Question: how would i do this ? You have been approached by an investor who has been given the opportunity to purchase 10% of the shares

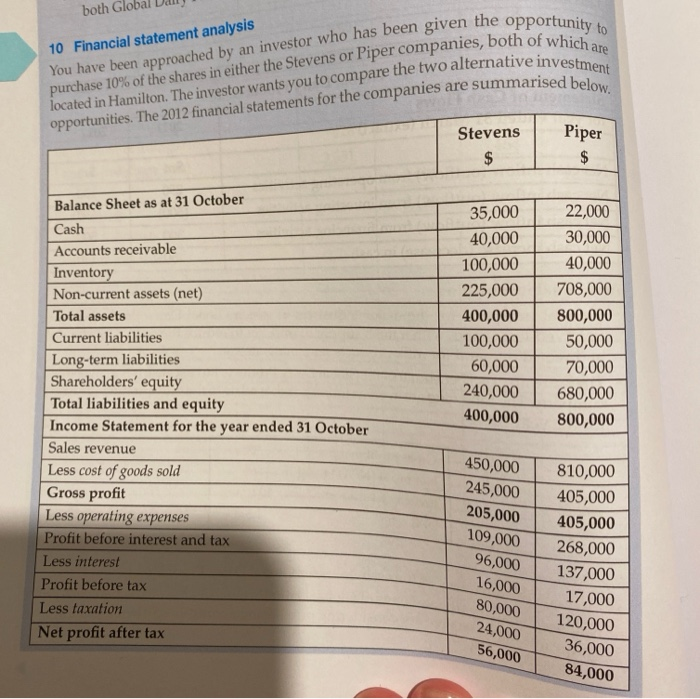

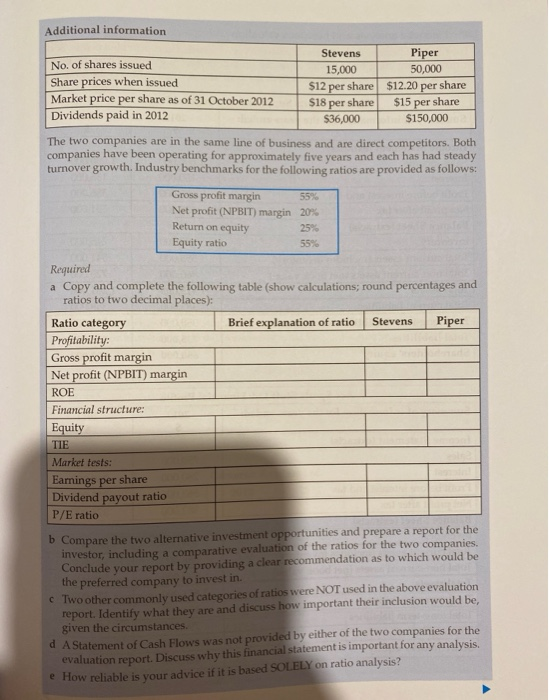

You have been approached by an investor who has been given the opportunity to purchase 10% of the shares in either the Stevens or Piper companies, both of which are located in Hamilton. The investor wants you to compare the two alternative investment opportunities. The 2012 financial statements for the companies are summarised below. both Globa 10 Financial statement analysis Stevens $ Piper $ Balance Sheet as at 31 October Cash Accounts receivable Inventory Non-current assets (net) Total assets Current liabilities Long-term liabilities Shareholders' equity Total liabilities and equity Income Statement for the year ended 31 October Sales revenue Less cost of goods sold Gross profit Less operating expenses Profit before interest and tax Less interest Profit before tax Less taxation Net profit after tax 35,000 40,000 100,000 225,000 400,000 100,000 60,000 240,000 400,000 22,000 30,000 40,000 708,000 800,000 50,000 70,000 680,000 800,000 450,000 245,000 205,000 109,000 96,000 16,000 80,000 810,000 405,000 405,000 268,000 137,000 17,000 120,000 24,000 56,000 36,000 84,000 Additional information Stevens Piper No. of shares issued 15,000 50,000 Share prices when issued $12 per share $12.20 per share Market price per share as of 31 October 2012 $18 per share $15 per share Dividends paid in 2012 $36,000 $150,000 The two companies are in the same line of business and are direct competitors. Both companies have been operating for approximately five years and each has had steady turnover growth. Industry benchmarks for the following ratios are provided as follows: Gross profit margin 55% Net profit (NPBIT) margin 20% 25% Equity ratio 55% Return on equity Required a Copy and complete the following table (show calculations; round percentages and ratios to two decimal places): Ratio category Brief explanation of ratio Stevens Piper Profitability: Gross profit margin Net profit (NPBIT) margin ROE Financial structure: Equity TIE Market tests: Earnings per share Dividend payout ratio P/E ratio b Compare the two alternative investment opportunities and prepare a report for the investor, including a comparative evaluation of the ratios for the two companies. Conclude your report by providing a clear recommendation as to which would be the preferred company to invest in Two other commonly used categories of ratios were NOT used in the above evaluation report. Identify what they are and discuss how important their inclusion would be, given the circumstances. d A Statement of Cash Flows was not provided by either of the two companies for the evaluation report. Discuss why this financial statement is important for any analysis, e How reliable is your advice if it is based SOLELY on ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts