Question: I added the info that was needed Problem 2 Accounts receivable transactions and bad debts adjustments - Lucy Loo Company, located in Los Alamitos, California,

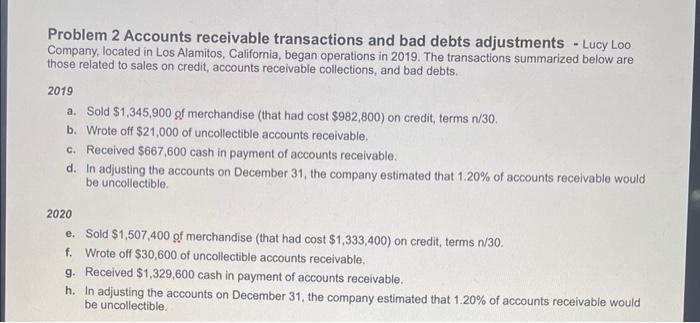

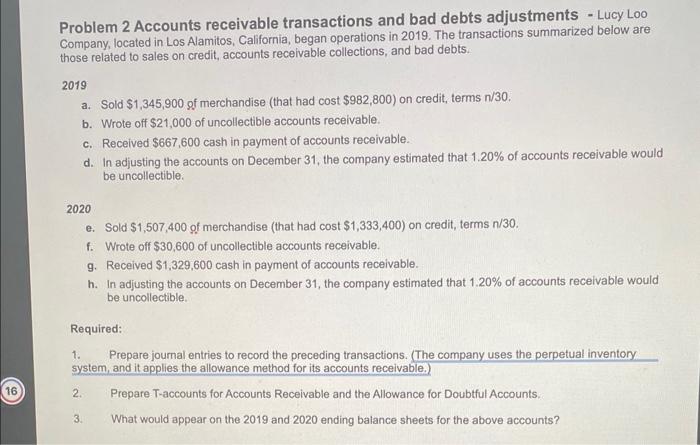

Problem 2 Accounts receivable transactions and bad debts adjustments - Lucy Loo Company, located in Los Alamitos, California, began operations in 2019. The transactions summarized below are those related to sales on credit, accounts receivable collections, and bad debts. 2019 a. Sold $1,345,900 of merchandise (that had cost $982,800 ) on credit, terms n/30. b. Wrote off $21,000 of uncollectible accounts receivable. c. Received $667,600 cash in payment of accounts receivable. d. In adjusting the accounts on December 31 , the company estimated that 1.20% of accounts receivable would be uncollectible. 2020 e. Sold $1,507,400of merchandise (that had cost $1,333,400 ) on credit, terms n/30. f. Wrote off $30,600 of uncollectible accounts receivable. g. Received $1,329,600 cash in payment of accounts receivable. h. In adjusting the accounts on December 31 , the company estimated that 1.20% of accounts receivable would be uncollectible. Problem 2 Accounts receivable transactions and bad debts adjustments - Lucy Loo Company, located in Los Alamitos, California, began operations in 2019. The transactions summarized below are those related to sales on credit, accounts receivable collections, and bad debts. 2019 a. Sold $1,345,900 of merchandise (that had cost $982,800 ) on credit, terms n/30. b. Wrote off $21,000 of uncollectible accounts receivable. c. Received $667,600 cash in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 1.20% of accounts receivable would be uncollectible. 2020 e. Sold $1,507,400 of merchandise (that had cost $1,333,400 ) on credit, terms n/30. f. Wrote off $30,600 of uncollectible accounts receivable. g. Received $1,329,600 cash in payment of accounts receivable. h. In adjusting the accounts on December 31 , the company estimated that 1.20% of accounts receivable would be uncollectible. Required: 1. Prepare journal entries to record the preceding transactions. (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable.) 2. Prepare-T-accounts for Accounts Receivable and the Allowance for Doubtful Accounts. 3. What would appear on the 2019 and 2020 ending balance sheets for the above accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts