Question: HW # 1 1 ( Ch 1 7 ) Back to Assignment Attempts 3 . 7 2 Keep the Highest ( 3 .

HW#Ch

Back to Assignment

Attempts

Keep the Highest

Inflationinduced tax distortions

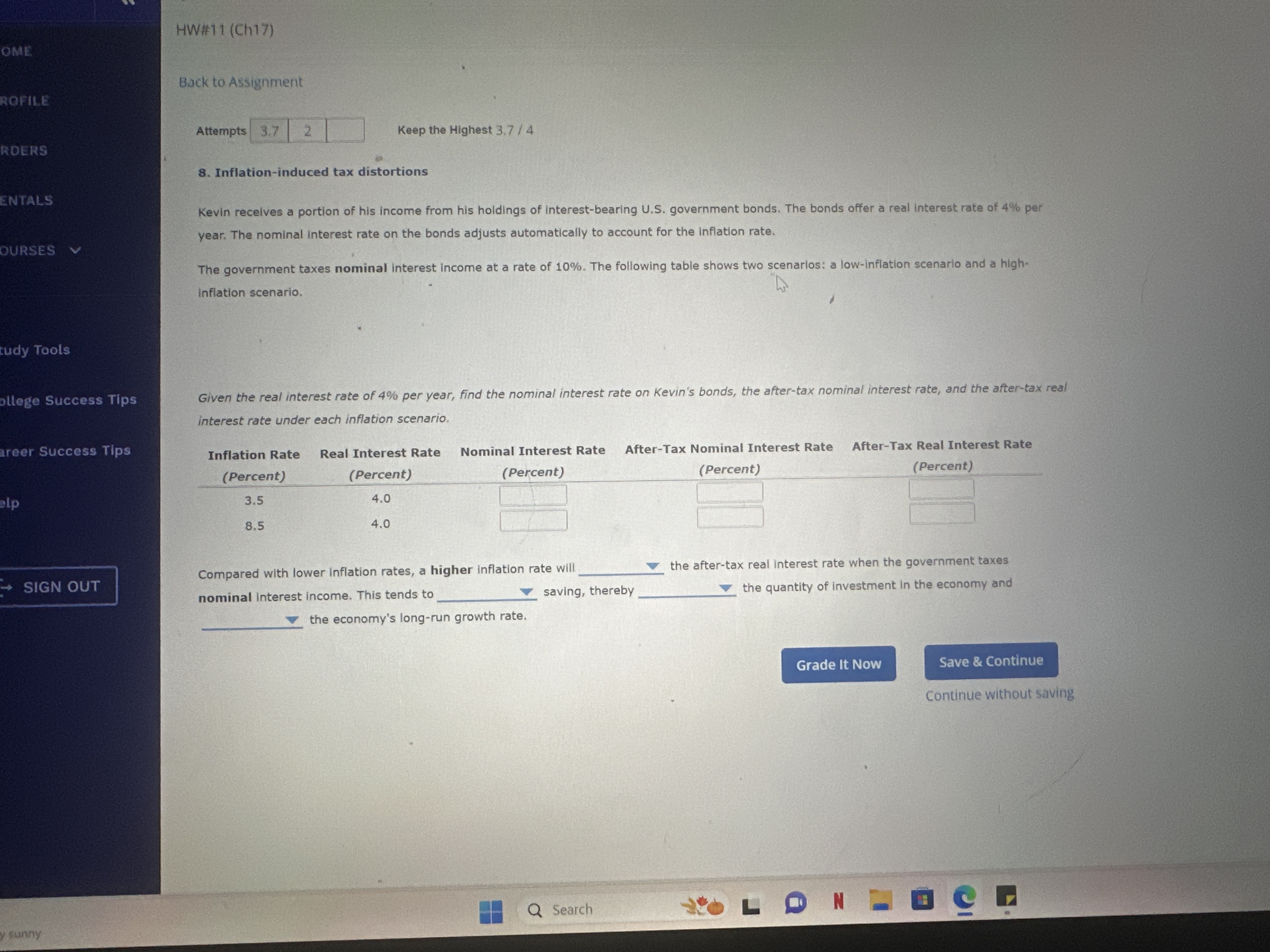

Kevin recelves a portion of his income from his holdings of interestbearing US government bonds. The bonds offer a real interest rate of per year. The nominal interest rate on the bonds adjusts automatically to account for the inflation rate.

The government taxes nominal interest income at a rate of The following table shows two scenarlos: a lowinflation scenario and a highinflation scenario.

Given the real interest rate of per year, find the nominal interest rate on Kevin's bonds, the aftertax nominal interest rate, and the aftertax real interest rate under each inflation scenario.

Compared with lower inflation rates, a higher inflation rate will the aftertax real interest rate when the government taxes nominal Interest income. This tends tc saving, thereby the quantity of investment in the economy and the economy's longrun growth rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock