Question: How to solve this problem? Problems: show all work dently to receive full credit. Provide supporting computations, Problem 1: (7 points) For the year ended

How to solve this problem?

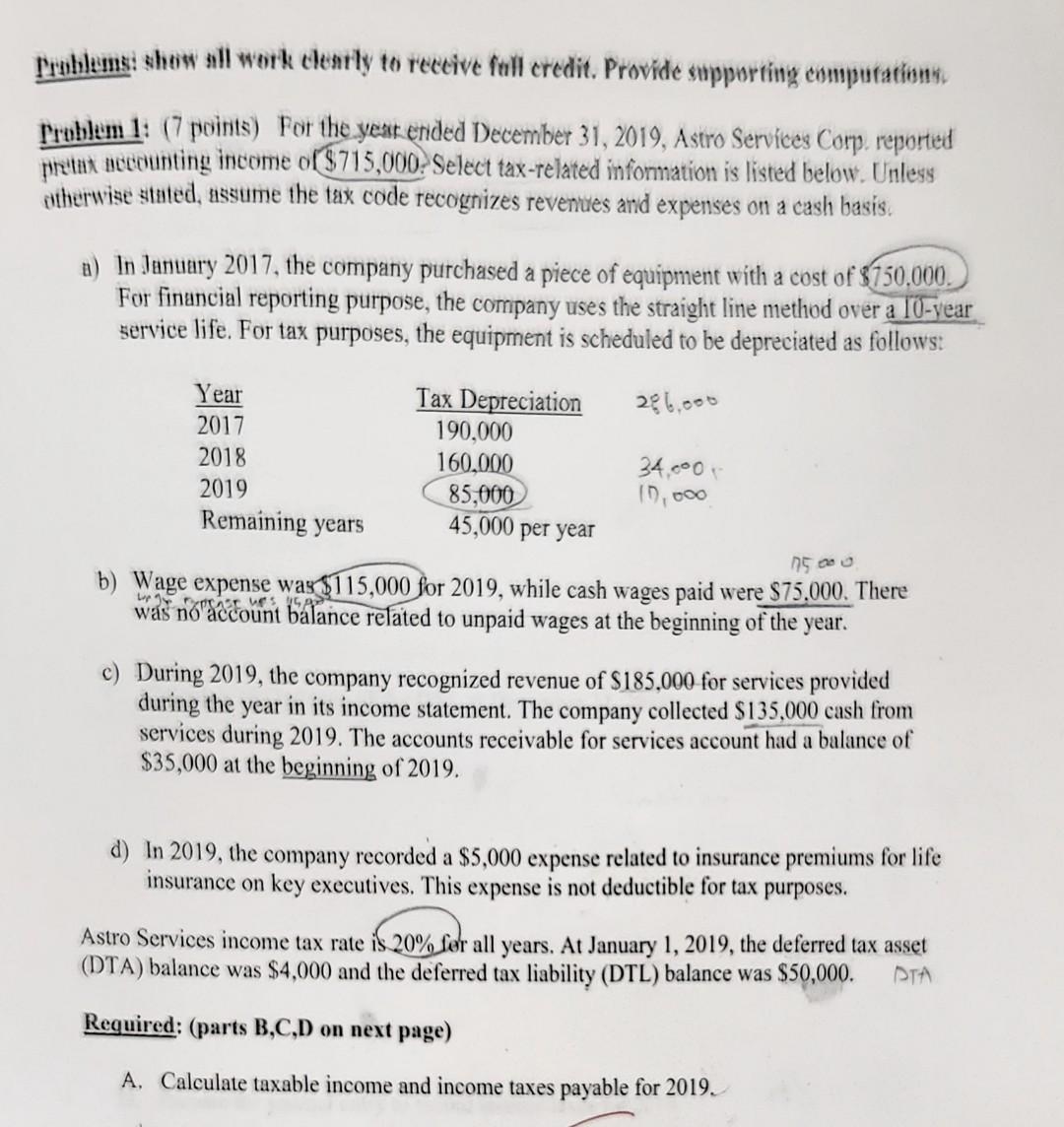

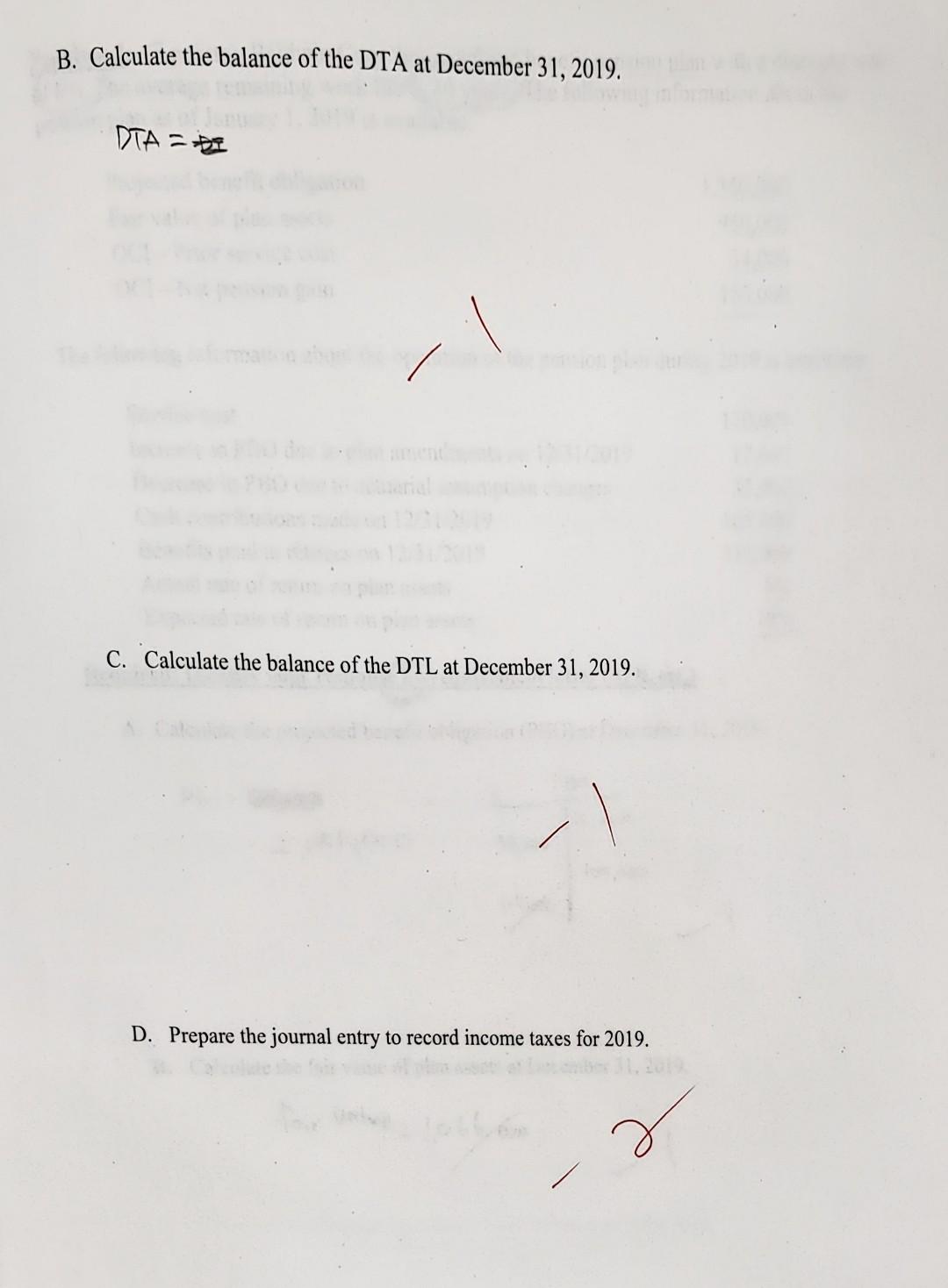

Problems: show all work dently to receive full credit. Provide supporting computations, Problem 1: (7 points) For the year ended December 31, 2019, Astro Services Corp, reported pretat necounting income of $715,000 Select tax-related information is listed below. Unless otherwise stated, assume the tax code recognizes revenues and expenses on a cash basis. a) In January 2017, the company purchased a piece of equipment with a cost of $150.000. For financial reporting purpose, the company uses the straight line method over a 10-year service life. For tax purposes, the equipment is scheduled to be depreciated as followst 286.000 Year Tax Depreciation 2017 190,000 2018 160,000 34.000 2019 85,000 11,000 Remaining years 45,000 per year 15.2 b) Wage expense was $115,000 for 2019, while cash wages paid were $75.000. There was no account balance related to unpaid wages at the beginning of the year. c) During 2019, the company recognized revenue of $185,000 for services provided during the year in its income statement. The company collected $135,000 cash from services during 2019. The accounts receivable for services account had a balance of $35,000 at the beginning of 2019. d) In 2019, the company recorded a $5,000 expense related to insurance premiums for life insurance on key executives. This expense is not deductible for tax purposes. Astro Services income tax rate is 20% for all years. At January 1, 2019, the deferred tax asset (DTA) balance was $4,000 and the deferred tax liability (DTL) balance was $50,000. STA Required: (parts B,C,D on next page) A. Calculate taxable income and income taxes payable for 2019. B. Calculate the balance of the DTA at December 31, 2019. DTA =D wana C. Calculate the balance of the DTL at December 31, 2019. D. Prepare the journal entry to record income taxes for 2019. r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts