Question: how we get 108 mo . can I get explanation for the answer please 8. On January 1, 2004, Mill Corporation purchaseu cul $304,000, equipment

how we get 108 mo . can I get explanation for the answer please

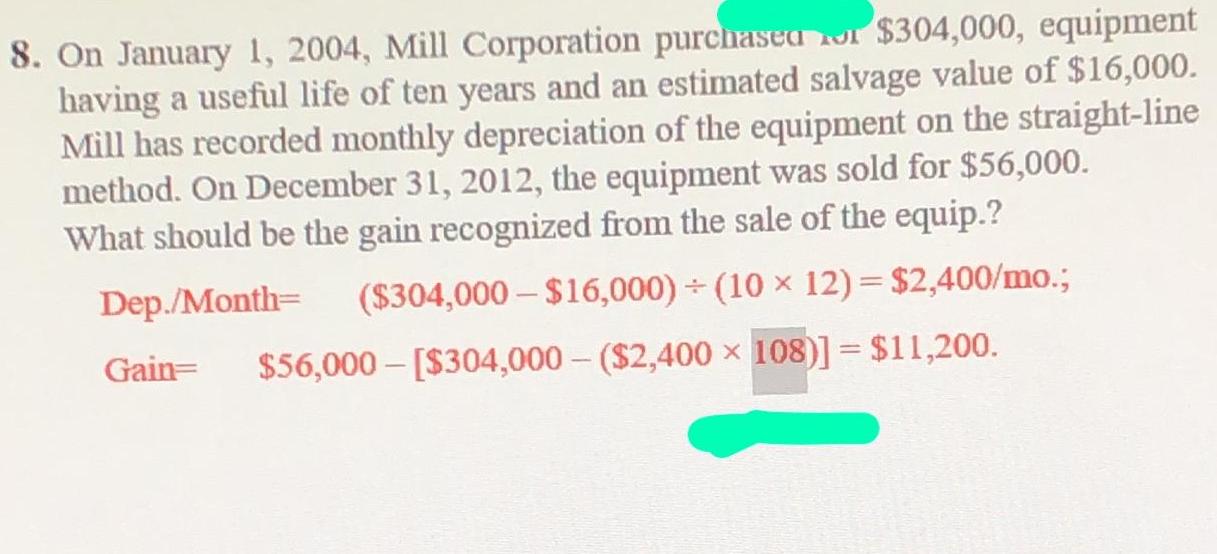

8. On January 1, 2004, Mill Corporation purchaseu cul $304,000, equipment having a useful life of ten years and an estimated salvage value of $16,000. Mill has recorded monthly depreciation of the equipment on the straight-line method. On December 31, 2012, the equipment was sold for $56,000. What should be the gain recognized from the sale of the equip.? Dep./Month= ($304,000 - $16,000) + (10 12) = $2,400/mo.; Gain=. $56,000 - [$304,000 - ($2,400 108)] = $11,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts