Question: How well is Teslas competitive strategy working? Also, how is the company doing financially and in a market position? Review Exhibit 2 and analyze the

How well is Teslas competitive strategy working? Also, how is the company doing financially and in a market position? Review Exhibit 2 and analyze the financial performance of the company. Using Chapter 4 concepts, calculate at least two ratios from the income statement and two ratios from the balance sheet to interpret the companys performance. Why is the company incurring mounting losses? Explain why the company is not consistently profitable.

chapter 4 concepts are the key financial ratios such as profitability, liquidity, leverage, and activity ratios.

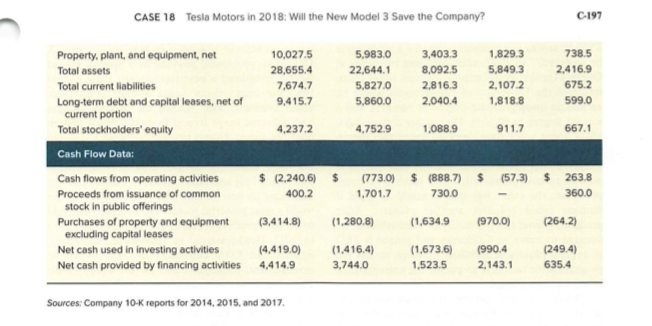

Selected Financial Data for Tesla, Ic., 2013-2017 (in millions, except EXHIBIT 2 share and per share data) Years Ended December 31 2017 2016 2015 2014 2013 Income Statement Data: Revenues: Automotive sales $ 8,534.8 $ $5,589.0 $ 3,431.6 $ 2,874.4 $ 1,921.9 761.8 Automotive leasing 1.106.5 309.4 132.6 Total automotive revenues 9,641.3 6,350.8 3,741.0 3,741.0 Energy generation and storage 1,116.3 181.4 14.5 4.2 Services and other 1,001.2 468.0 290.6 191.3 91.6 Total revenues 11,758.8 7,000.1 4,046.0 3,198.4 2,013.5 Cost of revenues: 4,268.1 Automotive sales 6,724.5 2,639.9 2,058.3 1,483.3 Automotive leasing 708.2 482.0 183.4 87.4 Total automotive cost of revenues 7,432.7 4,750.1 2,823.3 2,145.7 Energy generation and storage 874.5 178.3 4.0 12.3 Services and other 1,229.0 472.5 286.9 166.9 73.9 Total cost of revenues 1,557.2 9,536.3 5,400.9 3.122.5 2.316.7 Gross profit (loss) 2,222.5 1,599.3 923.5 881.7 456.3 Operating expenses: Research and development 232.0 1,378.1 834.4 717.9 464.7 Selling, general and administrative 2,476.5 1,432.2 922.2 603.7 285.6 Total operating expenses 2,266.6 3.854.6 1,640.1 1,068.4 517.5 Loss from operations (1,632.1) (667.3) (716.6) (186.7) (61.3) Interest income 19.7 8.5 1.5 1,126 189 Interest expense (100.9 (32.9 22.6 (471.3) (198.8) (118.9) Other income (expense), net (125.4) 111.3 (41.7) 1.8 Loss before income taxes (2,209.0) (875,624) (875.6) (284.6) (71.4) Provision for income taxes 31.5 13,039 13.3 9.4 2.6 $ (888.7) $ (2,240.6) $ (294.0) Net loss (773.0) (74.0) Net loss attributable to noncontrolling (279.1) (98.1) interests and subsidiaries $ (1,961.4) $ (888.7) $ ( 294.0) Net loss attributable to common shareholders (674.9) 24 (74.0) (11.83) (6.93) 24 Net loss per share of common stock, basic and diluted (4.68) %24 (2.36) (0.62) Weighted average shares used in computing net loss per share of common stock, basic and diluted 165.8 144.2 128.2 124.5 119.4 Balance Sheet Data: $ 3,367.9 $ 1,196.9 $ 1,905.7 $ 1,196,908 Cash and cash equivalents Inventory 24 845.9 2,263.5 2,067.5 1,277.8 953.7 340.4 Total current assets 6,259.8 6,570.5 2,791.4 3,198.7 1,265.9 C-197 CASE 18 Tesia Motors in 2018: Will the New Model 3 Save the Company? 738.5 Property, plant, and equipment, net 10,027.5 5,983.0 3,403.3 1,829.3 8,092.5 5,849.3 2,416.9 28,655.4 22,644.1 Total assets 2,816.3 675.2 7,674.7 5,827.0 2,107.2 Total current liabilities 1,818.8 599.0 Long-term debt and capital leases, net of current portion Total stockholders' equity 9,415.7 5,860.0 2,040.4 4,752.9 1,088.9 911.7 667.1 4,237.2 Cash Flow Data: $ (2,240.6) $ (888.7) %24 (57.3) $4 263.8 Cash flows from operating activities (773.0) 360.0 400.2 1,701.7 730.0 Proceeds from issuance of common stock in public offerings (1,634.9 (3,414.8) (1,280.8) (970.0) (264.2) Purchases of property and equipment excluding capital leases (1,673.6) (4,419.0) (1,416.4) (990.4 (249.4) Net cash used in investing activities 2,143.1 635.4 Net cash provided by financing activities 4,414.9 3,744.0 1,523.5 Sources: Company 10-K reports for 2014, 2015, and 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts