Question: This task asseses the following learning outcomes: Demonstrate a deep understanding of the theory and practices of financing a firm and its capital structure. Evaluate

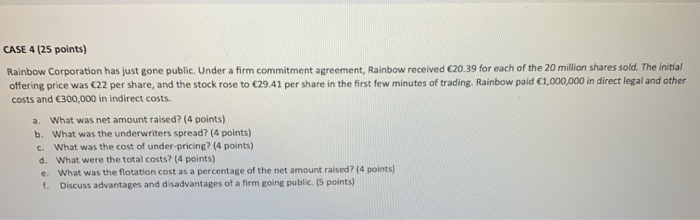

This task asseses the following learning outcomes: Demonstrate a deep understanding of the theory and practices of financing a firm and its capital structure. Evaluate the financing risk that may result from the chosen debt ratio. Critically evaluate the dividend payout ratio. Describe and analyze the trade-off between paying dividends and retaining the profits within the company. Explain the purpose and procedure related to stock repurchases. Evaluate and advice on a firm going from private to a public company. . . a CASE 4 (25 points) Rainbow Corporation has just gone public. Under a firm commitment agreement, Rainbow received 20.39 for each of the 20 million shares sold. The initial offering price was c22 per share, and the stock rose to 29.41 per share in the first few minutes of trading. Rainbow paid 1,000,000 in direct legal and other costs and 300,000 in indirect costs. a. What was net amount raised? (4 points) b. What was the underwriters spread? (4 points) c. What was the cost of under-pricing? (4 points) d. What were the total costs? (4 points) What was the flotation cost as a percentage of the net amount raised? (4 points) f. Discuss advantages and disadvantages of a firm going public. (5 points) e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts