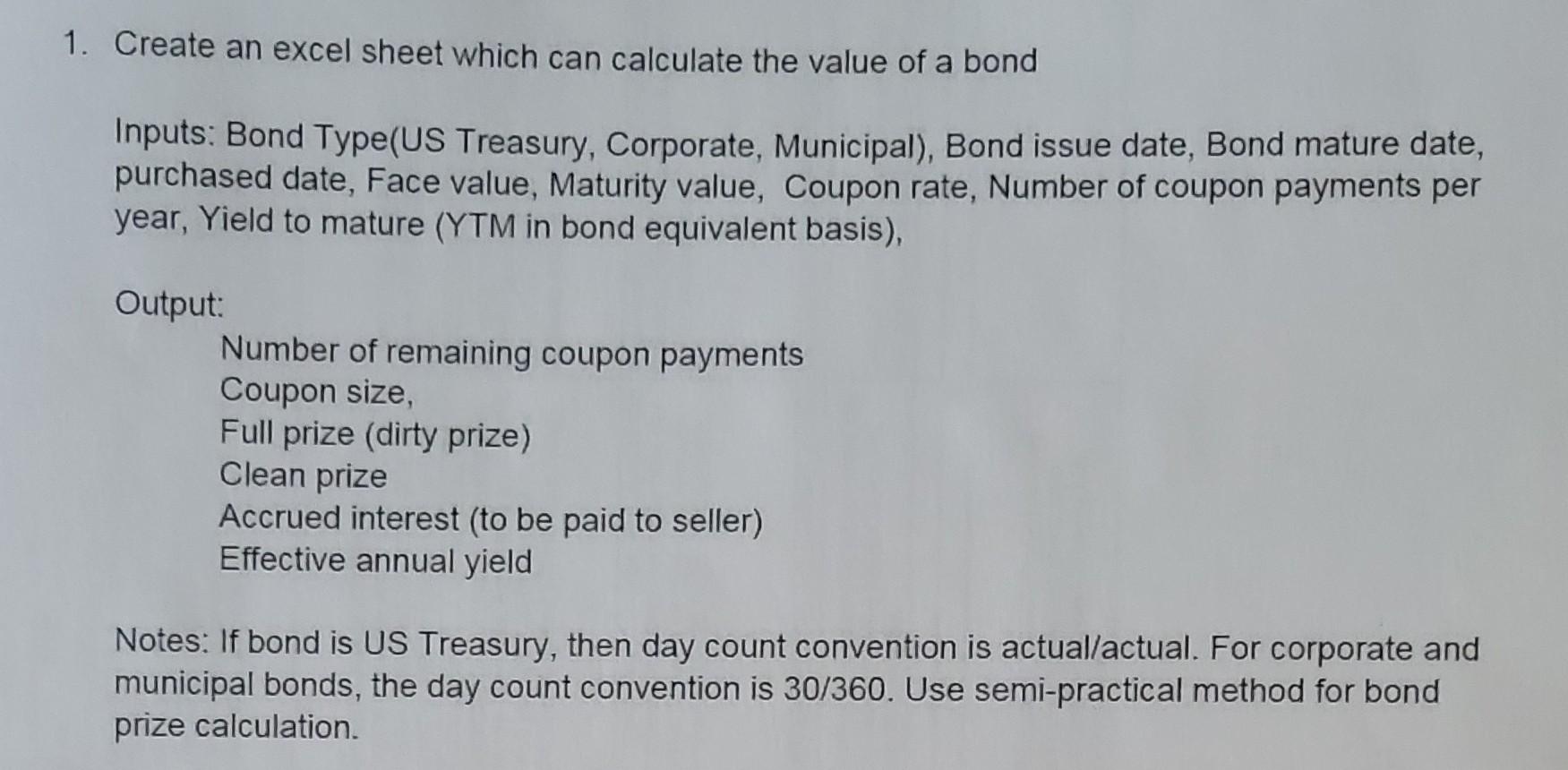

Question: 1. Create an excel sheet which can calculate the value of a bond Inputs: Bond Type(US Treasury, Corporate, Municipal), Bond issue date, Bond mature date,

1. Create an excel sheet which can calculate the value of a bond Inputs: Bond Type(US Treasury, Corporate, Municipal), Bond issue date, Bond mature date, purchased date, Face value, Maturity value, Coupon rate, Number of coupon payments per year, Yield to mature (YTM in bond equivalent basis), Output: Number of remaining coupon payments Coupon size, Full prize (dirty prize) Clean prize Accrued interest (to be paid to seller) Effective annual yield Notes: If bond is US Treasury, then day count convention is actual/actual. For corporate and municipal bonds, the day count convention is 30/360. Use semi-practical method for bond prize calculation. 1. Create an excel sheet which can calculate the value of a bond Inputs: Bond Type(US Treasury, Corporate, Municipal), Bond issue date, Bond mature date, purchased date, Face value, Maturity value, Coupon rate, Number of coupon payments per year, Yield to mature (YTM in bond equivalent basis), Output: Number of remaining coupon payments Coupon size, Full prize (dirty prize) Clean prize Accrued interest (to be paid to seller) Effective annual yield Notes: If bond is US Treasury, then day count convention is actual/actual. For corporate and municipal bonds, the day count convention is 30/360. Use semi-practical method for bond prize calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts