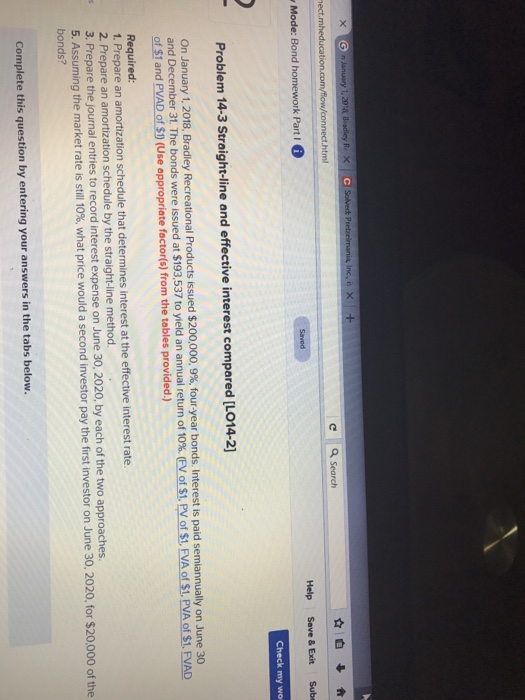

Question: html C a Search Mode: Bond homework Parti Help Save & ExitSube Problem 14-3 Straight-line and effective interest compared [L014-2] On January 1, 2018, Bradley

![ExitSube Problem 14-3 Straight-line and effective interest compared [L014-2] On January 1,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ebeae350137_12266ebeae2be57f.jpg)

html C a Search Mode: Bond homework Parti Help Save & ExitSube Problem 14-3 Straight-line and effective interest compared [L014-2] On January 1, 2018, Bradley Recreational Products issued $200,000, 9%, four-year bonds. Interest is paid s emiannually on June 30 and December 31 The bonds were issued at $193,537 to yield an annual return of 10% (FVors1 of S1 and PVAD of S0 (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare an amortization schedule that determines interest at the effective interest rate . Dy of $1. EVAotsi, PVAow. EVAD 2. Prepare an amortization schedule by the straight-ine method. 3. Prepar re the journal entries to record interest expense on June 30, 2020, by each of the two approaches 5, Assuming the market rate is still 10%, what price wou bonds? uld a second investor pay the first investor on June 30, 2020, for $20,000 of the Complete this question by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts