Question: How would you solve for this? You have been asked to conduct a valuation of 4 companies using their Free Cash Flow to Firm (FCFF).

How would you solve for this?

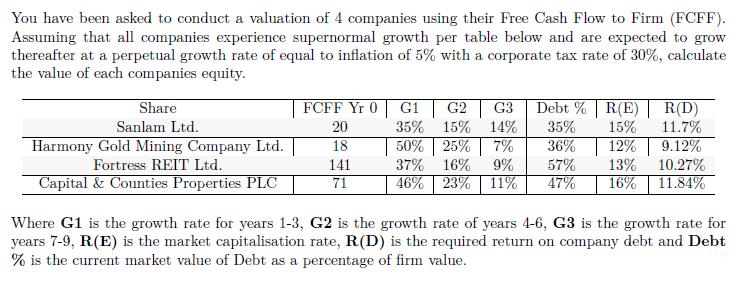

You have been asked to conduct a valuation of 4 companies using their Free Cash Flow to Firm (FCFF). Assuming that all companies experience supernormal growth per table below and are expected to grow thereafter at a perpetual growth rate of equal to inflation of 5% with a corporate tax rate of 30%, calculate the value of each companies equity. Share Sanlam Ltd. Harmony Gold Mining Company Ltd. Fortress REIT Ltd. Capital & Counties Properties PLC FCFF Yr 0 20 18 141 71 G1 G2 G3 15% 14% 35% 36% Debt % R(E) R(D) 15% 11.7% 35% 50% 25% 7% 9.12% 12% 37% 16% 9% 57% 13% 10.27% 46% 23% 11% 47% 16% 11.84% Where G1 is the growth rate for years 1-3, G2 is the growth rate of years 4-6, G3 is the growth rate for years 7-9, R(E) is the market capitalisation rate, R.(D) is the required return on company debt and Debt % is the current market value of Debt as a percentage of firm value.

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Calculate FCFF for each year FCFF Year 0 is given as 20 for all companies For years 13 calculate FCF... View full answer

Get step-by-step solutions from verified subject matter experts