Question: How would you go about determining a fair three-year fixed rate for a swap (first payment starting in November 2012 and ending in November 2015)

How would you go about determining a fair three-year fixed rate for a swap (first payment starting in November 2012 and ending in November 2015) with a notional of 250,000,000?

Derive via EXCEL

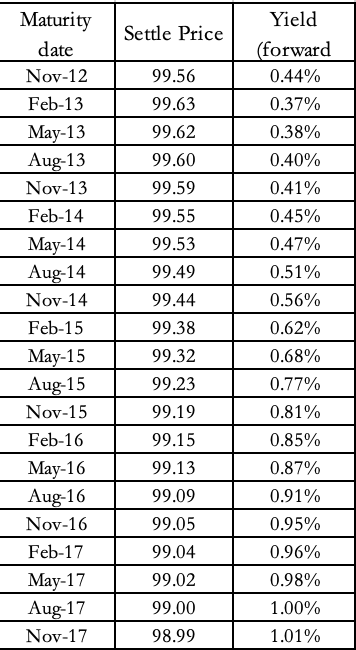

Maturity Yield Settle Price date (forward Nov-12 99.56 0.44% Feb-13 99.63 0.37% May-13 99.62 0.38% Aug-13 99.60 0.40% Nov-13 99.59 0.41% Feb-14 99.55 0.45% May-14 99.53 0.47% Aug-14 99.49 0.51% Nov-14 99.44 0.56% Feb-15 99.38 0.62% May-15 99.32 0.68% Aug-15 99.23 0.77% Nov-15 99.19 0.81% Feb-16 99.15 0.85% May-16 99.13 0.87% Aug-16 99.09 0.91% Nov-16 99.05 0.95% Feb-17 99.04 0.96% May-17 99.02 0.98% Aug-17 99.00 1.00% Nov-17 98.99 1.01%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts