Question: How to solve this problem with process?! Thank you Problem 1 Below you find mortgage rate information: Term 5 year 6 year 7 year 10

How to solve this problem with process?! Thank you

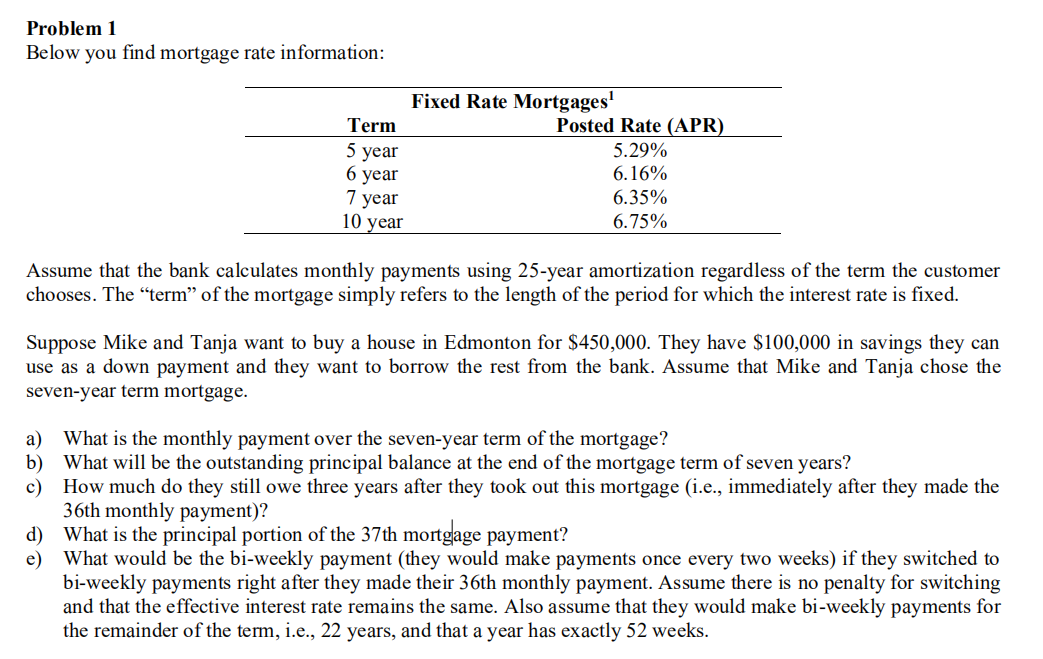

Problem 1 Below you find mortgage rate information: Term 5 year 6 year 7 year 10 year Fixed Rate Mortgages! Posted Rate (APR) 5.29% 6.16% 6.35% 6.75% Assume that the bank calculates monthly payments using 25-year amortization regardless of the term the customer chooses. The term of the mortgage simply refers to the length of the period for which the interest rate is fixed. Suppose Mike and Tanja want to buy a house in Edmonton for $450,000. They have $100,000 in savings they can use as a down payment and they want to borrow the rest from the bank. Assume that Mike and Tanja chose the seven-year term mortgage. a) What is the monthly payment over the seven-year term of the mortgage? b) What will be the outstanding principal balance at the end of the mortgage term of seven years? c) How much do they still owe three years after they took out this mortgage (i.e., immediately after they made the 36th monthly payment)? d) What is the principal portion of the 37th mortgage payment? e) What would be the bi-weekly payment (they would make payments once every two weeks) if they switched to bi-weekly payments right after they made their 36th monthly payment. Assume there is no penalty for switching and that the effective interest rate remains the same. Also assume that they would make bi-weekly payments for the remainder of the term, i.e., 22 years, and that a year has exactly 52 weeks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts