Question: Hyperion Inc., currently sells its latest high-speed colour printer, the Hyper 500, for $356. Its cost of goods sold for the Hyper 500 is $203

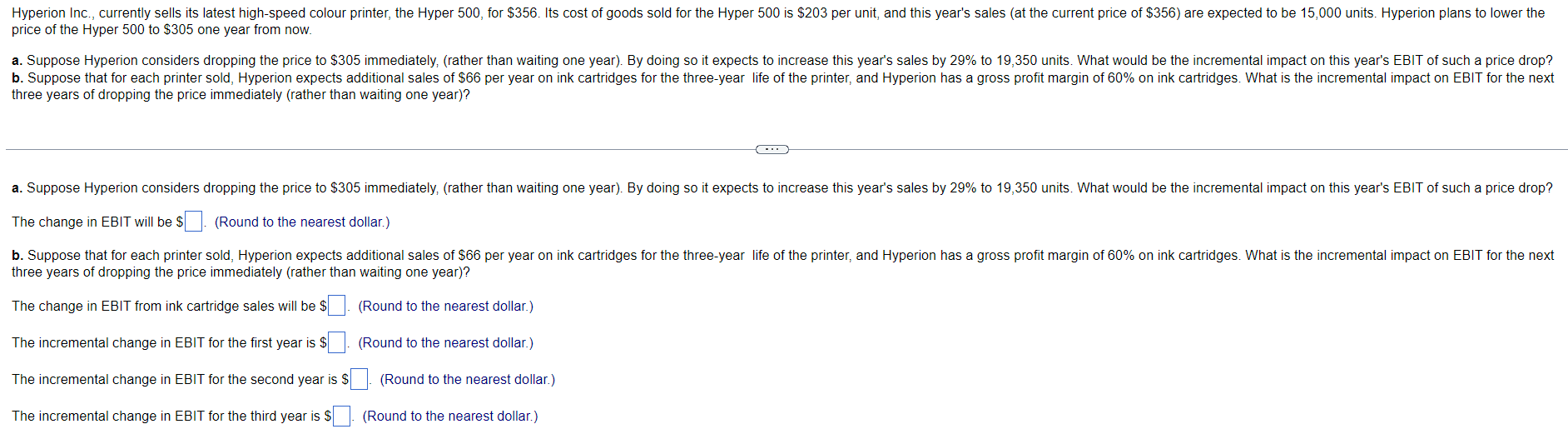

Hyperion Inc., currently sells its latest high-speed colour printer, the Hyper 500, for $356. Its cost of goods sold for the Hyper 500 is $203 per unit, and this year's sales (at the current price of $356) are expected to be 15,000 units. Hyperion plans to lower the price of the Hyper 500 to $305 one year from now. a. Suppose Hyperion considers dropping the price to $305 immediately, (rather than waiting one year). By doing so it expects to increase this year's sales by 29% to 19,350 units. What would be the incremental impact on this year's EBIT of such a price drop? b. Suppose that for each printer sold, Hyperion expects additional sales of $66 per year on ink cartridges for the three-year life of the printer, and Hyperion has a gross profit margin of 60% on ink cartridges. What is the incremental impact on EBIT for the next three years of dropping the price immediately (rather than waiting one year)? C a. Suppose Hyperion considers dropping the price to $305 immediately, (rather than waiting one year). By doing so it expects to increase this year's sales by 29% to 19,350 units. What would be the incremental impact on this year's EBIT of such a price drop? The change in EBIT will be $ (Round to the nearest dollar.) b. Suppose that for each printer sold, Hyperion expects additional sales of $66 per year on ink cartridges for the three-year life of the printer, and Hyperion has a gross profit margin of 60% on ink cartridges. What is the incremental impact on EBIT for the next three years of dropping the price immediately (rather than waiting one year)? The change in EBIT from ink cartridge sales will be $ (Round to the nearest dollar.) (Round to the nearest dollar.) The incremental change in EBIT for the first year is $. The incremental change in EBIT for the second year is $ The incremental change in EBIT for the third year is $ (Round to the nearest dollar.) (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts