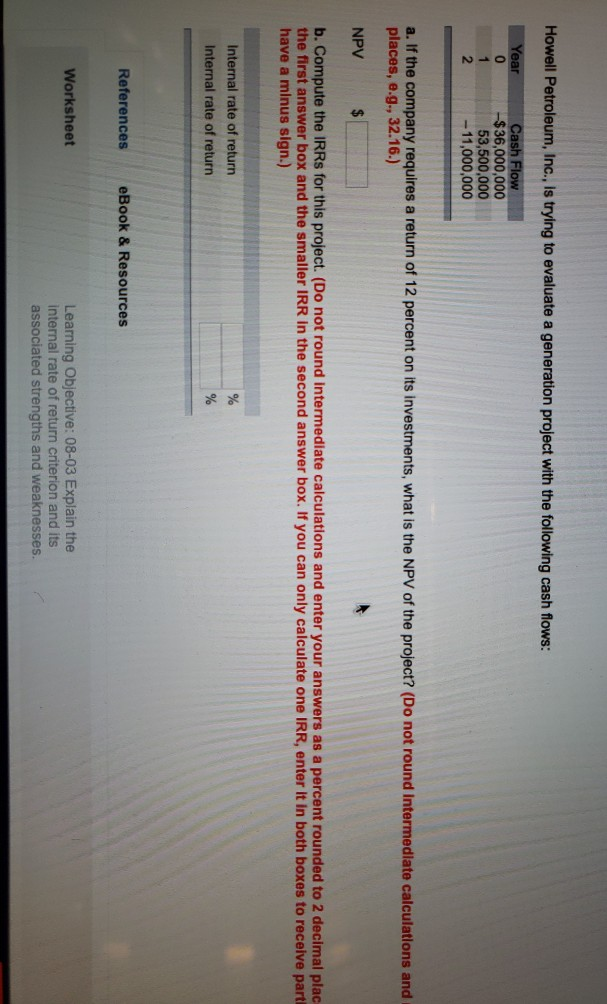

Question: Howell Petroleum, Inc., Is trying to evaluate a generation project with the following cash flows 0 0 $36,000,000 53,500,000 -11,000,000 a. If the company requires

Howell Petroleum, Inc., Is trying to evaluate a generation project with the following cash flows 0 0 $36,000,000 53,500,000 -11,000,000 a. If the company requires a return of 12 percent on its investments, what is the NPV of the project? (Do not round Intermedlate calculations and places, e.g., 32.16.) NPV $ b. Compute the IRRs for this project. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal plac the first answer box and the smaller IRR in the second answer box. If you can only calculate one IRR, enter It in both boxes to recelve part have a minus sign.) Internal rate of return Internal rate of return References eBook & Resources Worksheet Learning Objective: 08-03 Explain the internal rate of return criterion and its associated strengths and weaknesses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts