Question: = HW Comprehensive Classes 1-10 - Protected View - Ex... File Home Insert Page Layout Formulas Data Review View Help O PROTECTED VIEW Be careful--files

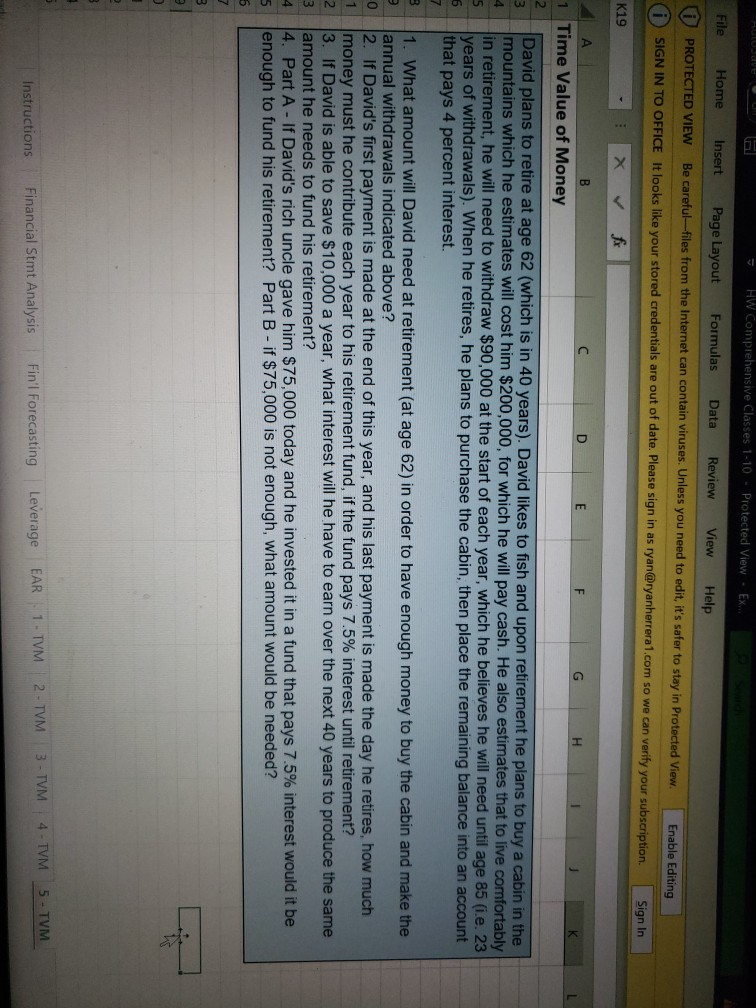

= HW Comprehensive Classes 1-10 - Protected View - Ex... File Home Insert Page Layout Formulas Data Review View Help O PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected view Enable Editing i SIGN IN TO OFFICE It looks like your stored credentials are out of date. Please sign in as ryan@ryanherrera1.com so we can verify your subscription Sign In K19 : X for AA C D E F G H I J K 1 Time Value of Money David plans to retire at age 62 (which is in 40 years). David likes to fish and upon retirement he plans to buy a cabin in the mountains which he estimates will cost him $200,000, for which he will pay cash. He also estimates that to live comfortably in retirement, he will need to withdraw $90,000 at the start of each year, which he believes he will need until age 85 (i.e. 23 years of withdrawals). When he retires, he plans to purchase the cabin, then place the remaining balance into an account that pays 4 percent interest. 0 1 1. What amount will David need at retirement (at age 62) in order to have enough money to buy the cabin and make the annual withdrawals indicated above? 2. If David's first payment is made at the end of this year, and his last payment is made the day he retires, how much money must he contribute each year to his retirement fund, if the fund pays 7.5% interest until retirement? 3. If David is able to save $10,000 a year, what interest will he have to earn over the next 40 years to produce the same amount he needs to fund his retirement? 4. Part A - If David's rich uncle gave him $75,000 today and he invested it in a fund that pays 7.5% interest would it be enough to fund his retirement? Part B - if $75,000 is not enough, what amount would be needed? 3 OU Fin'l Forecasting Leverage EAR 1 - TVM 2. TVM Financial Stmt Analysis 3 - TVM Instructions 4-VM 5. IM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts