Question: how to solve using excel solver Problems 335 Huber Steel is $5 per share. U.S. Oil sells for $25 per share and Huber Steel sells

how to solve using excel solver

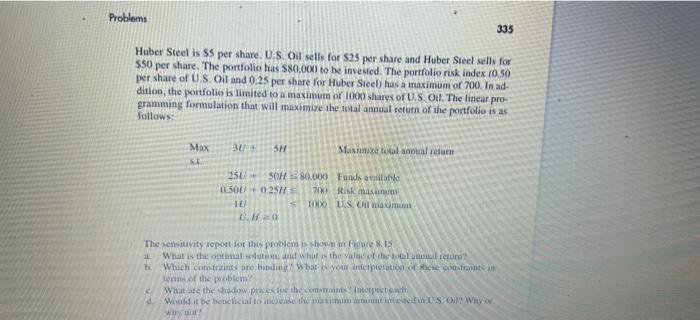

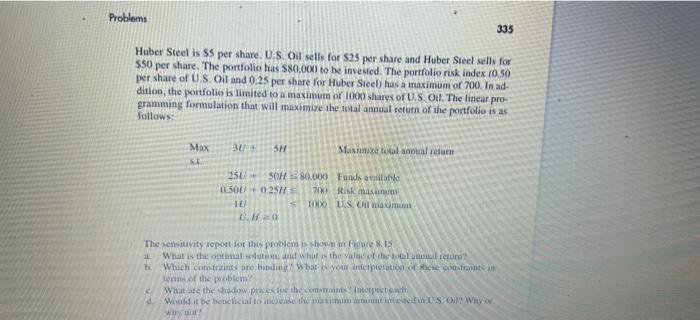

Problems 335 Huber Steel is $5 per share. U.S. Oil sells for $25 per share and Huber Steel sells for $50 per share. The portfolio has $80,000 to be invested. The portfolio risk index (0.50 per share of U.S. Oil and 0.25 per share for Huber Steel) has a maximum of 700. In ad- dition, the portfolio is limited to a maximum of 1000 shares of U.S. Oil. The linear pro- gramming formulation that will maximize the total annual return of the portfolio is as follows: Max 30+ SH Maximize total annual return KL Funds available 250+ 50H 80.000 0.50 +0.257 Risk maxim 700 1000 US. O maximum 10 U.B=0 The sensitivity report for this problem is shown in Figure 8.15. ak What is the optimal solution, and what is the value of the total anal return? ts Which constraints are binding What is your interpretation of these constraints in terms of the problem? What are the shadow prices for the constraints Interpret each d. Would it be beneficial to increase the maximum amount invested in US. Oil? Why or Why not

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock