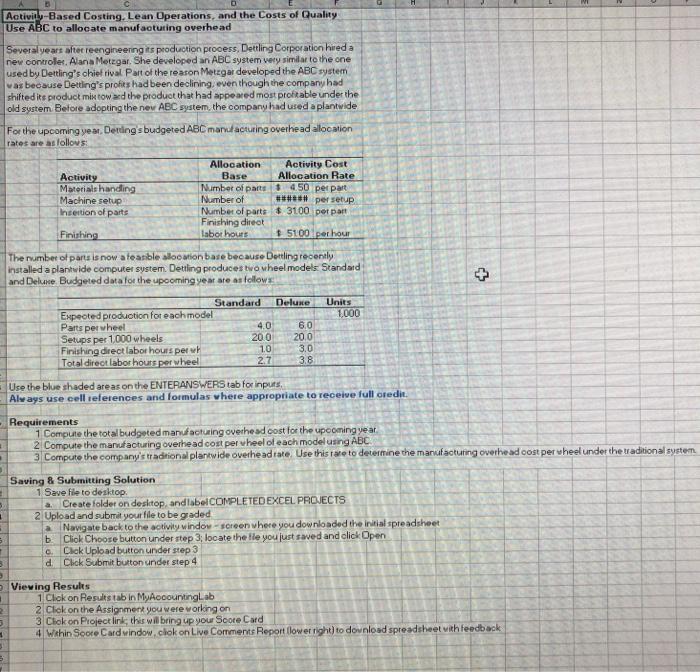

Question: how would i input this directly into the blue shaders? Activity-Based Costing. Lean Operations, and the Costs of Quality Use ABC to allocate manufacturing overhead

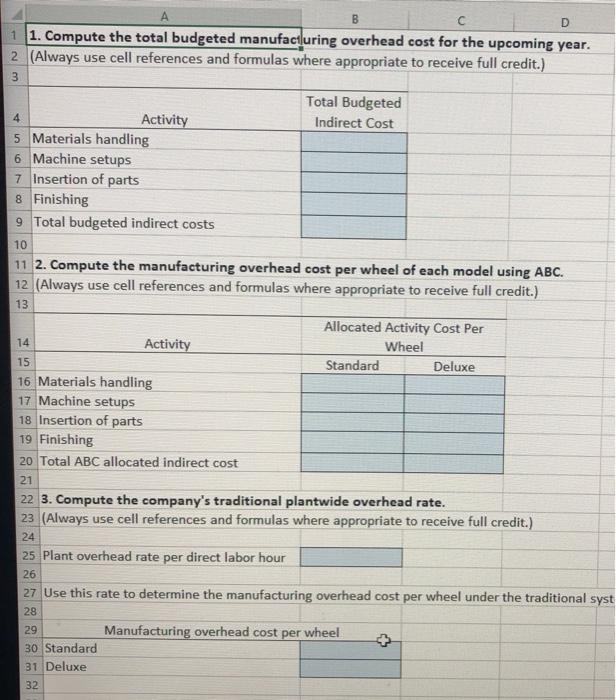

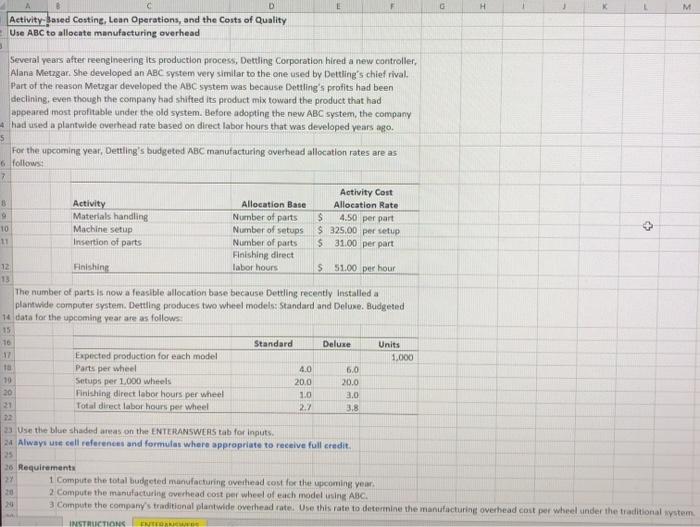

Activity-Based Costing. Lean Operations, and the Costs of Quality Use ABC to allocate manufacturing overhead Several years after reengineering as production process. Dettling Corporation hired a new controler. Alana Metzgar. She developed an ABC system very similar to the one used by Dettling's chief rival Part of the reason Metzgar developed the ABC system was because Desting's prohes had been declining, even though the company had shifted its product mix toward the product that had appeared most probable under the old system Before adopting the new ABC system, the company had used a plantwide For the upcoming year. Dertingsbudgeted ABC mordfacturing overhead allocation rates are as follows: Allocation Activity Cost Activity Base Allocation Rate Materials handling Number of parts $ 4.50 per part Machine setup Number of #*#**# per setup Insertion of parts Number of parts $ 3100 per part Finishing direct Finishing Isbot hours 5100 per hour The number of parts is now a teasible slocation base because Dettling recently installed a plantwide computer system. Detting produces two wheel models: Standard and Deluxe Budgeted data for the upcoming year are as follow Standard Deluxe Units Expected production for each model 1,000 Parts per wheel 4.0 60 Setups per 1,000 wheels 200 20.0 Finishing direct labor hours per 1.0 3.0 Total direct labor hours per wheel 2.7 38 + Use the blue shaded areas on the ENTERANSWERS tab for inputs, Always use cell selerences and formulas where appropriate to receive full credit. - Requirements 1 Compute the total budgeted manufacturing overhead cost for the upcoming year 2 Compute the manufacturing overhead cost per Wheel of each model using ABC . 3 Compute the company's traditional plantwide overhead tate. Use this we to determine the manufacturing overhead cost per Wheel under the traditional system Saving & Submitting Solution 1 Save file to desktop a Create folder on desitop and labelCOMPLETEDEXCEL PROJECTS 2 Upload and submit your file to be graded Navigate back to the activity window - screen where you downloaded the initial spreadsheet b. Click Choose button under step 3: locate thelle you just saved and click Open Clck Upload button under step 3 d Chok Submit button under step 4 Vieving Results 1 Click on Results tab in My Accountinglab 2 Click on the Assignment you were working on 3 Clokon Project link, this will bring up your Score Card 4 Wahin ScoreCard window, chok on Live Comments Report flower right) to download spreadsheet with feedback 5 . c 2 3 1 3 3 C D 1 1. Compute the total budgeted manufacturing overhead cost for the upcoming year. 2 (Always use cell references and formulas where appropriate to receive full credit.) 3 4 Total Budgeted Activity Indirect Cost 5 Materials handling 6 Machine setups 7 Insertion of parts 8 Finishing 9 Total budgeted indirect costs 10 11 2. Compute the manufacturing overhead cost per wheel of each model using ABC. 12 (Always use cell references and formulas where appropriate to receive full credit.) 13 Allocated Activity Cost Per 14 Activity Wheel 15 Standard Deluxe 16 Materials handling 17 Machine setups 18 Insertion of parts 19 Finishing 20 Total ABC allocated indirect cost 21 22 3. Compute the company's traditional plantwide overhead rate. 23 (Always use cell references and formulas where appropriate to receive full credit.) 24 25 Plant overhead rate per direct labor hour 26 27 Use this rate to determine the manufacturing overhead cost per wheel under the traditional syst 28 29 Manufacturing overhead cost per wheel 30 Standard 31 Deluxe 32 D G H M Activity Based Costing, Lean Operations, and the costs of Quality Use ABC to allocate manufacturing overhead + Several years after reengineering its production process, Dettling Corporation hired a new controller, Alana Metzgar. She developed an ABC system very similar to the one used by Dettling's chief rival. Part of the reason Metrgar developed the ABC system was because Dettling's profits had been declining, even though the company had shifted its product mix toward the product that had appeared most profitable under the old system. Before adopting the new ABC system, the company 4 had used a plantwide overhead rate based on direct labor hours that was developed years ago. 5 For the upcoming year, Dettling's budgeted MBC manufacturing overhead allocation rates are as 6 follows: 7 Activity Cost B Activity Allocation Base Allocation Rate Materials handling Number of parts S 4.50 per part 10 Machine setup Number of setups $325.00 per setup 11 Insertion of parts Number of parts $31.00 per part Finishing direct 12 Finishing labor hours $ $1.00 per hour 13 The number of parts is now a feasible allocation base because Dettling recently installed a plantwide computer system. Dettling produces two wheel models: Standard and Deluxe. Budgeted 14 data for the upcoming year are as follows: 15 10 Standard Deluxe Units 17 Expected production for each model 1.000 Parts per wheel 4.0 5.0 10 Setups per 1.000 wheels 20.0 20.0 20 Finishing direct labor hours per wheel 1.0 3.0 21 Total direct labor hours per Wheel 2. 3.8 22 33 Use the blue shaded areas on the ENTERANSWERS tab for inputs. 24 Always use coll references and formulas where appropriate to receive full credit 25 20 Requirements 2 1. Compute the total budgeted manufacturing overhead cost for the upcoming year, 20 2 Compute the manufacturing overhead cost per wheel of each modelusine ABC 3 Compute the company's traditional plantwide overhead rate. Use this rate to determine the manufacturing overhead cost per Wheel under the traditional system INSTRUCTIONS ENTER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts