Question: Humber Tech is considering starting either a small, regular, or large tech store in Etobicoke. The type of store they open depends on the city's

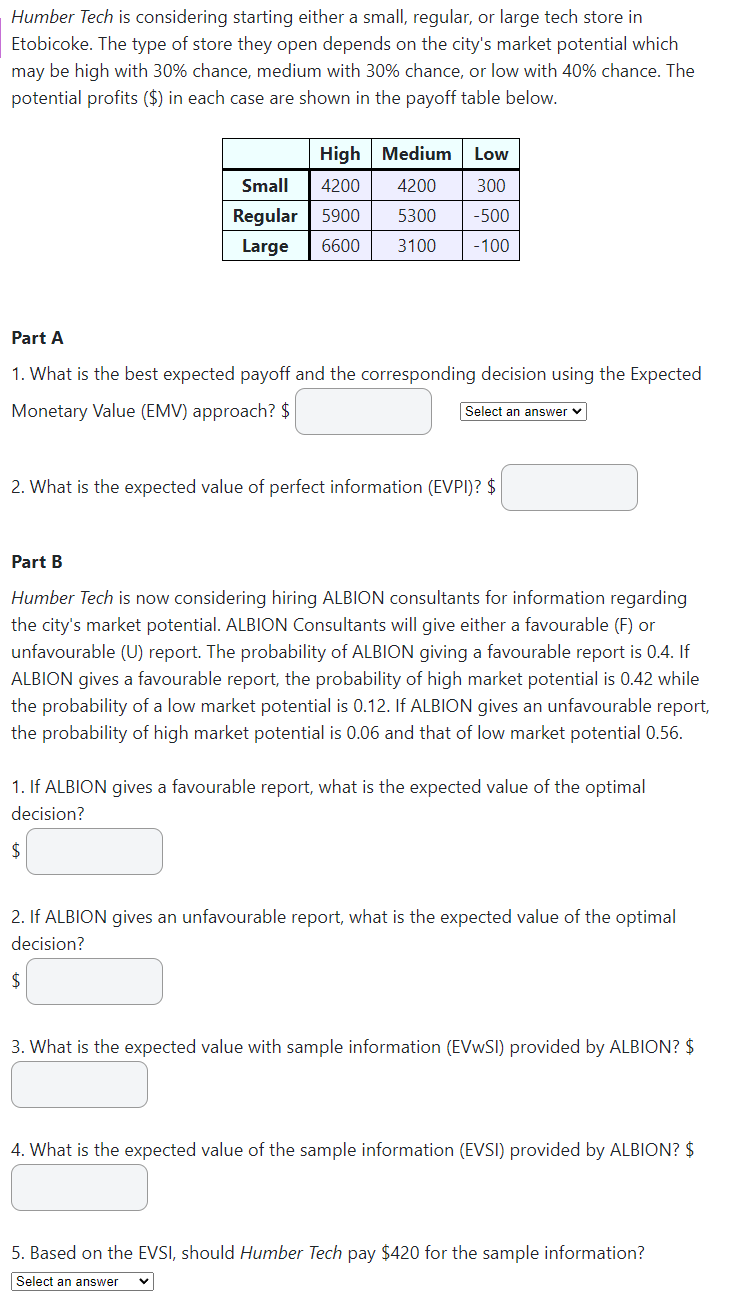

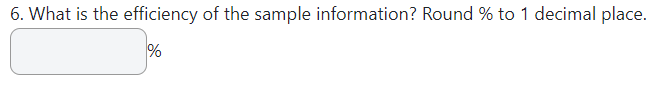

Humber Tech is considering starting either a small, regular, or large tech store in Etobicoke. The type of store they open depends on the city's market potential which may be high with 30% chance, medium with 30% chance, or low with 40% chance. The potential profits (\$) in each case are shown in the payoff table below. Part A 1. What is the best expected payoff and the corresponding decision using the Expected Monetary Value (EMV) approach? \$ 2. What is the expected value of perfect information (EVPI)? \$ Part B Humber Tech is now considering hiring ALBION consultants for information regarding the city's market potential. ALBION Consultants will give either a favourable (F) or unfavourable (U) report. The probability of ALBION giving a favourable report is 0.4. If ALBION gives a favourable report, the probability of high market potential is 0.42 while the probability of a low market potential is 0.12. If ALBION gives an unfavourable report, the probability of high market potential is 0.06 and that of low market potential 0.56. 1. If ALBION gives a favourable report, what is the expected value of the optimal decision? $ 2. If ALBION gives an unfavourable report, what is the expected value of the optimal decision? $ 3. What is the expected value with sample information (EVwSI) provided by ALBION? \$ 4. What is the expected value of the sample information (EVSI) provided by ALBION? \$ 5. Based on the EVSI, should Humber Tech pay $420 for the sample information? 6. What is the efficiency of the sample information? Round \% to 1 decimal place. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts