Question: HW = 1 4 Problem 1 Isley Construction negotiabes a lump - sum purchase of severnl assets hom a compary that a poing out of

HW

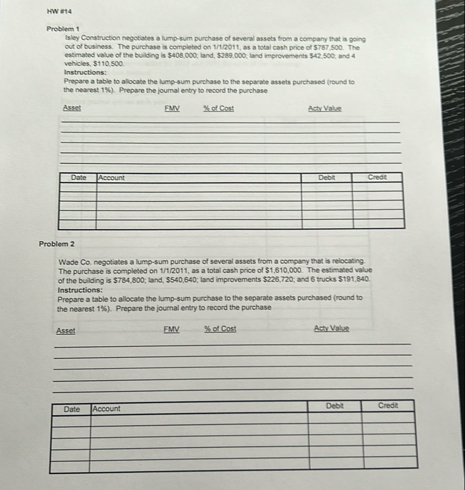

Problem

Isley Construction negotiabes a lumpsum purchase of severnl assets hom a compary that a poing out of business. The purchase is completed on as a total cash price of $ The estimated value of the building is $ land, $ land improvements $ and vehicles, $

Instructions:

Prepare a table to allocabe the lumpsum purchase to the separabe assets purchased round to the nearest Prepare the joumal entry to record the purchase

Asert

EMV

Wet Cons:

Asty Vales

tableDateAccount,Debi,Credt

Problem

Wade Ca negotiates a lumpsum purchase of several assets from a company that is relocating The purchase is completed on as a total cash price of $ The estimated value of the bulding is $; land, $; land improvements $; and trucks $ Instructions:

Prepare a table to allocate the lumpsum purchase to the separate assets purchased round to the nearest Prepare the journal entry to record the purchase

Asset

EMY

K of Cost

ActyValat

tableDateAccount,Debit,Credt

HW

Problem A

Keller Co purchased a delivery truck for $ on The truck has an expected salvage value of $ and is expected to be driven miles over its year expected useful life. Actual miles driven were in and in Compute depreciation for and for each of the following:

a straightline method

b unitsofproduction method

c doubledeclining balance

Prepare journal entries each year.

tableDateAccount,Debit,Creditabb

HW

Problem Assumes the same data as Problem truck installed on

Keller Co purchased a delivery truck for $ on The truck has an expected salvage value of $ and is expected to be driven miles over its year expected useful life. Actual miles driven were in and in Compute depreciation for and for each of the following:

a straightline method

b unitsofproduction method

c doubledeclining balance

Prepare journal entries each year.

tableDateAccount,Debit,Credtabab

HW

Problem

Wade Co pays $ for equipment expected to last years and have a salvage value. Prepare journal entries to record the following costs related to the equipment.

During the third year of the equipment's life, $ cash is paid for a new component expected to increase the equipment's productivity by each year.

During the fourth year, cash is paid for normal repairs necessary to ketp the equipment in good condition.

During the fourth year, $ is paid for repairs expected to increase the useful life of the equipment from to years.

tableDateAccount,Debt,Credt

Problem

Silva Co owns a machine that cost $ and has accumulated depreciation of $ Record a journal entry to dispose of the machine on lan.

under each of the following situations.

Sold the machine for $ cash

Sold the machine for $ cash

Sold the machine for $$ cash

Scrapped the machine

tableDateAccount,Debt,Credit

Problem

Rock Co acquired a gravel pit on July Yr for $ Estimabed ite is yoars weth a r

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock