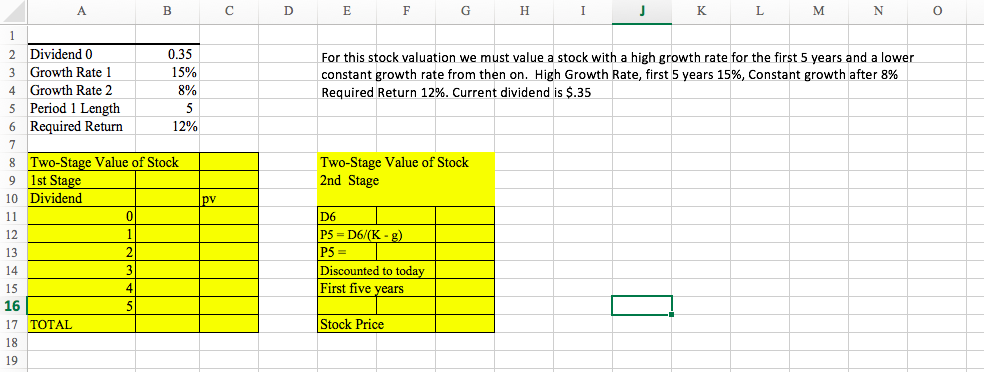

Question: I A C E G H K M N Dividend 0 Growth Rate1 0.35 2 For this stock valuation we must value a stock with

I A C E G H K M N Dividend 0 Growth Rate1 0.35 2 For this stock valuation we must value a stock with a high growth rate for the first 5 years and a lower constant growth rate from then on. High Growth Rate, first 5 years 15%, Constant growth after 8% Required Return 12%. Current dividend is $.35 15% Growth Rate 2 8% 4 5 Period 1 Length 6 Required Return 12% 7 Two-Stage Value of Stock 1st Stage Two-Stage Value of Stock 2nd Stage 10 Dividend pv D6 P5 D6/(K- g) P5 11 12 13 Discounted to today First five years 14 4 15 16 Stock Price 11 TAL 18 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts