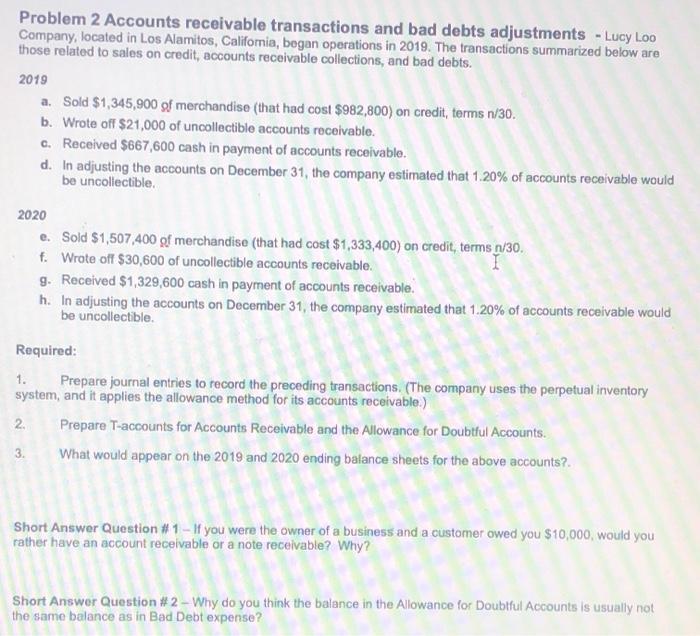

Question: Problem 2 Accounts receivable transactions and bad debts adjustments - Lucy Loo Company, located in Los Alamitos, Califomia, began operations in 2019. The transactions

Problem 2 Accounts receivable transactions and bad debts adjustments - Lucy Loo Company, located in Los Alamitos, Califomia, began operations in 2019. The transactions summarized below are those related to sales on credit, accounts receivable collections, and bad debts. 2019 a. Sold $1,345,900 gf merchandise (that had cost $982,800) on credit, terms n/30. b. Wrote off $21,000 of uncollectible accounts receivable. c. Received $667,600 cash in payment of accounts receivable. d. In adjusting the accounts on December 31, the company estimated that 1.20% of accounts receivable would be uncollectible. 2020 e. Sold $1,507,400 gf merchandise (that had cost $1,333,400) on credit, terms n/30. f. Wrote off $30,600 of uncollectible accounts receivable. g. Received $1,329,600 cash in payment of accounts receivable. h. In adjusting the accounts on December 31, the company estimated that 1.20% of accounts receivable would be uncollectible. Required: 1. Prepare journal entries to record the preceding transactions. (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable.) 2. Prepare T-accounts for Accounts Receivable and the Allowance for Doubtful Accounts. 3. What would appear on the 2019 and 2020 ending balance sheets for the above accounts?. Short Answer Question # 1-If you were the owner of a business and a customer owed you $10,000, would you rather have an account receivable or a note receivable? Why? Short Answer Question # 2 - Why do you think the balance in the Allowance for Doubtful Accounts is usually not the same balance as in Bad Debt expense?

Step by Step Solution

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Required 1 and 2 a Year 2019 Journal Entries Date Account Dr Cr Cost Of Goods Sold 982000 Inventory 982000 Cost of goods sold during the year Date Account Dr Cr Accounts Receivable 1345900 Sales Reven... View full answer

Get step-by-step solutions from verified subject matter experts