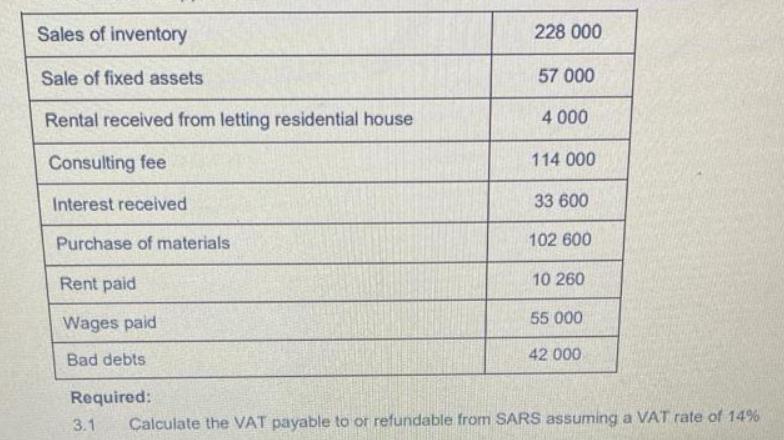

Question: XYZ (Pty) Ltd carries on a manufacturing business and asks that you calculate the VAT payabl or refundable to it, during the VAT period, based

XYZ (Pty) Ltd carries on a manufacturing business and asks that you calculate the VAT payabl or refundable to it, during the VAT period, based on the following information. All amounts are inclusive where applicable:

Sales of inventory Sale of fixed assets Rental received from letting residential house Consulting fee Interest received Purchase of materials Rent paid Wages paid Bad debts Required: 3.1 228 000 57 000 4 000 114 000 33 600 102 600 10 260 55 000 42 000 Calculate the VAT payable to or refundable from SARS assuming a VAT rate of 14%

Step by Step Solution

3.32 Rating (152 Votes )

There are 3 Steps involved in it

ANSWER VAT... View full answer

Get step-by-step solutions from verified subject matter experts