Question: I already know the answer, but I do not really understand what is really going on in this question or how I would solve a

I already know the answer, but I do not really understand what is really going on in this question or how I would solve a similar one, Can someone explain it step by step, also I prefer to use a BAII plus for these types of questions so please don't just upload spreadsheet files, thanks!

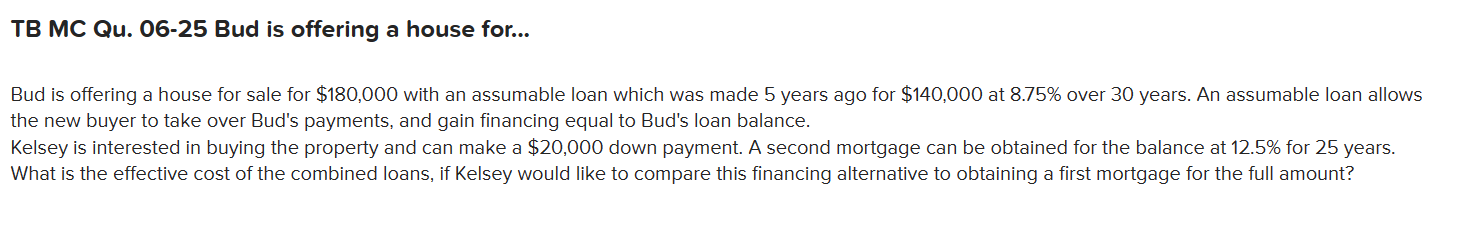

TB MC Qu. 06-25 Bud is offering a house for... Bud is offering a house for sale for $180,000 with an assumable loan which was made 5 years ago for $140,000 at 8.75% over 30 years. An assumable loan allows the new buyer to take over Bud's payments, and gain financing equal to Bud's loan balance. Kelsey is interested in buying the property and can make a $20,000 down payment. A second mortgage can be obtained for the balance at 12.5% for 25 years. What is the effective cost of the combined loans, if Kelsey would like to compare this financing alternative to obtaining a first mortgage for the full amount? TB MC Qu. 06-25 Bud is offering a house for... Bud is offering a house for sale for $180,000 with an assumable loan which was made 5 years ago for $140,000 at 8.75% over 30 years. An assumable loan allows the new buyer to take over Bud's payments, and gain financing equal to Bud's loan balance. Kelsey is interested in buying the property and can make a $20,000 down payment. A second mortgage can be obtained for the balance at 12.5% for 25 years. What is the effective cost of the combined loans, if Kelsey would like to compare this financing alternative to obtaining a first mortgage for the full amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts