Question: please please help I will rate definately. All questions pls. 9. An investor who receives rights to purchase 100 shares at $15 per share has

please please help I will rate definately. All questions pls.

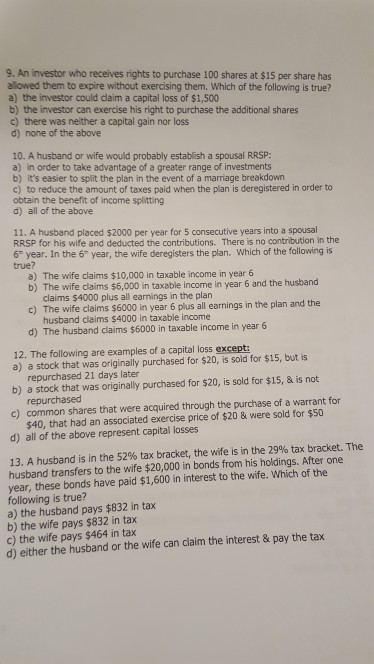

9. An investor who receives rights to purchase 100 shares at $15 per share has allowed them to expire without exercising them. Which of the following is true? a) the investor could dlaim a capital loss of $1,500 b) the investor can exercise his right to purchase the additional shares c) there was neither a capital gain nor loss d) none of the above 10. A husband or wife would probably establish a spousal RRSP: a) in order to take advantage of a greater range of investments b) it's easier to split the plan in the event of a marriage breakdown c) to reduce the amount of taxes paid when the plan is deregistered in order to obtain the benefit of income splitting d) all of the above 11. A husband placed $2000 per year for 5 consecutive years into a spousal RRSP for his wife and deducted the contributions. There is no contribution in the 6" year. In the 6" year, the wife deregisters the plan. Which of the following is true? a) The wife claims $10,000 in taxable income in year 6 b) The wife claims $6,000 in taxable income in year 6 and the husband claims $4000 plus all earnings in the plan The wife claims $6000 in year 6 pus all earnings in the plan and the c) husband claims $4000 in taxable income d) The husband claims $6000 in taxable income in year 6 12. The following are examples of a capital loss except: a) a stock that was originally purchased for $20, is sold for $15, but is repurchased 21 days later b) a stock that was originally purchased for $20, is sold for $15, & is not repu rchased c) common shares that were acquired through the purchase of a warrant for $40, that had an associated exercise price of $20 & were sold for $50 d) all of the above represent capital losses 13, A husband is in the 52% tax bracket, the wife is in the 29% tax bracket, The husband transfers to the wife $20,000 in bonds from his holdings. After one year, these bonds have paid $1,600 in interest to the wife. Which of the following is true? a) the husband pays $832 in tax b) the wife pays $832 in tax c) the wife pays $464 in tax d) either the husband or the wife can claim the interest & pay the tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts