Question: How would I go about doing a problem like this? 1. Create an excel sheet which can calculate the value of a bond Inputs: Bond

How would I go about doing a problem like this?

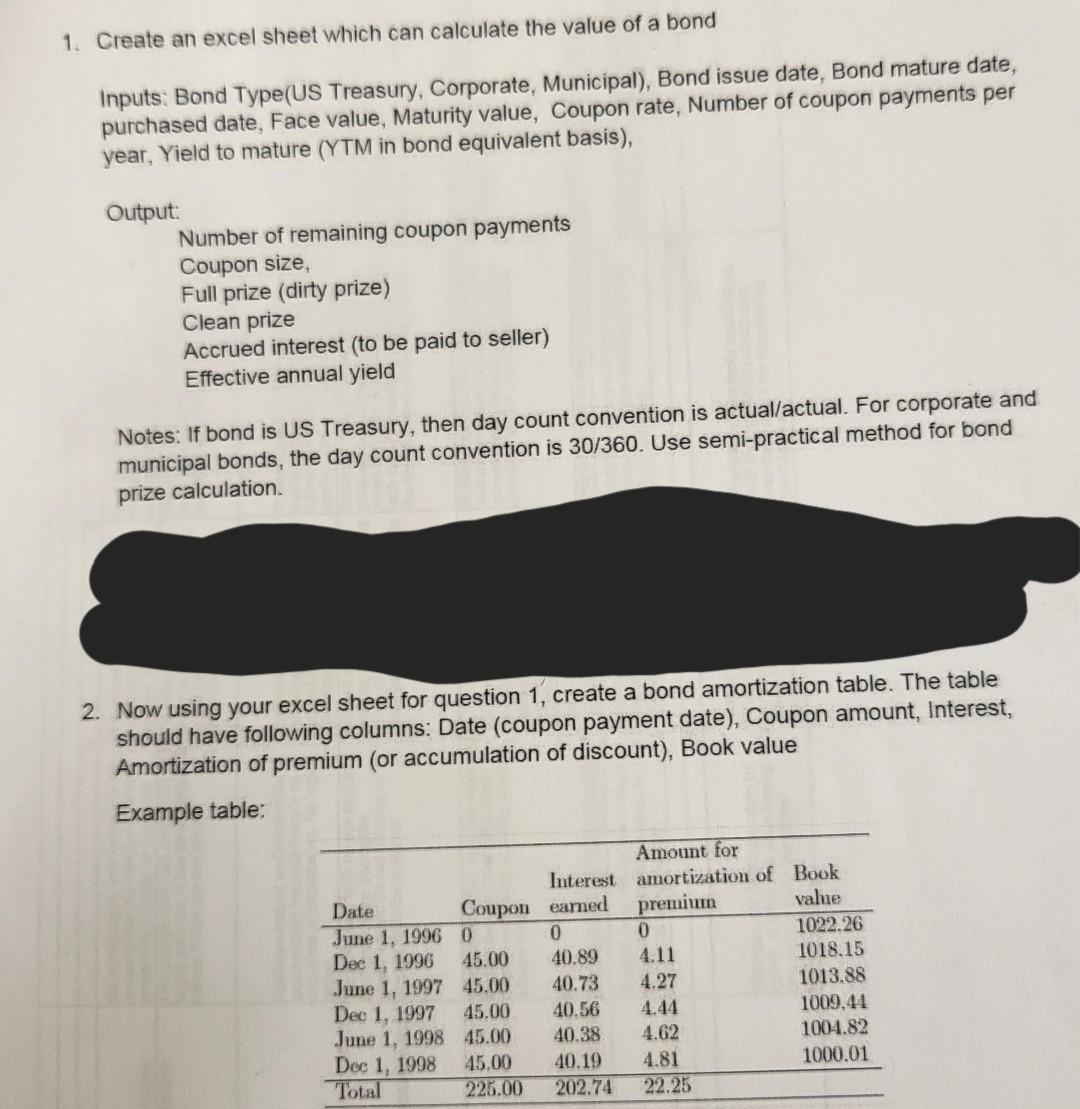

1. Create an excel sheet which can calculate the value of a bond Inputs: Bond Type(US Treasury, Corporate, Municipal), Bond issue date, Bond mature date, purchased date, Face value, Maturity value, Coupon rate, Number of coupon payments per year, Yield to mature (YTM in bond equivalent basis), Output: Number of remaining coupon payments Coupon size, Full prize (dirty prize) Clean prize Accrued interest (to be paid to seller) Effective annual yield Notes: If bond is US Treasury, then day count convention is actual/actual. For corporate and municipal bonds, the day count convention is 30/360. Use semi-practical method for bond prize calculation. 2. Now using your excel sheet for question 1 , create a bond amortization table. The table should have following columns: Date (coupon payment date), Coupon amount, Interest, Amortization of premium (or accumulation of discount), Book value Example table: 1. Create an excel sheet which can calculate the value of a bond Inputs: Bond Type(US Treasury, Corporate, Municipal), Bond issue date, Bond mature date, purchased date, Face value, Maturity value, Coupon rate, Number of coupon payments per year, Yield to mature (YTM in bond equivalent basis), Output: Number of remaining coupon payments Coupon size, Full prize (dirty prize) Clean prize Accrued interest (to be paid to seller) Effective annual yield Notes: If bond is US Treasury, then day count convention is actual/actual. For corporate and municipal bonds, the day count convention is 30/360. Use semi-practical method for bond prize calculation. 2. Now using your excel sheet for question 1 , create a bond amortization table. The table should have following columns: Date (coupon payment date), Coupon amount, Interest, Amortization of premium (or accumulation of discount), Book value Example table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts