Question: How would the below information be completed on a From 4 7 9 7 ? The assets Phillip sold on March 2 0 are as

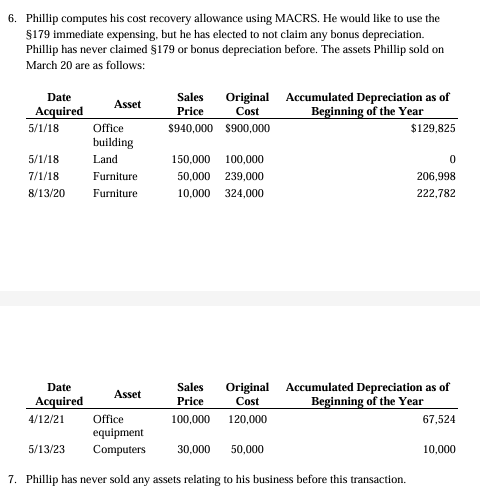

How would the below information be completed on a From The assets Phillip sold on March are as follows: Date Acquired Asset Sales Price Original Cost Accumulated Depreciation as of Beginning of the Year Office building $ $ $ Land Furniture Furniture Date Acquired Asset Sales Price Original Cost Accumulated Depreciation as of Beginning of the Year Office equipment Computers Phillip has never sold any assets relating to his business before this transaction. Phillip computes his cost recovery allowance using MACRS. He would like to use the immediate expensing, but he has elected to not claim any bonus depreciation. Phillip has never claimed $ or bonus depreciation before. The assets Phillip sold on March are as follows: Phillip has never sold any assets relating to his business before this transaction.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock