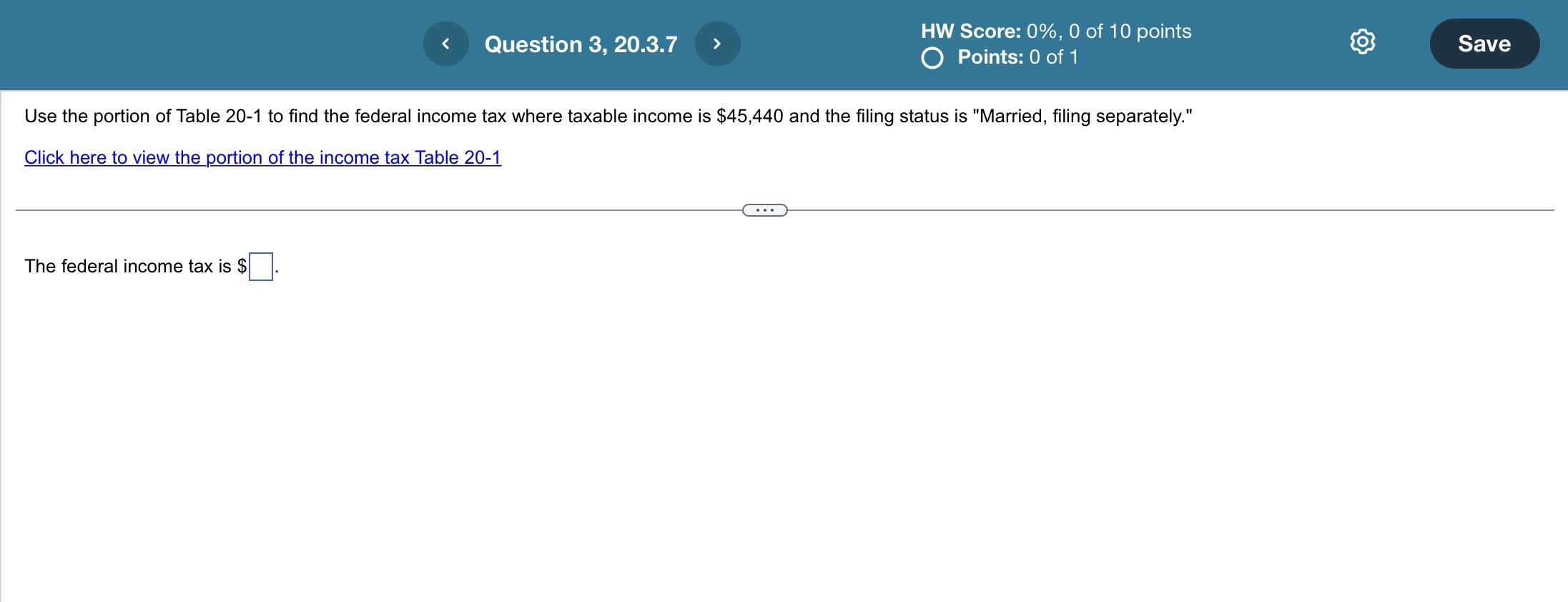

Question: . HWS :0,0f10 't Question 3, 20.3.7 core A} 0 pom S 0 Points: 0 of1 Use the portion of Table 20-1 to find the

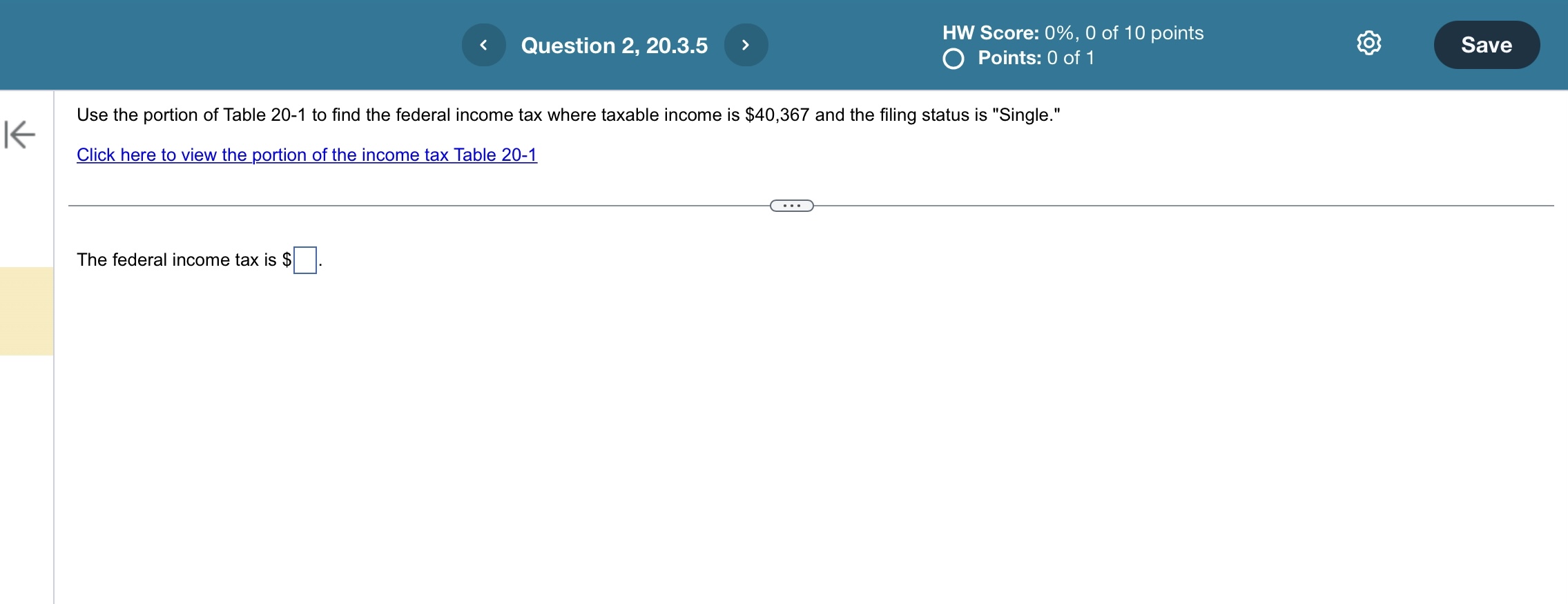

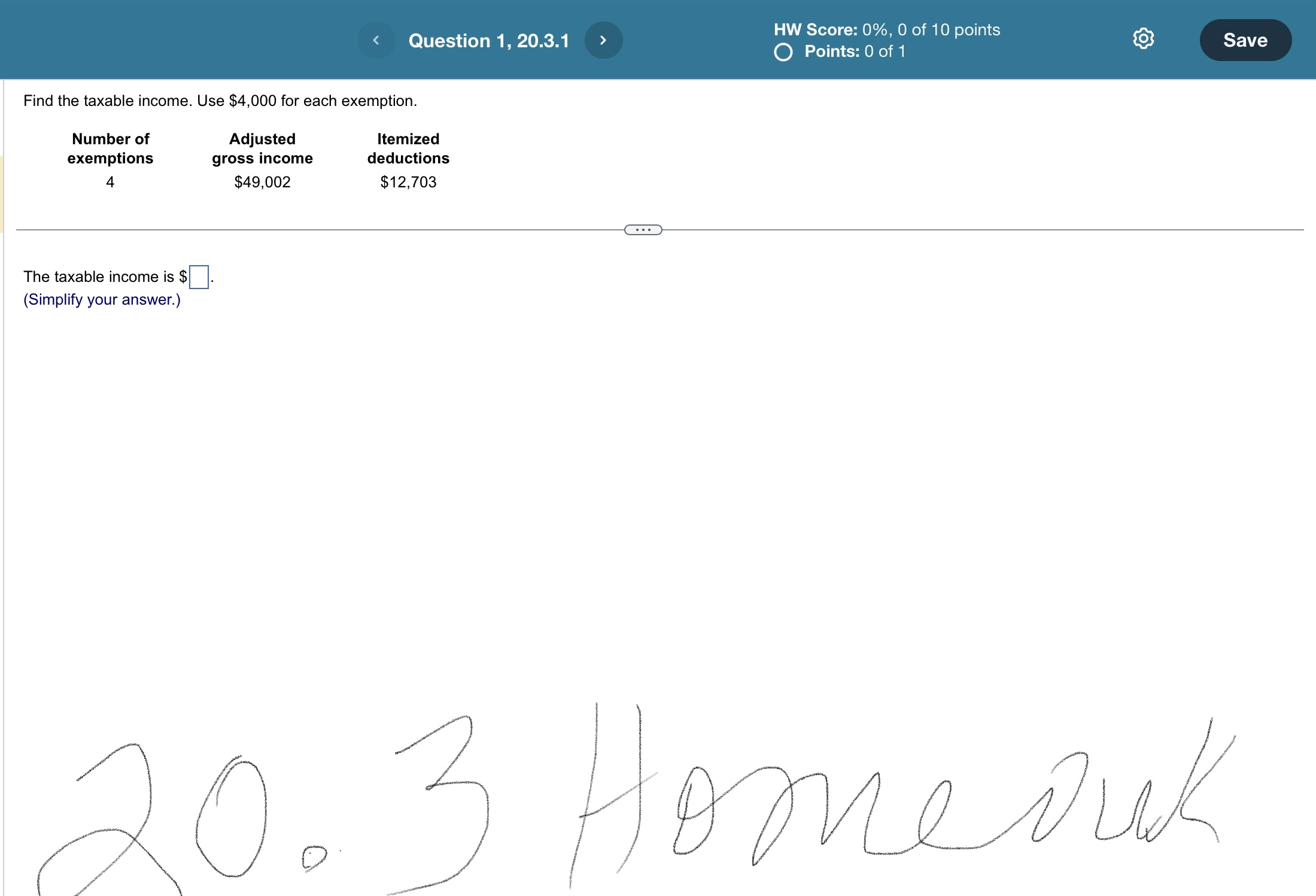

. HWS :0,0f10 't Question 3, 20.3.7 core A} 0 pom S 0 Points: 0 of1 Use the portion of Table 20-1 to find the federal income tax where taxable income is $45,440 and the ling status is "Married, ling separately." Click here to view the portion of the income tax Table 20-1 The federal income tax is $ HW Score: 0%, 0 of 10 points 0 Points: 0 of 1 Question 2. 20.3.5 Use the portion of Table 20-1 to find the federal income tax where taxable income is $40,367 and the ling status is "Single." I Click here to view the portion of the income tax Table 20-1 The federal income tax is $|:|. HW Score: 0%, 0 of 10 points 0 Points: 0 of '1 Question 1, 20.3.1 Find the taxable income. Use $4,000 for each exemption. Number of Adjusted Itemized exemptions gross income deductions 4 $49,002 $12,703 The taxable income is $|:. (Simplify your answer.) A 5 \\ 1:: \\E [\\x l E f\\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts