Question: how to solve this problem Question 4 ( Total 1 8 marks ) The following table gives the relevant information of four bonds. table

how to solve this problem Question Total marks

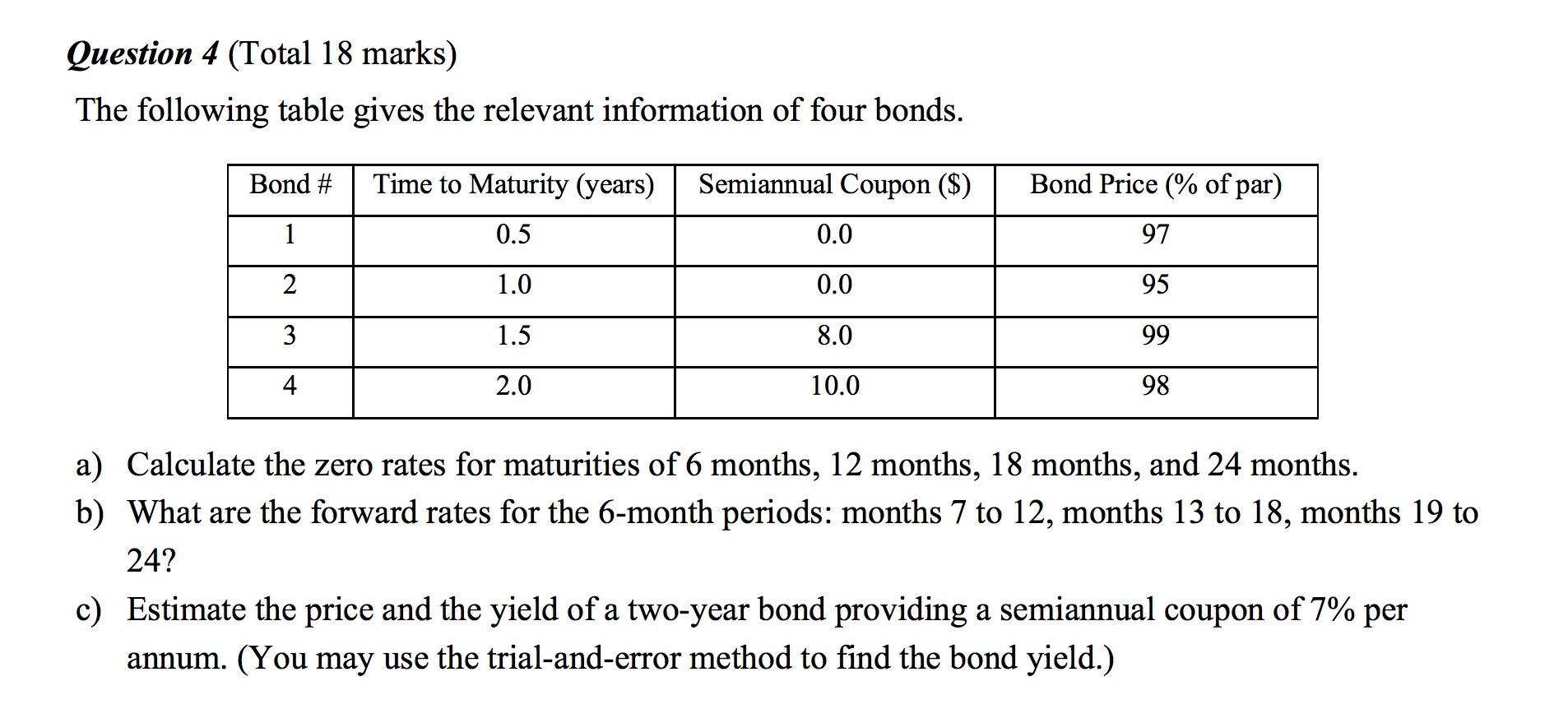

The following table gives the relevant information of four bonds.

tableBond #Time to Maturity yearsSemiannual Coupon $Bond Price of par

a Calculate the zero rates for maturities of months, months, months, and months.

b What are the forward rates for the month periods: months to months to months to

c Estimate the price and the yield of a twoyear bond providing a semiannual coupon of per annum. You may use the trialanderror method to find the bond yield.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock