Question: Ignoring possible tax effects and signaling costs, the total value of a firm's equity remains the same irrespective of how the firm distributes its

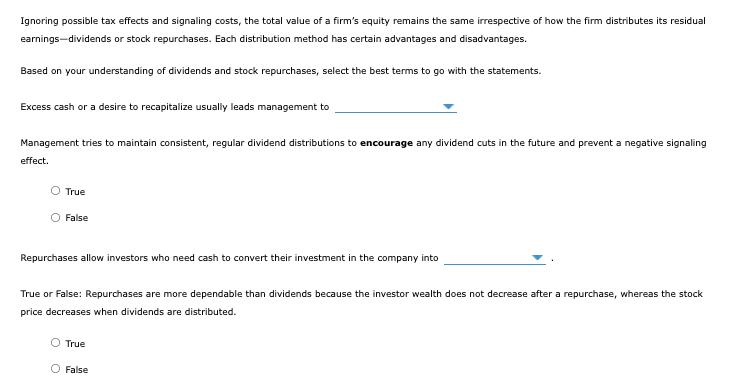

Ignoring possible tax effects and signaling costs, the total value of a firm's equity remains the same irrespective of how the firm distributes its residual earnings-dividends or stock repurchases. Each distribution method has certain advantages and disadvantages. Based on your understanding of dividends and stock repurchases, select the best terms to go with the statements. Excess cash or a desire to recapitalize usually leads management to Management tries to maintain consistent, regular dividend distributions to encourage any dividend cuts in the future and prevent a negative signaling effect. O True False Repurchases allow investors who need cash to convert their investment in the company into True or False: Repurchases are more dependable than dividends because the investor wealth does not decrease after a repurchase, whereas the stock price decreases when dividends are distributed. True O False

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

1 Excess cash or a desire to recapitalize usually leads man... View full answer

Get step-by-step solutions from verified subject matter experts