Question: Question 5 (20 marks) a) Describe two features of a forward contract, and two features of a future contract and state why you would use

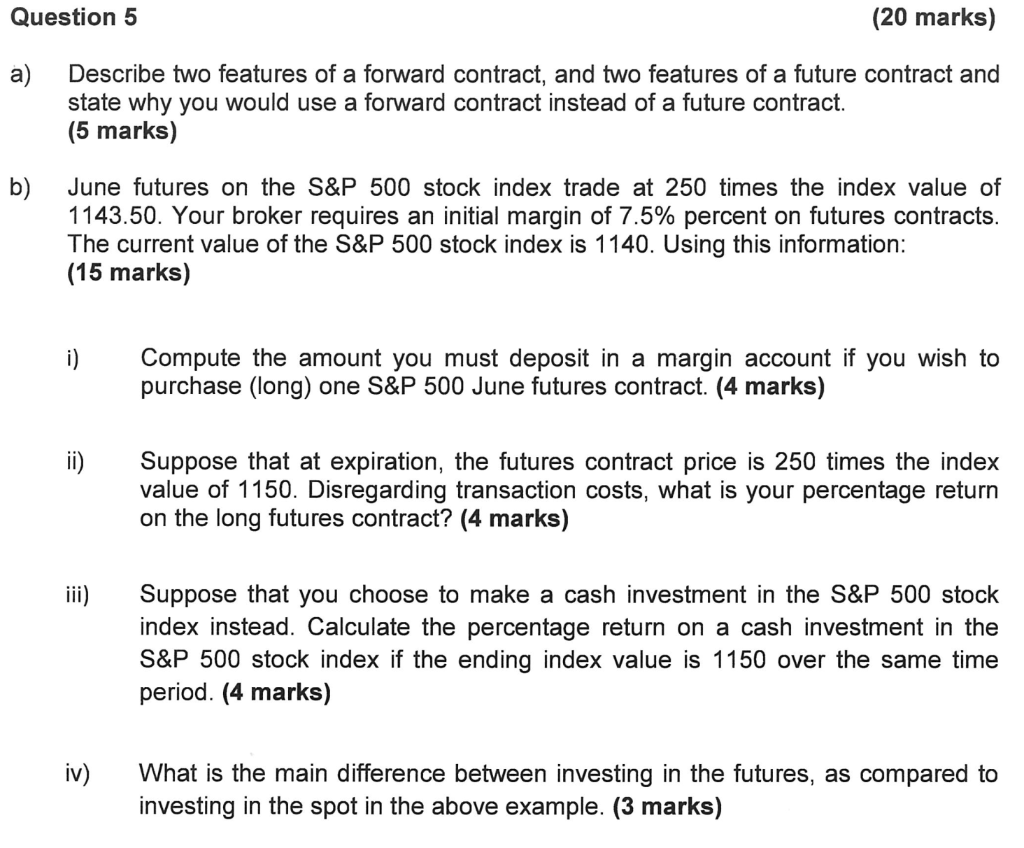

Question 5 (20 marks) a) Describe two features of a forward contract, and two features of a future contract and state why you would use a forward contract instead of a future contract. (5 marks) b) June futures on the S&P 500 stock index trade at 250 times the index value of 1143.50. Your broker requires an initial margin of 7.5% percent on futures contracts. The current value of the S&P 500 stock index is 1140. Using this information: (15 marks) i) Compute the amount you must deposit in a margin account if you wish to purchase (long) one S&P 500 June futures contract. (4 marks) Suppose that at expiration, the futures contract price is 250 times the index value of 1150. Disregarding transaction costs, what is your percentage return on the long futures contract? (4 marks) iii) Suppose that you choose to make a cash investment in the S&P 500 stock index instead. Calculate the percentage return on a cash investment in the S&P 500 stock index if the ending index value is 1150 over the same time period. (4 marks) iv) What is the main difference between investing in the futures, as compared to investing in the spot in the above example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts