Question: HW Set #4-MGT 45 x D PS4 Winter 2018.pdf x D Class 12 slides physica x O Drake God's Plan Y UPI Update: Equifax data

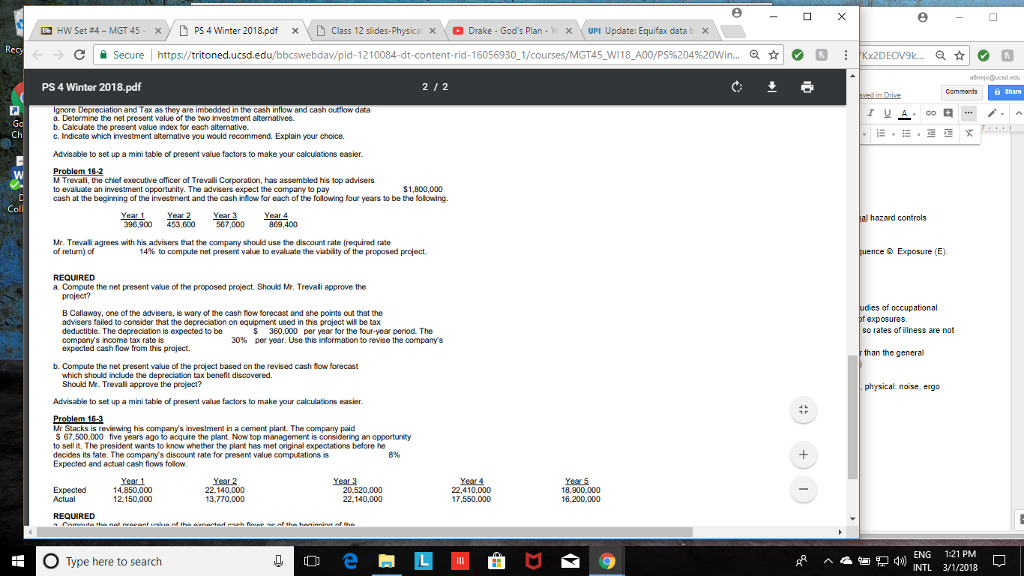

HW Set #4-MGT 45 x D PS4 Winter 2018.pdf x D Class 12 slides physica x O Drake God's Plan Y UPI Update: Equifax data x C secure https://trit oned.ucsd.edu/bbcswebdav/pid 1210084-dt-content rid 16056930 1/courses/MGT45 WI18 A00/PS%204%20Win Q Ko2DEOV9k. Q ejoucsd edu PS 4 Winter 2018.pdf 212 Ignore Depreciation and Tax as they are imbedded in the cash inflow and cash outflow data a. Determine the net present value of the two irvestment altermatives. b. Calculate the present value index for each altemative c. Indicate which investment altemative you would recommend. Explain your choice. Ch Advisable to set up a mini tabie of present value factors to make your calculations easier M Trevali, the chief executive officer of Trevalli Corporation, has assembled his lop advisers to evaluate an investment opportunity. The advisers expect the company to pay cash at the begirring of the investment and the cash inow for each of the folowing four years to be the folowing. $1,800,000 Coll Year Y Year 3Year4 396900 453600 567,000 hazard controls 809,400 Mr. Trevali of return) of grees with his advisers that the should use the discount rate (required rate 14% to compute net present value to evaluate the vabity of the proposed project. e Exposure (E). a. Compute the net present value of the proposed project. Shouid Mr. Trevali approve the project? B Callaway, one of the advisers, is wary of the cash fow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in ths project wil be tax deductible. The depreciation is expected to be compeny's income tax rate is expected cash flow from this project. exposures. so rates of illness are not S per year. Use this information to revise the company's 360,000 per year for the four-year period. The 30% than the general b. Compute the net present value of the project based on the revised cash fow forecast which should include the depreciation tax benefit discovered Should M. Trevali approve the project? physical: noise, ergo Advisable to set up a mini table of present value factors to make your calculations easier. Mr Stacks is reviewing his company's investment in a cement plant. The company paid 67,500,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company's discount rate for present value computations is Expected and actual cash flows follow 8% Year 2 22.140,000 13,770,000 Year4 22,410,000 17,550,000 18.900,000 Actual 12.150,000 22140,000 O Type here to search ENG 1:21 PM INTL 3/1/2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts