Question: How would you solve the attached problems using a Financial calculator? Input: N= I/Y= PV= PMT= FV= Q3. In the Global Financial Crisis box in

How would you solve the attached problems using a Financial calculator?

Input: N= I/Y= PV= PMT= FV=

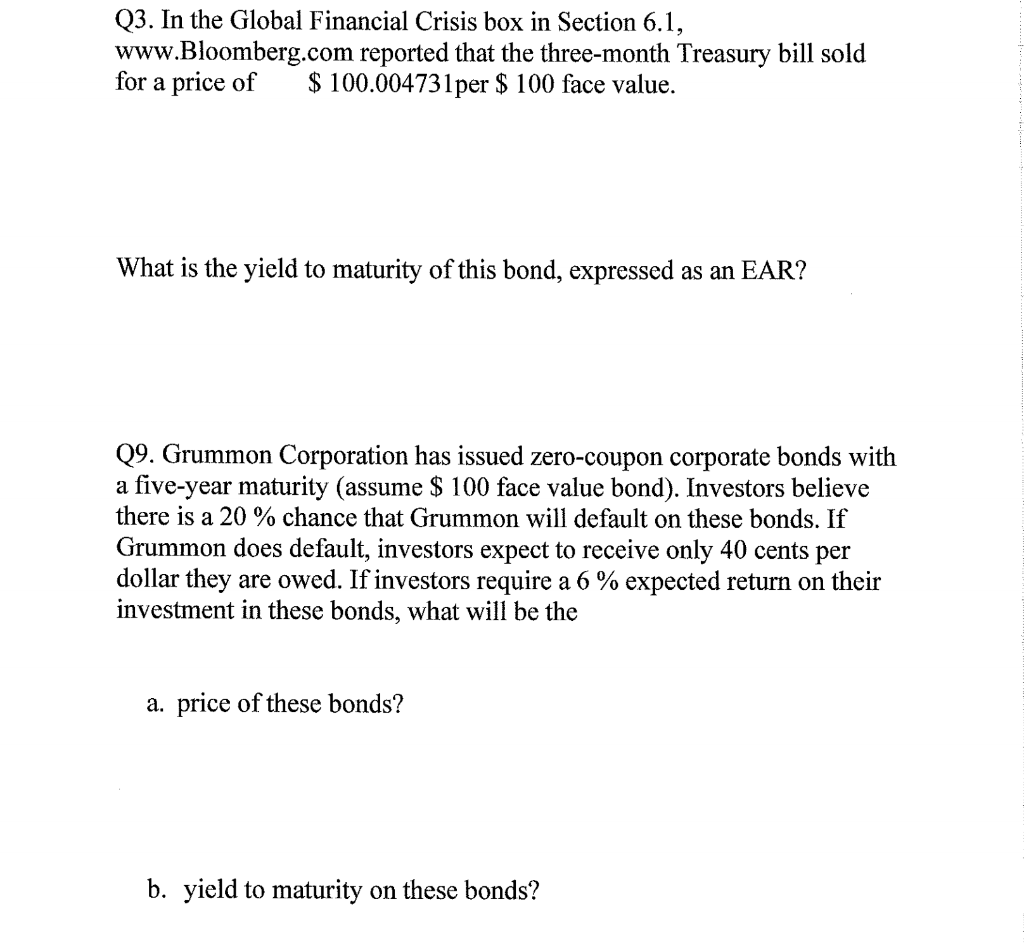

Q3. In the Global Financial Crisis box in Section 6.1, www.Bloomberg.com reported that the three-month Treasury bill sold for a price of $ 100.004731per $ 100 face value. What is the yield to maturity of this bond, expressed as an EAR? 09. Grummon Corporation has issued zero-coupon corporate bonds with a five-year maturity (assume $ 100 face value bond). Investors believe there is a 20 % chance that Grummon will default on these bonds. If Grummon does default, investors expect to receive only 40 cents per dollar they are owed. If investors require a 6% expected return on their investment in these bonds, what will be the a. price of these bonds? b. yield to maturity on these bonds? Q3. In the Global Financial Crisis box in Section 6.1, www.Bloomberg.com reported that the three-month Treasury bill sold for a price of $ 100.004731per $ 100 face value. What is the yield to maturity of this bond, expressed as an EAR? 09. Grummon Corporation has issued zero-coupon corporate bonds with a five-year maturity (assume $ 100 face value bond). Investors believe there is a 20 % chance that Grummon will default on these bonds. If Grummon does default, investors expect to receive only 40 cents per dollar they are owed. If investors require a 6% expected return on their investment in these bonds, what will be the a. price of these bonds? b. yield to maturity on these bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts