.40 State Unemployment Tax Payable 62.64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts