Question: HW7: Chapter 16 Option Valuation i Saved Help Save 10 You observe a premium of $44.00 for a call option on Birdwell Enterprises common stock,

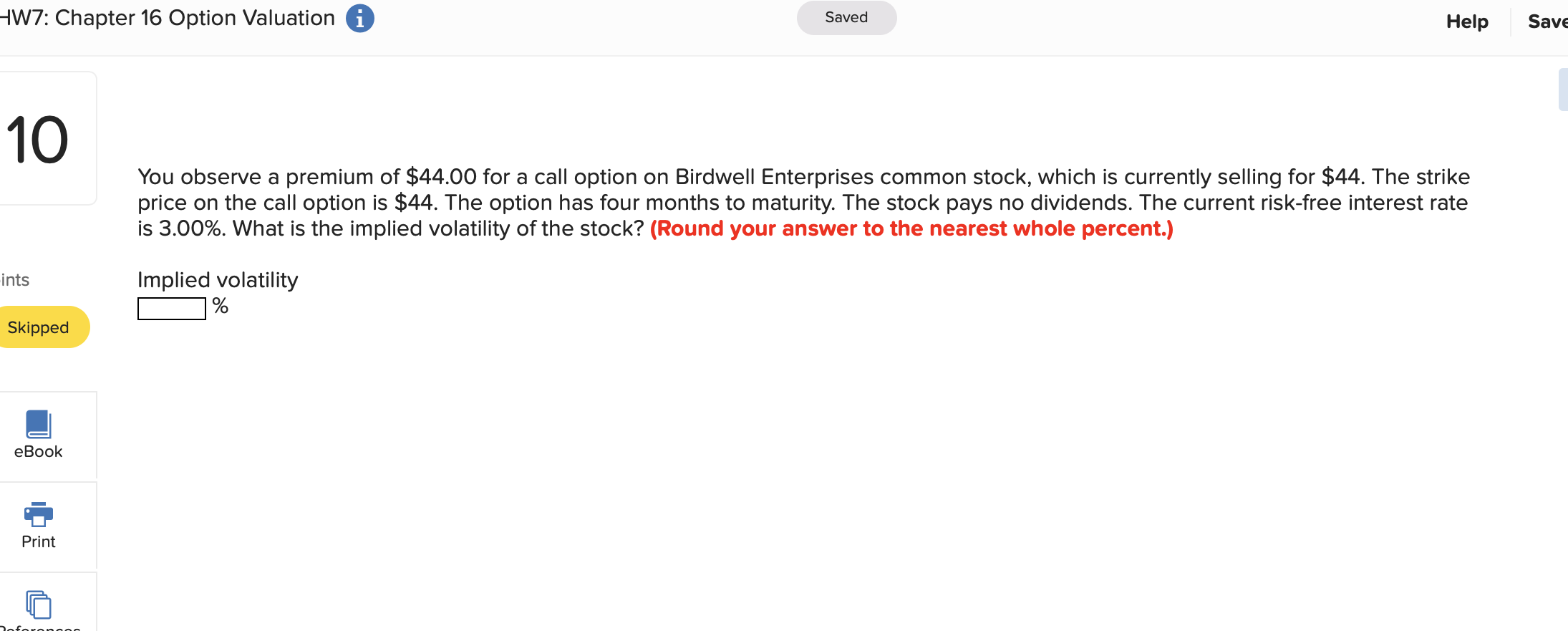

HW7: Chapter 16 Option Valuation i Saved Help Save 10 You observe a premium of $44.00 for a call option on Birdwell Enterprises common stock, which is currently selling for $44. The strike price on the call option is $44. The option has four months to maturity. The stock pays no dividends. The current risk-free interest rate is 3.00%. What is the implied volatility of the stock? (Round your answer to the nearest whole percent.) ints Implied volatility % Skipped eBook Print HW7: Chapter 16 Option Valuation i Saved Help Save 10 You observe a premium of $44.00 for a call option on Birdwell Enterprises common stock, which is currently selling for $44. The strike price on the call option is $44. The option has four months to maturity. The stock pays no dividends. The current risk-free interest rate is 3.00%. What is the implied volatility of the stock? (Round your answer to the nearest whole percent.) ints Implied volatility % Skipped eBook Print

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts