Question: how would i do this in excel? Show correct answers 24 A fast-growing firm recently paid a dividend of $0.60 per share. The dividend is

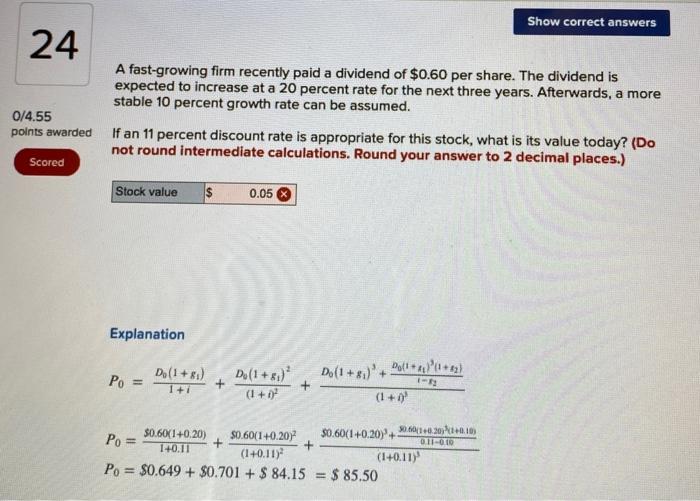

Show correct answers 24 A fast-growing firm recently paid a dividend of $0.60 per share. The dividend is expected to increase at a 20 percent rate for the next three years. Afterwards, a more stable 10 percent growth rate can be assumed. 0/4.55 points awarded If an 11 percent discount rate is appropriate for this stock, what is its value today? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Scored Stock value $ 0.05 Explanation D. (1+:) Do(1+81) + Po = + D. (1 +81) (1+ + 1: 011-010 30.0126.30.2010) Po = 30.60(1+0.20) $0.60(1+0.20)+ $0.60(140.20) + 140.11 + (1 +0.11) (1+0.11) Po = $0.649 + $0.701 + $ 84.15 = $ 85.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts